Digital feature: long read

Sausages, Casings, Burgers & Food Forming

Perhaps inevitably as workers return to offices at least some of the time, shoppers are cooking less at home and this has impacted supermarket sales, says AHDB retail insight manager Grace Randall.

Comparing the 52 weeks to 15 May with the same period last year, retail volume sales of beef burgers & grills and sausages fell by 12% and 9.1% respectively. Value sales dropped by 8.3% and 6.8%.

Dicing this up, sales from the big four supermarkets' bricks and mortar stores, online channels and the discounters all recorded double digit percentage falls.

Plant-based impact

While some might speculate that retail sales of plant-based sausages and burgers were making a dent on their meat-based counterparts, Randall quickly denies this theory. "Plant-based is having very minimal impact. It's growing, but only minimally."

There's still all to play for though and talk of a summer heatwave holds promise. "I think we will see an uplift in burgers and sausages, but I'm not sure it will be enough to reach the same levels we saw last year."

That said, there may be room for a late surge in November and December coinciding with the FIFA World Cup, Randall says.

Charles Coleman, sales director at Dartford-based meat wholesaler The Sausage Man UK, says: "Retail sales of barbecue-related food always surge in line with the weather for us, and this has certainly been the case with the warmer spring temperatures we have been experiencing this year."

Foodservice, by contrast, is generating strong year-on-year sales uplifts, with English breakfasts featuring pork doubling in volume (52 w/e 20 March 2022 versus 52 w/e 21 March 2021). That said, they haven't recovered fully on pre-pandemic levels, says Randall. "They are still down 23% on 2019."

Still, volume sales of beef burgers rose by more than a third and meals with sausage at the centre rose by 27%, comparing 2021 with 2022.

"After two years of intermittent lockdowns and a strong comeback from our foodservice customers, we're also aware that the trend for grab & go meals continues to build at pace," says Coleman. "We have seen increased demand from our catering customers for our precooked sausages, which provide a quick, easy to prepare, and versatile menu option that offers great margins."

Given this mixed performance, are there any trends offering promise for those seeking to boost retail sales? On the one hand, consumers know what they like and the standard pork sausage continues to remain the favourite purchase. However, Randall says: "In foodservice, we are seeing bolder flavours coming through." She notes that black pudding sausage has excited some interest.

Zaggy Zachariou, site director (Linton) at Pilgrim's UK says: “Across Pilgrim’s UK, we’ve been working with our retail partners to help them deliver exciting new options for consumers to enjoy. For example, the Passion for Food Academy at our Linton site produced a new Red Leicester and Jalapeno sausage for one of our customers last year, which proved incredibly popular."

Premium growth

Randall adds: "Premium sausages and burgers are doing really well. We have seen their share grow over the past year."

In the niche area of beef sausages, for example, several small brands have produced Wagyu variants.

"As they do more shopping online, people tend to go for a slightly more premium option, because they think it will be better quality," Randall observes.

Charcuterie sausages, such as Brunswick and smoked Bavarian, sold well over the pandemic, according to Randall, reflecting a current trend for continental meats to outperform more traditional sliced meats and hams. In tandem with this, salami also proved popular in main meals, with further potential to encourage continental meat snacking, Randall claims.

Coleman says: “Post COVID, at The Sausage Man, we have seen growing foodservice demand for authentic German Bratwurst and Frankfurters as consumers return to work and want to relive the freedom of a ‘festival atmosphere’ at concerts, stadia events, and pubs."

Healthy eating and high animal welfare standards are two further areas of consumer focus that, while challenging, have paid dividends for Pilgrim's UK, says Zachariou. “While steps are being taken to reduce the fat content of products like burgers and sausages, there is a balance to be struck. We’re regularly working with customers to produce lower fat sausages using leaner cuts of meat. But there can be difficulties with formulation and binding without some level of fat content, which can impact the quality of the end product.

Animal welfare

On animal welfare, he says: “As the UK’s leading producer of higher welfare pork, our focus is on producing high-quality meat, reared sustainably and responsibly here in the UK. Our higher welfare sows spend their entire lives outdoors and all of our pigs are reared on RSPCA assured farms.

“Since 2018, 100% of Pilgrim’s UK’s farming operations have been higher welfare RSPCA assured for its Co-op Pioneer & Irresistible pork ranges. The business secured BBFAW (business benchmark on farm animal welfare) accreditation – operating in line with a clear framework for action and reporting on animal welfare practises."

In burgers, consumers are also seeking something a bit different to the standard beef option, Randall says, with stilton and chilli popular flavour variants.

Devro UK & Ireland sales director Lee Hamilton on casings

"It is challenging times for the sausage industry, with high price inflation and therefore manufacturers are doing all they can to improve productivity and add value if it can help counter the impact of rising costs.

"As a result of this in the sausage world, there is currently a high amount of activity converting gut to alternative casing options. The Devro Select-F range is the perfect substitute for gut casings. Offering a more tender bite, and excellent meat transparency for the consumer, this solution also offers significant cost and productivity savings to the manufacturer.

"Sustainability is also an important driver for many manufacturers. Devro Scotland uses only UK and Irish hides for its bovine range and all our casings offer traceability from farm.

"Devro offers a complete range of collagen casings in beef and pork varieties as an alternative to hog and sheep gut. Where there are current challenges in the pig processing industry, and the inevitable challenges of increasing raw material prices, there is a plentiful supply of collagen. The way collagen casings are produced means this is not impacting our raw material supply to satisfy Devro customers' demand. In recent years, the growth of a plant-based alternative alginate has also been used for these sausage ranges but lacks the bite and cooking properties of collagen.

Collagen

"Devro's 'Sausage Love Story' consumer research shows that UK premium sausage buyers view collagen as a natural source of protein. It's clear this protein association appeals strongly to health-conscious consumers and an area that is showing significant growth is the protein snacking category.

"The Devro Stix casing range is housing meat sticks that are generating significant sales in the protein supplement industry. These products have really taken off in America as substitutes for the mainstream dairy and confectionery protein supplements. We are increasingly seeing demand for these products move to our shores. At Devro we have worked with collagen for over 60 years and we continue to develop our expertise to develop new casing ranges for our customers.

"We have experienced growing demand for premium porcine casings, which provides all the traceability and quality control benefits of collagen as well as shorter ingredient labels which appeal to consumers.

"We also note an emerging trend for hybrid meat & veg sausages which meet the needs of flexitarian consumers who enjoy the unique taste of meat but who are trying to cut back, or perhaps simply keen to try something new in terms of flavours, textures and even colours. 'Skinny' sausages or chipolatas are also growing in popularity."

So much for the consumer trends. What demands are influencing processors?

Reiser UK managing director Richard Watson says the continued lack of available semi-skilled and unskilled labour is pressing them down the route of increased automation. To that end, it officially launched a tranche of machines from partner Vemag at meat processing show IFFA in Frankfurt last month, concentrating equally on the smaller craft market and larger players.

Smaller craft producers

For the craft sector, there was the MPF818 for the production of burgers and patties as well as various shapes from dough, cheese or plant based products.

The MC0818 is a manual device for the production of round product shapes with a diameter, such as ćevapčići and salami pretzels. Other shapes and varieties of products are also possible, including cheese and plant based.

Meanwhile, the HP1 with inline grinder 985 is the first inline grinder designed specifically for small sausage producers. Featuring Vemag’s double screw technology, the HP1 can process up to 2,000kg/hour in continuous mode, with the 985 able to grind and fill masses down to -1 degrees. It can be used with filling horn, casing holder devices, clippers and all small attachments.

Larger producers

For larger producers, the CC215 with precrimper belts can be used for producing sausages with alginate casings.

Following on from the long-established LL335 auto loader, there's the launch of the LG336, a grouping and depositing module for sausages in alginate casing. This system deposits groups of sausages onto other conveyor belts (freezer or oven, for example) and includes reject functionality. It can also be used with sausages in natural and collagen casings.

Reiser says it anticipates the introduction of a robotic solution for collating and auto loading sausages into flow wrap and thermoforming.

For paper interleaving burgers, there's the PI355 - a compact machine automatically placing paper under burgers on the forming line. It's suitable for products with a diameter from 55-300 mm, single or double lane operations.

The HP duo combines two HP20s in one filling machine. Launched at the same time as the burger former FM254, it allows producers to run two burger lines from one filler, with an output of up to 500 burgers/min and is available with the twin lane process check VPC720.

Added to the FM250 home style burger maker and the DJM system for low pressure vac forming, the BF255 enables people to form up to 240 haché burgers/minute.

The last new edition to the current forming range is the BC236 XL. With a belt width of 1,200mm, it is suitable for producing all meat, vegetable and potato masses and normally stands in front of other inline units such as deep fryers, cooking tunnels or freezer units.

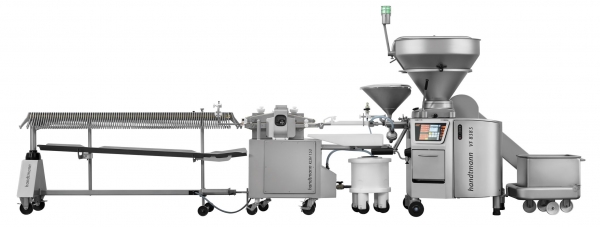

Handtmann highlights two recent range additions: the FS525, offering flexibility for the formation of meatballs and burgers and the Con Pro Compact - a low-cost entry-level model in the field of alginate technology with an alginate feed unit.

The watchwords for the FS525 are flexibility and versatility. It combines two different forming principles, maximising flexibility in industrial applications. The hole plate forming technique allows the production of free-formed 3D products and the rotary cutter enables production of different cross-sections with a straight cut.

It can also be can be incorporated into integrated processes or synchronised with automation options, such as a weighing system, tray feeding or depositing into thermo-forming machines.

Product quality can be increased through the optional use of integrated inline grinding technology: the product is gently ground to final grain size and at the same time precisely portioned in a single process step.

The main feature of the Con Pro Compact system is the alginate feed unit, with a volume of 40 litres for feeding the alginate paste. Fully scalable, the machine is capable of cutting and forming or cutting, forming and hanging in strings. Continuous production into alginate casing opens up a wide range of new product variants and the alginate casing can be customised in terms of thickness, colour and taste.

Crucially for cash-strapped manufacturers, Reiser and Handtmann offer a range of finance models for machine purchase to accommodate tight budgets.