Despite a market downturn, global revenues from alternative proteins are looking promising.

According to Ali Al Suhail, an associate at investment bank DAI Magister, investor appetite remains healthy, as reflected by start-ups securing $3.5bn in funding last year. Moreover, the investment bank believes global revenues for alternative proteins should surpass $290bn by 2035.

Drivers behind investments could be attributed to the potential for alternative proteins to transform the sector in a world grappling with a pressing need to preserve resources and mitigate severe weather conditions.

According to the Good Food Institute, moving to alternative proteins could contribute between 14% and 20% of the necessary emissions reductions to meet the 1.5°C target set by the Paris Agreement until 2050.

Additionally, research from BCG and Blue Horizon Corporation shows that moving away from processes which rely on vast expanses of land, could save 39bn cubic metres of water.

The alternative protein market can be divided into four segments, with each representing different opportunities and challenges. These are as follows:

- Plant-based

- Insect-based

- Mycoprotein

- Cultured meat

Plant-based protein market

Within the plant-based market, Beyond Meat and Impossible Foods are arguably the two of the most prominent players.

Impossible is valued at around $7mn although there are rumours to suggest it could be as much as $10bn now. Earlier this year, Sherene Jagla was hired as the company’s first chief demand officer, following a record year of sales growth.

Meanwhile Beyond Meat has reported a 21% decline in fourth quarter revenue of $79.9mn. This is higher than Wall Street estimates - $79.9mn vs $75.7mn – which has seen the shares increase by more than 15% in after-market trading. Its current market cap is 829.166mn, according to Yahoo Finance.

Plant-based meat sales in the US and UK have stagnated or fallen, but global retail for the sector grew in 2022 by dollar sales and weight sales, 8% and 5% respectively, compared to the previous year.

With continued product innovation and consumer adoption, the plant-based meat category could earn a similar dollar share of the total meat market as plant-based milk has of the milk market (15%). That opportunity is worth $15 billion in US retail alone.

Potential reasons for the retail drop could be a result of the cost-of-living crisis, as well as sustainability concerns around certain alternative proteins such as almond milk.

Across the board, plant-based options carry a premium compared to their counterparts, but GFI anticipates that gap shrinking as producers scale-up. Indeed, the price comparison between more developed categories such as milk and butter are much smaller.

“While these leading players [Beyond Meat etc.] and others have made significant technological advancements and demand continues to rise in the US and other Western markets, resistance to plant-based proteins persist in countries where plant-rich diets are prevalent and meat consumption is considered a status symbol,” commented Suhail.

Plant-based companies to watch

Suhail points to several companies innovating within this sector, including Israel-based start-up, Innovopro. This brand is using a natural process to extract chickpea protein which can be used as a base to make a range of products, including ice cream and protein bars. The company products enable producers to create clean label products with significantly less ingredients.

Meanwhile in the UK, plant-based drink brand Minor Figures has been attracting interest from large players on the market, with an investment from Danone Manifesto Ventures and Green Monday Group back in 2022. Its founders have extensive experience within the coffee industry and have a strong portfolio of barista oat milks – a significant category as Covid saw consumers looking to recreate café culture in the home.

Another company, Umiami, based in France, is looking to create plant-based whole cuts, with fewer ingredients, lower salt content and higher protein levels compared to other plant-based products on the market.

Later this year, the company will begin production of the world’s first plant-based whole cuts factory. At 14,000m2, the plant will be capable of producing up to 22,000 tons of plant-based meat and fish each year.

Insect protein market

Entomophagy is practised in many countries across the globe, in particular parts of Asia, Africa and Latin America. Overall, insects supplement the diets of around 2bn people.

In Western culture, it’s less common with safety concerns and consumer acceptance being two main barriers. However, insect farming in Europe is witnessing growth.

UN Food and Agriculture Organization (FAO) says that to meet the demand of a growing population, food production will need to increase by 70%. In this way, insects as food could be a game-changer.

According to the FAO, there have been no known cases of transmission of diseases or parasitoids to humans from the consumption of insects (on the condition that the insects were handled under the same sanitary conditions as any other food). Allergies may occur and are comparable with allergies to crustaceans, which are also invertebrates.

Moreover, the FAO states that compared with mammals and birds, insects may pose less risk of transmitting zoonotic infection.

Insect companies to watch

“While start-ups creating insects for food have been around for some time, we are seeing a new wave of start-ups focused on using insects to create animal feed following the $250m raise by InnovaFeed and $175m raise by Ynsect,” said Suhail.

Danish start-up, ENDORM, produces insect protein from black soldier fly larvae for animal and aquafeed. The company raised funding in 2022 to build an expanded factor that can produce an expanded factory producing around 11,000 tonnes annually.

Sunhail also pointed to Agroloop and Better Orgins as ones to watch. While the former transforms organic waste into a sustainable protein source by upcycling organic materials, the latter uses AI to empower its insect farms aiming to eliminate food waste.

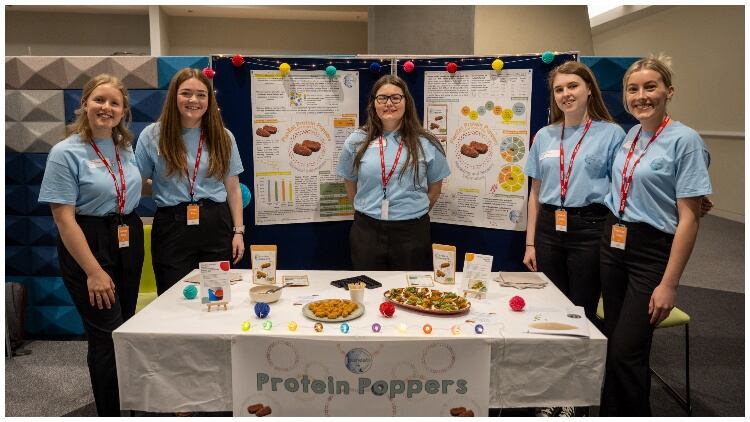

We also saw this year’s Ecotrophelia UK winner showcasing the appetite for insects, as the five-strong team presented their PlanEat Protein Poppers made with 41% texturised mealworm.

Mycoprotein market

Derived from fungi, mycoprotein is produced via three primary fermentation processes – traditional, biomass and precision.

Quorn is probably the most well-known company using mycoprotein and claims that its produce uses 95% less Co2 than typical beef mince.

Mycoprotein is a market experiencing rapid growth, expected to grow at a CAGR of 12.6% between 2022 and 2032. Precision fermentation specifically is predicted to grow from $1.6bn in 2022 to $36bn in 2030.

Unilever is investigating the use of precision fermentation in ice cream, while Nestle announced a partnership with precision fermentation company Perfect Day to pilot a dairy milk alternative.

Mycoprotein companies to watch

Sunhail picks out four companies worth watching in this arena – TurtleTree, Imagindairy, Mushlabs and Solar Food.

“TurtleTree has developed a precision fermentation technology that produces milk-based products, the world’s first precision fermentation-produced lactoferrin —LF+—a high-value bioactive milk protein and one of the most powerful parts of cow’s milk.”

Imagindairy uses precision fermentation to produces non-GMO and animal-free dairy products from microorganisms with the use of AI. In May 2022 it closed a seed round, reaching $28mn in investment. This is being used to accelerate its efforts in R&D and to attract new talent to its workforce.

German-based company Mushlabs meanwhile uses fermentation to create food from the roots of mushrooms, while Solar Food is focused on a process which involves making proteins from air, electricity and fermentation.

Lab grown meat

Cultured meat is gaining more and more traction. Singapore has been leading the way in commercial development for a while, but now the US is hot on its heels, as Good Meat and Upside Foods gained commercial approval from the USDA earlier this month.

Commenting on the market, Sunhail said: “Prominent companies in the US, Israel, and the Netherlands are currently focused on establishing large-scale farms equipped with multiple bioreactors to enhance production scale. They are working to overcome technical hurdles in scaling production, reducing costs, and addressing regulatory frameworks and public acceptance, but there is a significant way to go. Investors will need to pony up substantial capital in the range of hundreds of billions to facilitate a successful industry scale-up.”

Cultured meat companies to watch

While Good Meat and Upside Foods are obvious brands to keep an eye on, Sunhail also notes Meatable and Vow as two worthwhile contenders.

Meatable is a developer of cell-cultured meat and has raised over $60 million in funding and recently achieved a world-first breakthrough by producing high-quality cultivated meat in eight days.

Out of Australia, Vow has begun the regulatory approval process to launch a line of cultivated quail called morsel in restaurants by 2024. It received a lot of attention following its mammoth-based meatballs.

Meanwhile, research from UC Davis suggests that cultured meat may not be “inherently better for the environment than conventional beef”.

“It’s not a panacea,” said the study’s corresponding author Edward Spang, and an associate professor in the Department of Food Science and Technology. “It’s possible we could reduce its environmental impact in the future, but it will require significant technical advancement to simultaneously increase the performance and decrease the cost of the cell culture media.”

Even the most efficient beef production systems reviewed in the study outperform cultured meat across all scenarios (both food and pharma). This indicates that investments to advance more climate-friendly beef could yield greater reductions in emissions more rapidly than investments in lab grown meat.

Alternative proteins – it’s still early days

Despite these promising advancements and the potential for alternative proteins to reduce the global food system’s environmental footprint, as the UC Davis study reflected, it’s still early days for alternatives.

“Transitioning to an alternative protein system will require substantially more funding and financing to support research, development, and large-scale implementation and deeper collaboration and coordination among governments, industries, and scientific communities worldwide,” concluded Sunhail.

You may also enjoy our Editor's takeaways from this year's City Food & Drink Lecture in which the audience heard from Sir Charles Godfray on feeding the world sustainably.