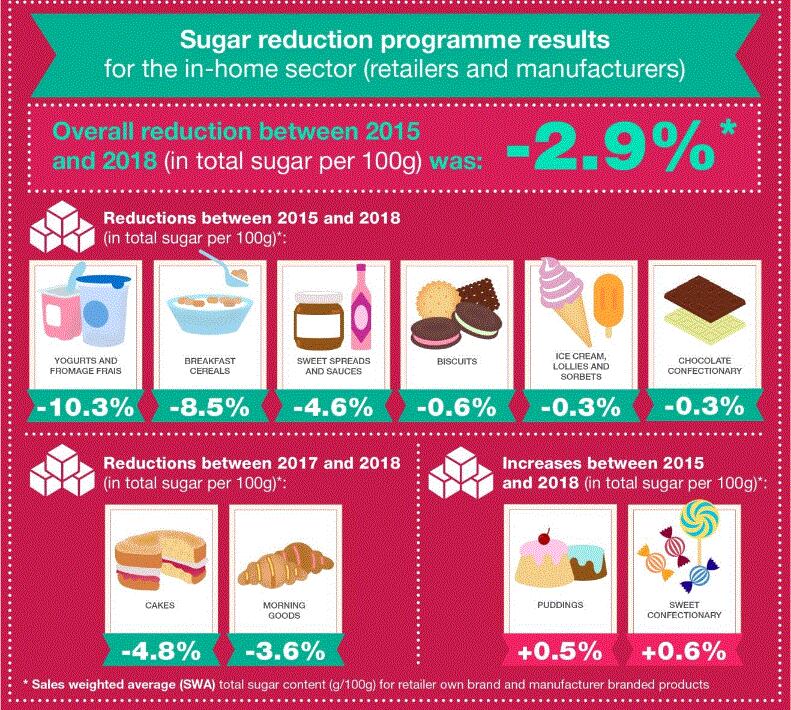

The report, Sugar reduction: progress between 2015 and 2018, found manufacturers and retailers had managed an overall sugar reduction of 2.9% (in sales weighted average sugar per 100g) by August/September 2018, since 2015.

For the out-of-home (OOH) sector, where data is more limited, there was a 4.9% reduction (in simple average sugar per 100g).

PHE has set the food industry a 20% sugar reduction target by 2020 from the 2015 baseline.

Retailer own brand and manufacturer branded yogurts and fromage frais and breakfast cereals have reduced sugar by 10.3% and 8.5% respectively.

Significant reductions have also been made in cakes (-4.8%) and morning goods (-3.6%) from a 2017 baseline – the earliest data available.

Meanwhile, there was only minor progress in biscuits (-0.6%) and chocolate confectionery (-0.3%), while the sales weighted sugar averages actually increased in sweet confectionery (0.6%) and puddings (0.5%).

No direct comparison between sectors

When looking at simple average sugar levels, the PHE data suggests that the OOH sector has made more progress. However, PHE stressed direct comparisons should not be made due to the lack of data available. There is no data available at all for OOH sweet confectionery, and sweet spreads and sauces.

The report also that from 2015–2018, there was a 28.8% sugar reduction per 100ml in retailer own-brand and manufacturer branded soft drinks, and a 27.2% reduction per 100ml for soft drinks consumed OOH.

In all, 30,133t of sugar were removed from soft drinks in this period as the industry prepared for the introduction of the Soft Drinks Industry Levy (SDIL) in April 2018.

Overall, the report showed a “mixed picture”, said PHE chief nutritionist Dr Alison Tedstone.

“Encouragingly, some businesses have made good progress in reducing sugar but some businesses and categories have made very little or none,” she said.

“We know the public wants the food industry to make food healthier. It is clear this can be done, but we urge the whole of the food and drink industry to keep up the momentum to help families make healthier choices.”

Next progress report in 2020

Tedstone said PHE remained committed to the “transparent monitoring” of the sugar reduction programme, adding that the next progress report would be due in the first half of 2020.

Meanwhile, PHE said it was undertaking final work towards setting guidelines for the foods to be included in its calorie reduction programme, for which a 20% reduction target has been set by 2024.

It also announced it will publish revised salt reduction targets in 2020 for industry to achieve by mid-2023, and guidelines for commercial baby foods and drinks in early 2020, following the publication of the Government’s green prevention paper.

In addition, work has begun on the next phase of engagement with specific parts of the OOH sector and will be focused towards travel and leisure businesses.

PHE chief executive Duncan Selbie said: “We are seeing some encouraging progress from the food industry. Our second-year report shows some food categories reducing sugar faster than others but this is realistic at this early stage.

“A third of children leave primary school overweight or obese, while severe obesity in Year 6 children has now reached an all-time high.

“To help them play their part in tackling this, businesses have three options to meet the 20% ambition – reduce sugar levels (reformulation), produce smaller portions, or encourage consumers to purchase lower or no sugar products.”

Action on Sugar comment

Commenting on PHE’s report, Katharine Jenner, campaign director of pressure group Action on Sugar, said: “While it’s encouraging to learn that both sugary yoghurts and cereals have been successful in the sugar reduction programme proving that reformulation is easily achievable, it is shameful that other manufacturers are dragging their heels and will likely fail to meet the 20% target. Every year, more and more children are becoming obese.

“However, the Government should be proud that they were brave enough to introduce the soft drinks levy, which has been remarkable in that it allowed for significant sugar reduction in drinks.

“Manufacturers were then able to avoid paying the tax – resulting in a much bigger reduction of sugar content in drinks in the UK than originally anticipated.

“This demonstrates that when properly motivated, the food industry can give us healthier options. It is imperative that this momentum and levy continues and is applied to calorie-dense processed foods and milk-based drinks that meet an agreed criterion set by the Government. Fat is a bigger contributor to calories in the diet than sugar and, therefore, essential that manufacturers are encouraged to reduce both in order to tackle the UK’s unhealthy eating habits and the excessive calorie intake.”

PHE sugar reduction data

Key

(*) the baseline for cakes and morning goods in 2017 rather than 2015.

(**) data for sweet confectionery in the out of home sector has been excluded due to incomparability of results.

SWA is the mean weighted by total sales. This gives more influence to products with higher sales.

SA is the simple arithmetic mean. Products are given equal influence. The baseline is 2017.