Poultry giant strives to address losses

Despite reporting an 8.7% like-for-like sales increase for the 13 weeks to October 26, with powerful gains in its protein division, operating profit before exceptional items fell by £4M.

And while like-for-like operating profit saw a slight rise, net debt for the firm rose and it recorded a £12.1M loss during the period, up from £5.1M in the same three months last year.

Although the company claimed its branded operations continued to bounce back, they still fell 3.8% as a result of lower promotions and reorganising its sales mix in biscuits.

Net debt rose

In addition, its net debt figure rose by £18.4M compared to the same period last year, to £561M.

That said, the firm pointed out that it had still reduced its full-year net debt by £5.7M. It also boosted net cashflow from operating activities, from £2.1M in the first quarter of 2012 to £27M.

While branded Q1 sales dipped, it claimed branded operating profit continued to improve, driven by new product launches and dropping uneconomic own-label lines.

“New product introductions in frozen pizza and tight cost management improved results in frozen, but trading conditions remain tough, particularly in Ireland with increasing competition from discounters,” the firm added.

Chilled food sales were up on last year, while profits in the division fell, due to the “headwinds” of commodity inflation, an adverse sales mix and disruption from product transfers, the company said.

New product development

However, it added that it was investing in new product development in Christmas lines, and in beef ready meals to entice shoppers back to them in the wake of the horsemeat scandal.

The business’s strongest performance was achieved in protein, where it said like-for-like sales rocketed by 20%, driven by business gains, cost recovery through improved operational efficiency.

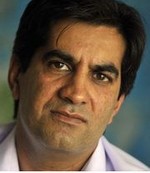

“The integration of Vion in our protein division is progressing on plan and our branded recovery continues,” said 2 Sisters Food Group ceo Ranjit Boparan.

“During Q1 we have invested in our chilled business and our approach in understanding our customers and helping them to innovate is reflected in the significant number of new product launches in the first half of the year.

“We are taking actions to address chilled performance once Christmas is delivered for our customers and we would expect to see the benefits coming through in the second half.”

2 Sisters' parent Boparan Holdings reported Q1 operating profit before exceptional items down £4M, from £30.5M in last year’s Q1 to £26.5M, while sales climbed by 43.6%, from £616.7M to £885.3M. Like-for-like operating profit rose by £0.8M, from £30.5M to £31.3M.