The impacts of climate change are clearly visible, underscored by the extreme weather events we have seen across the world this year alone.

Targets and commitments have been put place left, right and centre - including the landmark Paris Agreement, the UK’s 2050 net zero pledge and a loose outline of a food strategy which sets out a vision for “a healthier, more affordable, sustainable and resilient 21st century UK food system“. Meanwhile, new regulations, schemes and voluntary commitments have been rolled out and/or earmarked.

With around a third of all human-caused greenhouse gas emissions linked to food globally, industry recognises the momentous challenge it faces and its responsibility to play its part.

In this 2025 Sustainability Report, we investigate the biggest consumer trends in sustainability and the actions that the food and drink sector are taking to deliver to the demands of the public and government.

This is a collaborative project between Food Manufacture and its sister brand and market insight firm, Lumina Intelligence.

Quick links

Consumer trends

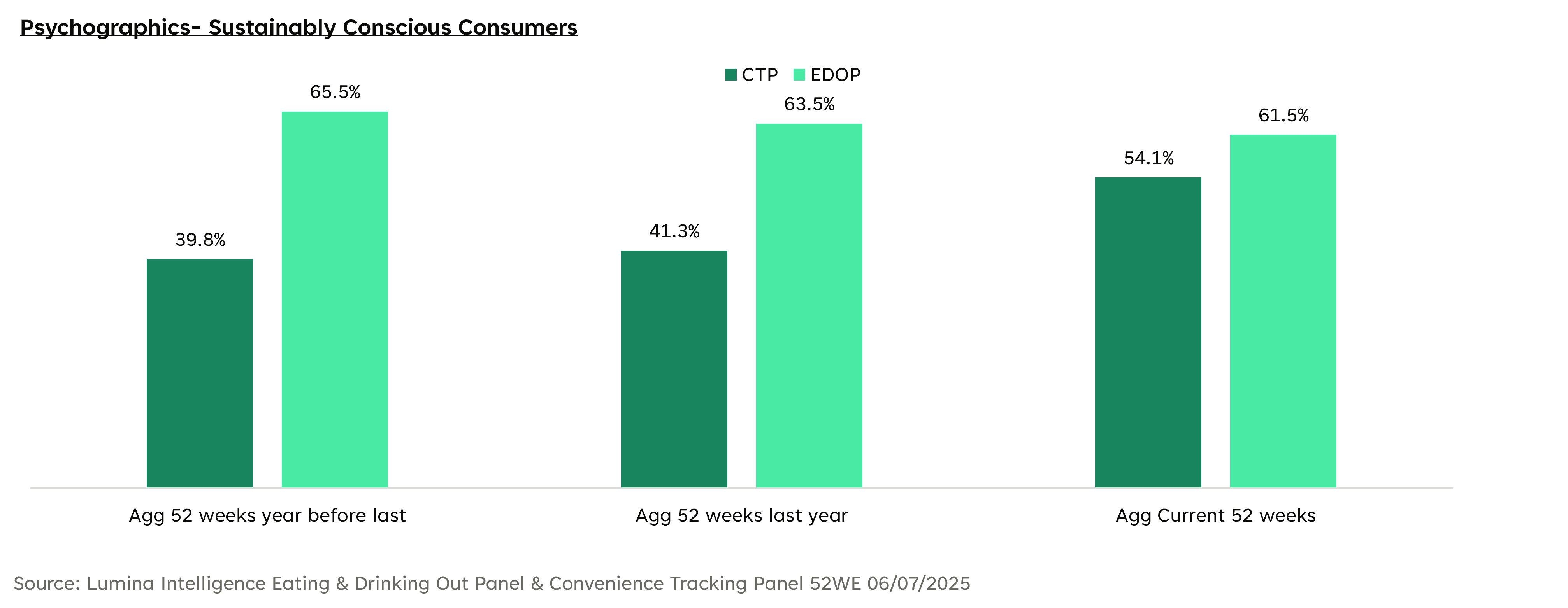

For consumers, sustainability is a lower priority than quality and value when eating out and in retail (convivence stores), driven by pressures such as the increased cost of living.

Sustainably-minded consumers in the eating out market have shrunk by four percentage points in the last two years, whilst sustainably-minded convenience consumers have grown by 14.2 percentage points.

The over index (i.e. importance) in quality and locality by consumers also represents a shift towards health and integrity.

Consumers are increasingly seeking reassurance, with regards to nutrition, authenticity and product origin.

| Reason for choosing establishment - % UK occasions vs. % sustainability consumer occasions | ||

|---|---|---|

| Local and independence | 15.7% | xi. 114 |

| Quality of ingredients | 13.8% | xi. 108 |

44% of consumers regularly purchase local and seasonal products

Lumina Intelligence Convenience Tracking Panel 52WE 06/07/2025 & Lumina Intelligence Sustainability Survey 2024

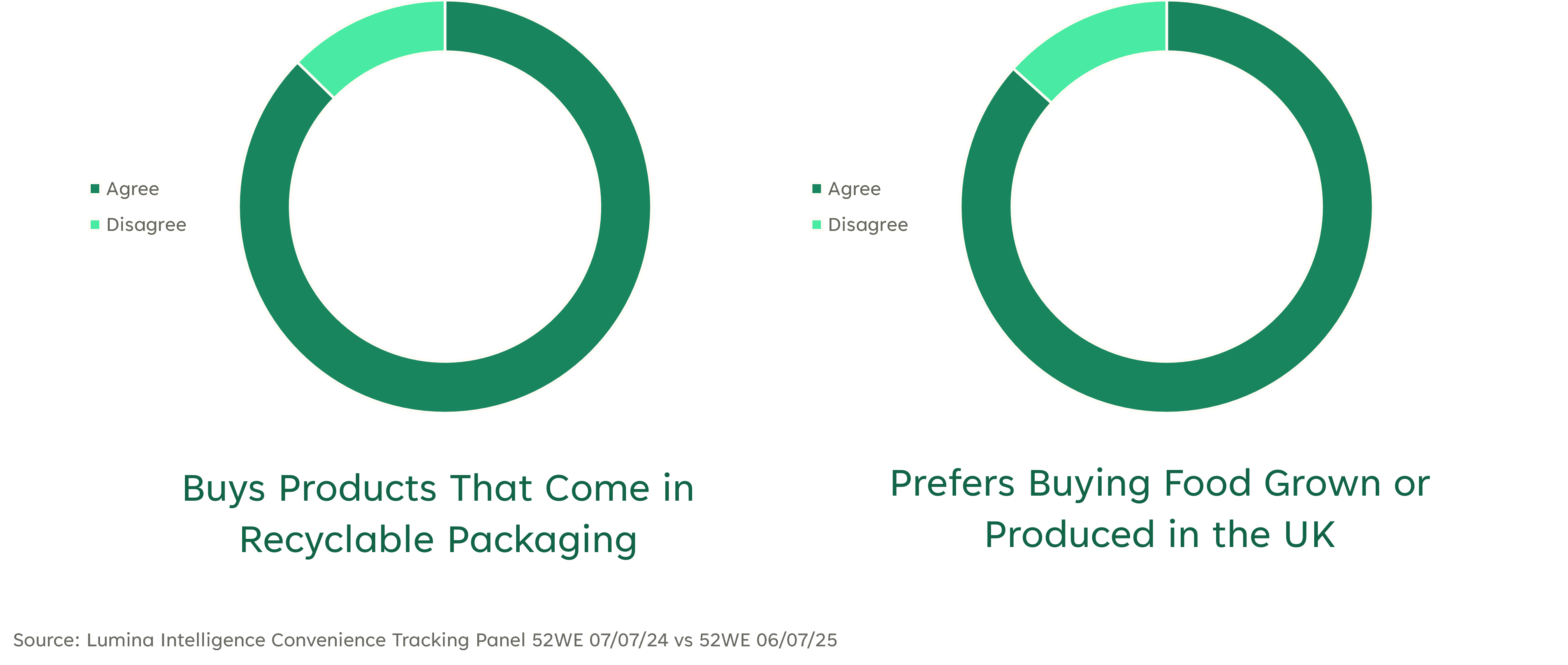

The number of consumers purchasing products that come in recyclable packaging stands at 62.5% vs those who prefer to buy local produce at 61%. However, the latter is growing at a faster rate year-on-year (YoY).

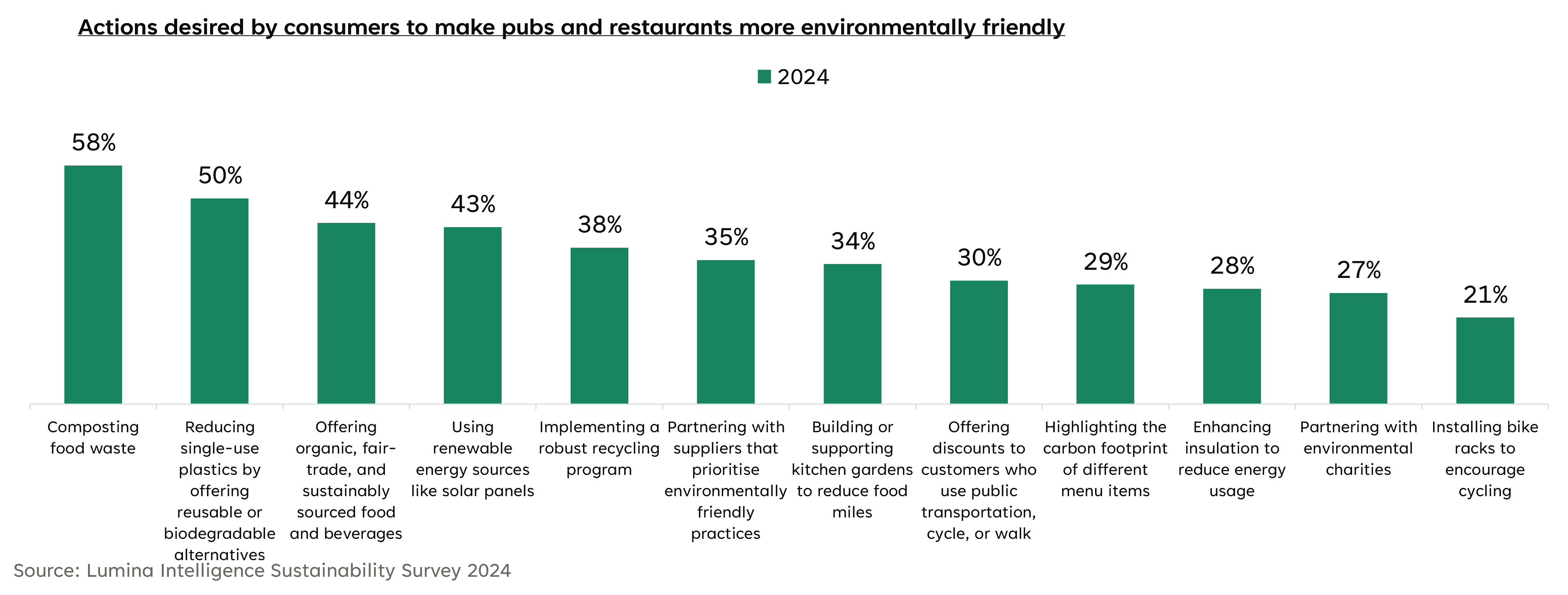

Consumers prioritise sustainability actions in pubs and bars that are visible and directly linked to the food and drink experience, such as composting food waste, reducing single-use plastics, and offering ethically sourced options.

Behind the scenes efforts like using renewable energy or improving insulation rank lower, likely because they’re less noticeable to consumers. This highlights the value of clear communication of strategy.

Behind the label – Why EU organic sets the standard

Veryan Bliss, adviser to the EU’s More Than Only Food & Drink campaign, explains why the European Union’s organic system is one of the most trusted in the world.

“Despite the cost-of-living crisis and rising bills, consumers are increasingly seeking to make sustainable and trustworthy choices.

“Organic food production uses only natural substances and methods. Food produced with limited synthetic pesticides, fertilisers or antibiotics, and with a lower carbon footprint, clearly represents a significant opportunity for growers and retailers.

“By working more harmoniously with natural resources, organic farms reduce their reliance on chemicals, helping mitigate climate change and prevent the deterioration of soil and water.

“To help achieve its commitment to convert 25% of agricultural land to organic farming by 2030, the EU has a detailed Organic Action Plan[2] to increase demand and supply while enhancing sustainability.

“Organic certification plays a crucial role. For fresh produce, rules prohibit GMOs, forbid ionising radiation, and significantly limit fertilisers, herbicides and pesticides. Each EU country appoints control bodies or authorities to inspect operators at least once a year. Producers must register, and only after a successful inspection and confirmation are they awarded a certificate.

“The EU organic logo, launched in 2010, makes it easier for consumers to identify organic products. According to Eurobarometer 556 (2024)[3], 56% of Europeans recognise it, making it the most recognised EU quality label.

“With strict regulations, large-scale governance and ambitious targets, the EU provides a trustworthy source of organic produce.”

For more information on the EU’s ‘More Than Only Food & Drink’ campaign, click here.

References:

- Worldpanel Division, Kantar, Europanel, GfK - Who Cares? Who Does? 2023

- https://agriculture.ec.europa.eu/farming/organic-farming/organic-action-plan_en

- https://europa.eu/eurobarometer/surveys/detail/3226

Operator outlook

Business priorities

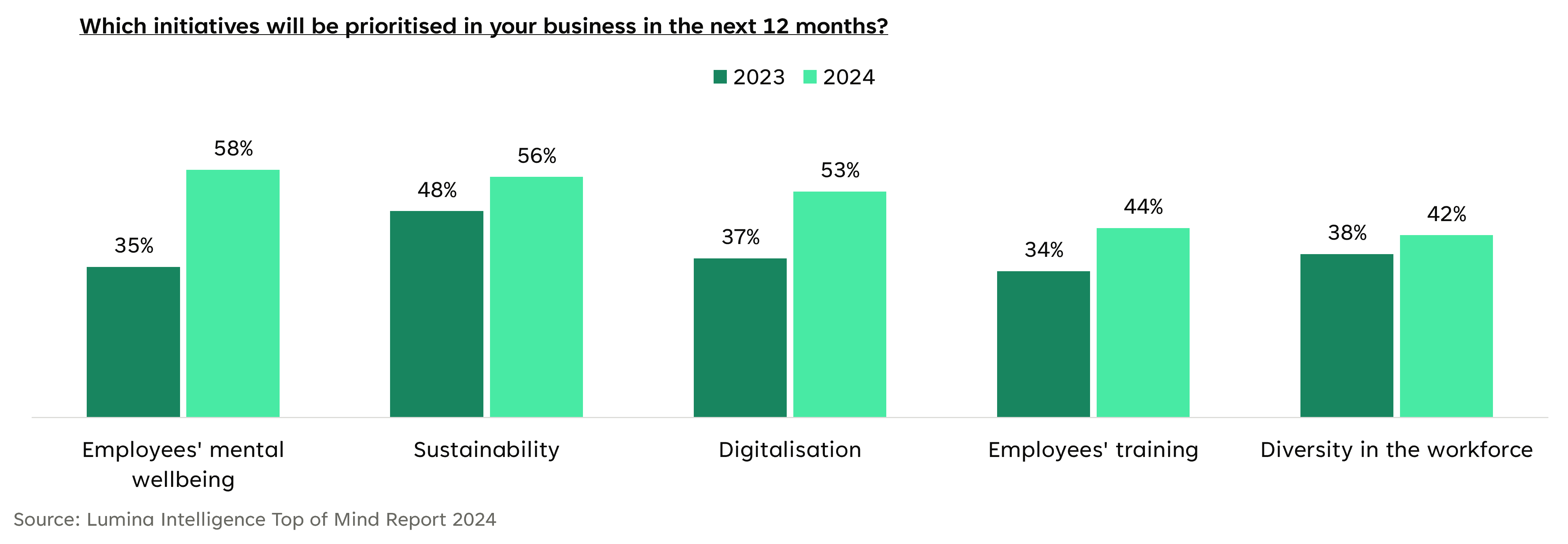

Lumina’s data shows that among leaders in hospitality and retail, sustainability is becoming much more of a priority for businesses but it doesn’t top the list.

Employee mental wellbeing, which had been among the lowest priorities in 2023, has jumped up from 35% to 58% in 2024, now trumping sustainability.

With wellbeing being talked about more openly, it’s unsurprising that businesses are seeing it as more of a priority. But we are also seeing trends suggesting lower rates of mental wellness overall, which is most likely another contributing factor.

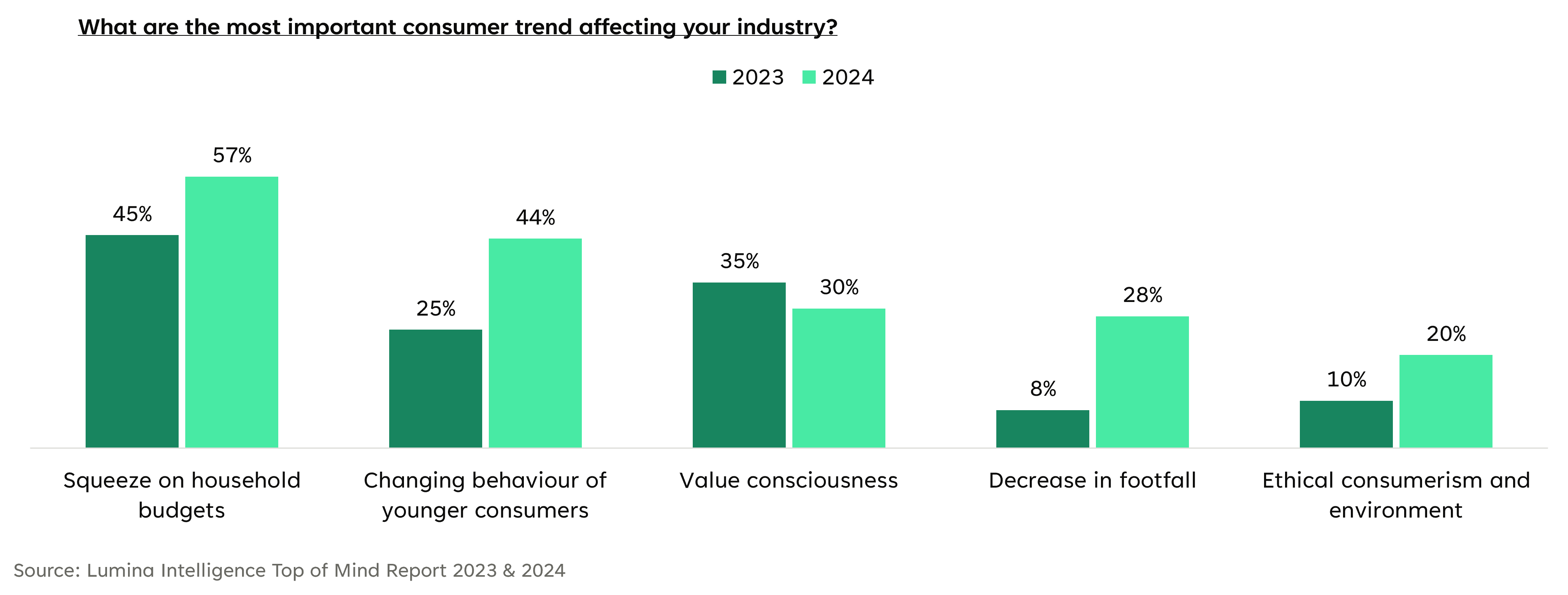

Most important consumer trends

Ethical consumerism and environment has risen by 10 percentage points as a consumer trend affecting the industry.

Comparatively to other factors though, it remains less important. However, it has risen in the ranks, moving from the seventh place to fifth.

It is worth noting that ethical consumerism encompasses many avenues (including sustainability) that could appeal to consumers and be integrated into a business strategy alongside.

Sustainability viewed as ‘nice to have’

In terms of business challenges facing operators, Lumina’s data shows sustainability quite far down the list. This demonstrates that these issues are often viewed as ‘nice to have’ rather than essential, especially when businesses are grappling with more immediate pressures like staffing, inflation and supply chain disruptions.

As a result, long-term environmental goals are being deprioritised in favour of short-term survival and operational stability.

Manufacturers outlook

Sustainability is a core strategy

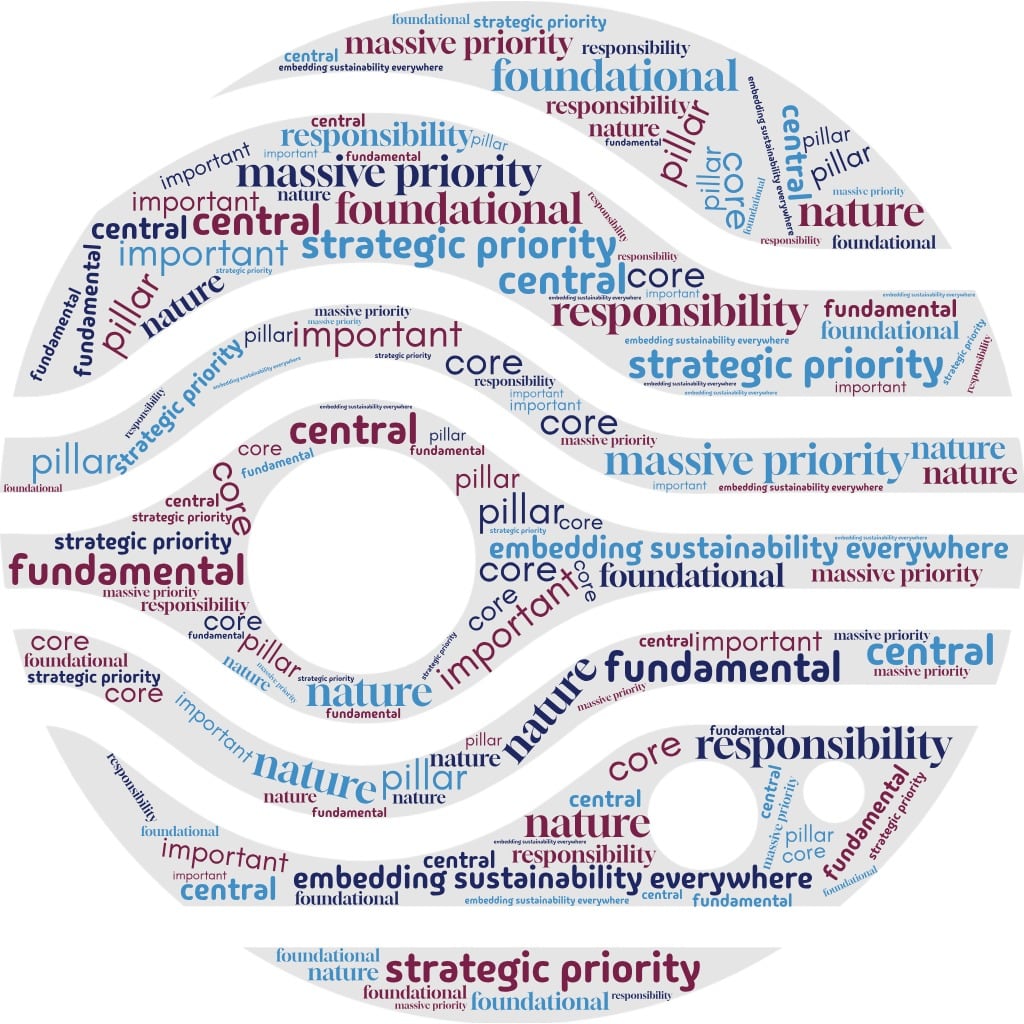

Speaking directly with F&B producers from several different categories, it is evident that sustainability is a key priority for them.

Sustainability is a strand which runs throughout our entire business. It’s a core, strategic priority for us, and for our customers.

Nicholas Bevan, director of sustainability at Baker & Baker

Below is a word cloud Food Manufacture generated using some of the terms expressed by manufacturers during these interviews, when we asked them: ‘How important is sustainability within your overall business strategy?’

Our approach to sustainability is increasingly important as the business environment and natural climate changes at pace around us and requires us to always consider the different ways Greencore can operate in a more sustainable manner.

Fran Haycock, head of sustainability, Greencore

Top priorities within sustainability

When asked about what areas of sustainability is front of mind, manufacturers mostly shared multifaceted responses, but there was an overall evident theme centred upon emissions.

Emma Keller, head of sustainability at Nestlé UK&I, said the scale of the business requires Nestlé to consider all the various areas where it has an impact, from food waste and recycling, through to sustainable sourcing, ethical workforces, logistics and emissions.

“If I was to summarise it, the key areas that we’re really collectively driving forward as a business is [addressing] climate change. So focusing on delivering our net zero goal - which is 2050,” she said.

In the short term, the business is looking at how it can halve its greenhouse gas (GHG) footprint by 2030.

“The second big area for us is sourcing our ingredients from regenerative agriculture,” said Keller, who explained the company is putting in efforts to work with its farmers in cocoa growing regions such as Cote d’Ivoire to make sure regenerative practices are used.

The third priority for Nestlé is circularity, with a big focus on packaging and how it is designing this for recyclability and educating consumers on how to be able to better recycle or reuse materials.

“We’re also looking at the systems and the infrastructure needed to drive that circularity.”

Baker and Baker’s, director of sustainability, Nicolas Bevan, also noted several areas of focus, including net zero targets, packaging, and compliance with regulations such as the Corporate Sustainability Reporting Directive (CSRD).

“Climate has been a key focus for Baker & Baker over the last couple of years,” Bevan told Food Manufacture.

“We have a clearly defined strategy, and a net-zero target of 2040 that has been verified by the Science Based Targets initiative (SBTi). Our priority now is decarbonisation initiatives so that we can achieve our near term target of 2030.

“We have a detailed packaging strategy, and are improving the packaging materials we use, and reducing packaging volumes where feasible. However, packaging is also a collaborative issue, and we have to dovetail with the requirements of our customers.

“In addition, preparing for compliance with incoming EU regulation has been important. We are on track with the imminent deforestation regulation, EUDR, and we are putting considerable resource into our CSRD preparations.”

Raynor Food’s innovation and technical director, Tom Holland, also said emissions is a main focus for them too.

“Approximately 90% of our total emissions fall under Scope 3, which originates from our supply chain,” he said.

“While we benefit from the increased use of renewable energy within the UK’s national grid, which reduces our Scope 2 emissions, our primary focus is on decarbonising our Scope 1 and Scope 3 emissions. We are specifically targeting Scope 3 food waste through a proprietary initiative, the S3 Project.”

We’re seeing climate impacts happen all around the world, that’s having a huge impact on our business.

Emma Keller, head of sustainability, Nestle UK & Ireland

Greencore meanwhile is prioritising several areas, related to sourcing and ethics, as well as emissions and health.

“We are progressing our Responsible Sourcing programme, which sets out how Greencore approaches responsible sourcing across our entire supply chain, with topics such as cage-free eggs, deforestation-free soy and supplier engagement on Scope 3,” explained Fran Haycock, head of sustainability Greencore.

“We are developing and launching a Group Scope 1 and 2 decarbonisation strategy to ensure we continue to decarbonise our operations.

“We are changing our approach to Healthy and Sustainable Diets, which is our commitment to positively influencing the health of those who eat our products. We are engaging with both our customers and supply chains to address key topics such as UPFs, GLP-1 and the UK Government’s food strategy asks of businesses.

“We are strengthening our approach to Human Rights in both our direct operations and supply chains by ensuring both our processes and people are set up to protect our sites and those who work for us directly and indirectly.”

Pilgrim’s Europe’s key priorities include carbon, human rights, nature and water.

“We undertake an annual materiality assessment to understand our top sustainability related risks and opportunities and utilise this assessment, as well as our sustainability framework, to help us priorities where we focus,” explained Josephine Blundy, sustainability director at Pilgrim’s Europe.

Elaborating further on the business’s efforts, she noted the importance of people.

“People are at the heart of this journey. Working with some of our key customers, we carried out a Human Rights Impact Assessment (HRIA) in the UK pig, lamb, and now poultry supply chains, helping ensure farmers, workers and communities are treated fairly.

“Similarly, through working with Bright Future Co-Operative we’re supporting victims of modern slavery on their journey back to stable employment. Since 2019 we’ve provided 16 placements across our manufacturing sites, offering safe and secure work, help with accommodation and training.

“If the people behind our food aren’t treated fairly and supported to thrive, the whole system is weaker. Protecting livelihoods and human rights isn’t just the right thing to do – it’s essential to a sustainable future for food."

Business leaders and their attitudes towards sustainability

During our Business Leaders’ Forum in February 2025, we also polled attendees anonymously to find out more about their views towards sustainability.

Among those who responded, more than half said their business has clear sustainability objectives.

In terms of the biggest challenge in making their supply chain more sustainable, cost was cited as the main obstacle.

For those that answered ‘other’ they specified the following:

- Defining standards

- Supply chain resilience is the biggest challenge

- Suppliers knowing LCA/CO2e

- Accessing the data

Within waste reduction, energy consumption was cited as the biggest challenge. For those who answered ‘other’, one person said all options were equally important, whilst the others said N/A (likely due to the nature of their work, i.e. academia).

When it came to consumer expectations for convenience with sustainability goals, most said they balance this by investing in eco-friendly packaging innovation. For the one person who answered ‘other’ they responded with: ‘Supply what the customer wants’.

When it came to promoting sustainability within their workforce, the majority said their business encourages the adoption of sustainable practices by leading by example. However, as many as 24% reported that their business does not.

For those that answered ‘other’, two said it was ‘not applicable’, one said ‘using gamification’, and another said ‘all of the above’.

We also asked attendees what they saw as the main tensions between food safety and sustainability.

Most said processing - including reduced processing, removal additives and increased shelf life - was the biggest conflict, at 38%. However, 30% said they didn’t feel there was any tension.

When asked what their top priority would be for driving sustainability in their business if they had unlimited resources, zero waste operations came top (37%) followed by the creation of a fully circular product lifecycle (27%). For those that answered with ‘other’, they cited:

- Collaboration with the supply chain facilitated by digital technologies to reduce total emissions in the supply chain

- Net zero climate impact

Industry case studies

Emissions

The UK was the first major economy to create a legally binding target to bring greenhouse gas emissions to net zero by 2050.

Much of the industry has set targets to meet this deadline, with some even committing to reach net zero earlier than the deadline.

Here’s some best-in-class case studies of industry ‘emission action’.

Innocent uses automation to boost efficiency

In 2024, Innocent Drinks' Rotterdam facility, known as The Blender, introduced several notable innovations to enhance its sustainability and operational efficiency. The factory now operates a fleet of five fully electric 50-ton trucks, reducing transportation emissions associated with ingredient delivery.

Additionally, the facility employs advanced automation technologies, including robotic forklifts and a robot dog named Spot, to monitor equipment and environmental conditions, optimising production processes. These advancements contribute to Innocent’s goal of achieving carbon neutrality by 2028.

While many other factories in similar positions are closing-down or moving out, investing in large scale efficiency innovations can ensure status as a market leader in sustainability.

Lumina Intelligence analysis

Nestlé coffee factory powered by coffee

Nestlé’s coffee factory in Tutbury is among one of the most efficient coffee plants in the world.

Here, the business monitors all the energy it uses to produce its coffee. To reduce its impact on the environment, spent coffee grounds (used to make Nescafé) are burnt to create steam and used to power some of the factor’s energy requirements.

Each year, around 50,000 tonnes of coffee grounds are recycled.

You can step inside the Tutbury factory in an exclusive video here.

Arla’s green farm gamification project

To encourage farmers to reduce the carbon footprint of their milk and improve protection of biodiversity on the farm, Arla rewards them every time they reduce their climate footprint with its FarmAhead Incentive platform.

Farmers get points for feeding their cows efficiently, managing manure well or using renewable electricity, to mention a few. The more points a farmer earns, the more they are paid per kilo of milk.

The company has earmarked up to €500 million annually to reward its farmer owners’ sustainability activities.

Moreover, through its FarmAhead Customer Partnership, Arla’s customers can invest in on-farm sustainability efforts and directly contribute to reducing Arla’s emissions, which also helps them reduce the emissions from their own value chain.

Oakham Ales launches UK’s first solar powered beer

Oakham Ales has launched Sun City, the UK’s first solar-powered beer, brewed using electricity generated from over 1,000 rooftop solar panels at their Peterborough facility.

This renewable energy installation is expected to reduce the brewery’s grid electricity use by 15%, saving nearly £11,000 in the first year and cutting over 2,200 tonnes of CO₂ emissions across the system’s lifetime.

This approach improves sustainability to meet what customers and regulators want whilst also helping businesses stay strong despite changing energy prices.

Lumina Intelligence analysis

Suntory’s new energy model

Since 2019, Suntory Beverage and Food (SBF) GB&I has procured 100% renewable energy across its factory site and head office.

In 2024, the business announced a £6 million investment to become completely independent of its current gas turbine through a new electricity connection.

The new energy model is set to be up and running in 2026 and will see the current 11 Kilovolt (kv) connection that feeds the factory upgraded with a 33kv connection, increasing the factory’s access to electricity purchased from renewable sources.

This investment will significantly reduce SBF GB&I’s Scope 1 emissions by an estimated 58%, putting it four years ahead of its target to halve its Scope 1 and 2 emissions by 2030.

The connection will also deliver efficiencies throughout the factory by reducing external outages and power cuts. Once the 33 kV project has completed, the business will be in a strong position to move to Power Purchase Agreements (PPAs) or onsite solar.

We’re investing heavily in renewable energy to cut emissions, lower costs, and strengthen our energy resilience.

Pilgrim’s solar powered sites

At Beech Farm, solar panels and battery storage have the potential generate all Pilgrim’s electricity needs, complemented by green energy from chicken litter, ground-source heating, and heat exchangers to further reduce emissions.

Meanwhile, it Tully anaerobic digestion plant processes 40,000 tonnes of chicken litter each year, producing 3 MW of renewable electricity - enough to power 6,000 homes.

Through a partnership with EDF Power Solutions and SAS Energy, it has also delivered major solar projects at its Bromborough, Corsham, Redruth, and Andover sites. The latest at Bromborough features 744 rooftop panels, helping to slash Scope 2 emissions.

“These combined efforts have already delivered measurable carbon footprint reductions and strengthened our resilience against future energy challenges,” said Blundy.

The business has submitted its net zero targets for approval by the Science Based Targets Initiative, as it looks to align its emissions strategy with the 1.5°C pathway.

Transport

Our appetite for diverse cuisine has placed transportation firmly in the spotlight when it comes to sustainability.

Whilst some companies have opted to localise sourcing and look at route optimisation to reduce food miles, others have explored the use of alternative fuels such as electric vehicles (EVs).

The infrastructure and technology needed for EVs is probably its biggest adoption hurdle, with more charging stations required, and batteries needing to be capable of quick charging and much longer journeys.

Currently, there are challenges with batteries able to cope with temperature-controlled transport over long distances. Moreover, those using EVs are having to plan out their journey far more meticulously than a petrol or diesel driver.

Meanwhile, biofuels come with their our set of challenges, including land use and food security due to their reliance on crops.

Bidfood’s transport testing

From 2020-2024, Bidfood had an electric Mitsubishi Fuso E Canter 7.5t truck on lease from Mercedes Benz at our Bidfood Battersea depot, equipped with a multi temperature refrigeration unit.

“Whilst we used this on small inner city routes, the data gathered was somewhat mixed with reliability issues affecting the platform and the lease contract expired in September 2024; it wasn’t renewed,” explained Bidfood’s head of sustainability, Julie Owst.

From February to October 2022, it trialled twelve 18t Mercedes and DAF vehicles at its Bidfood Edinburgh depot with HVO (Hydrotreated Vegetable Oil) which is derived predominantly from used cooking oils.

At the end of the trial, emission data was compared to sister vehicles which had been running on diesel and showed that CO emissions had reduced by 90% and NOx emissions reduced by 12%.

“Whilst this was viewed as a success, the supply of HVO was questioned with how much actually came from recycled oil and how much was made from virgin palm oil stock. Due to a lack of information from the suppliers at the time, it was decided to not expand the trial not to follow up the HVO trial as a means of emission reductions,” said Owst.

In May 2023, it trialled a 19t DAF LF Electric at its Bidfood Battersea depot for three weeks. The DAF vehicle performed well; however, there were some issue with the charging equipment which resulted in a few days VOR (vehicle of road).

In April 2024, it trialled an owned a DAF 18t vehicle fitted with an aerodyne aerodynamic kit against a sister vehicle without the kit for a month at its Bidfood Nottingham depot.

“With the vehicles running the same routes with the same driver for a month period, the vehicle fitted with the Aerodyne kit made an impressive 8.5% fuel saving and we’re now fitting Aerodyne body kits to all our new vehicles,” Owst said.

Eisberg uses Google Glass to guide warehouse pickers

The alcohol-free wine producer has been working with external partners to determine the most efficient way to pack pallets, maximising space usage.

By consolidating orders and optimising pallet loads, it is reducing the number of lorries required on the road. Over time, this has allowed the business to save up to one-third of the pallet space needed for certain customer orders, directly reducing transport-related emissions.

In its direct-to-consumer warehouses, it uses technology such as Google Glass to guide warehouse pickers along the most efficient routes. This reduces unnecessary movement, minimises forklift activity, and lowers energy consumption, further contributing to its carbon reduction efforts.

The Orangery launches hydroponic dining in London

The Orangery by The Good Eating Company features London’s largest on-site hydroponic farm, growing 35,000 plants using 90% less water than traditional farming. As much as 70% of produce is used directly in the restaurant, eliminating transport emissions and shortening the supply chain.

This example showcases hyper-local sourcing as a form of menu storytelling, reinforcing transparency, traceability and quality.

The Chef’s Table, located within the hydroponic farm, offers a bespoke tasting menu served amid the produce itself – a premium, immersive dining experience.

34% of consumers think restaurants should build kitchen gardens to reduce food miles

Lumina Intelligence

Creating immersive dining experiences like the Chef’s Table adds unique value and deepens customer engagement, showing that sustainability and storytelling can go hand-in-hand to differentiate a brand in a competitive market.

Packaging

Packaging has been a major demand from consumers, despite changes in this area not always being the most impactful or indeed easy. This is likely a result of alterations to packaging being a more visible action for consumers.

Lumina data shows that 39% of consumers are avoiding products with excessive packaging.

However, the move to other forms of packaging is not always simple given plastic’s ability to offer longer shelf-life and durability. The environment in which a food product is stored must also be considered, for example frozen, as well as the impact the material has on taste.

M&S trials sustainable ready meal packaging innovation

M&S has launched a UK-first recyclable paper fibre tray for its Fiery Chicken Tikka Masala, replacing plastic with an FSC-certified alternative that’s oven and microwave-safe.

The initiative, in partnership with 2SFG and GPI is unlike typical composite packaging, as it can be recycled at home with paper waste, without separating the two parts.

Lucozade Energy’s redesign

Earlier this year, Suntory’s £6.3 million investment into a major packaging redesign for its Lucozade Energy bottles hit shelves, significantly reducing plastic use and supporting the efficient recycling of its bottles.

Lucozade Energy bottles now feature a half sleeve that covers just 50% of the bottle height compared to previous full-length sleeves.

“This results in a 60% reduction in the total sleeve weight, removing 956 tonnes of new plastic per year. The changes also reduce water use during production, equivalent to an Olympic-sized swimming pool every 289 days,” said Fraser McIntosh, head of external affairs and sustainability.

Packaging accounts for 15.5% of the company’s Scope 3 emissions and a removal of 956 tonnes of plastic a year will help towards its goal of reducing these emissions by 30% by 2030.

The packaging evolution for Lucozade Energy follows similar changes to the sleeve length made to Ribena bottles in 2020 and Lucozade Sport in 2021.

“We have invested a total of £11.3 million over five years to support the development of our sustainable packaging through collaborating with industry experts to achieve a circular economy for plastics and are working towards delivering a DRS in the UK by October 2027 too,” added McIntosh.

Coca-Cola Europacific Partners

Today, all of CCEP’s 500ml bottles are made from 100% recycled plastic (excluding the cap and label).

The Coca-Cola bottler has also rolled out attached caps to help recycling and reduce litter, and it’s backing a consistent Deposit Return Scheme across Great Britain by 2027.

“Packaging is one of the biggest ways we can cut our impact, so we’re working to use less of it, make it easier to recycle, and explore new ways to reuse,” said Sam Jones, director of sustainability and policy at Coca-Cola Europacific Partners (GB).

“But recycling is only part of the picture. We’re also testing new ideas for reuse and refill. One trial with Milk & More saw Coca-Cola Zero Sugar delivered to doorsteps in one-litre glass bottles that could be collected, washed, and reused up to 20 times. It’s giving us valuable insights into how refill could work at scale, and how it could help cut waste and emissions”

One trial includes Reverse Vending Machines (RVMs) at Strathclyde University - a project it’s been working on in partnership with Keep Scotland Beautiful. It has now rolled them out at 12 Merlin Entertainments attractions.

“From recycled content to refill trials, we’re rethinking packaging so it plays a stronger role in a more circular economy.”

Wine in recyclable cans

Eisberg’s Be Free wines are only available in aluminium cans, which are lightweight, fully recyclable, and reduce shipping emissions. While not all wine products can be preserved adequately in cans, the business is actively exploring other ways to minimise its environmental impact.

“Glass remains the primary material for our bottles. We are preparing for initiatives such as the Deposit Return Scheme and are investigating ways to reduce bottle weight without compromising strength, particularly for sparkling wines,” said Dan Harwood, wine expert and managing director at Eisberg’s SW Wines Europe.

For instance, Eisberg distributes 2.2 million bottles in the UK alone, totalling approximately 924 tonnes of glass. It is currently exploring the possibility of transitioning to a new 300g lightweight bottle, offered by one of its packaging suppliers. If the transition is possible, it could save up to 264 tonnes of glass annually, also impacting the shipping weight.

Oata: Re-use is our watchword

Lawrence Moore, commercial director at Oato - the plant-based milk brand - is keen to encourage reuse.

A large percentage of its business is delivered direct to consumers’ doorsteps via a closed loop system, which means that milk bottles are reused up to 28 times.

“We see industry move straight to recycle as the first port of call, but elimination of materials and re-use can be a lot more valuable,” he said.

“A glass milk bottle may have quite the energy intensiveness, when it comes to manufacture, but if you are reusing it over 20 times, that diminishes pretty quickly! Our return rates are very high and all of our trading partners are suitably diligent. The reuse of bottles is embedded in our business model, so it is in everyone’s interest to reuse glass.

“If you directly attach sustainability to the bottom-line, your motivation always remains strong. No virtue signalling here!

“Our grocery business is a little more challenging, as the logistics don’t yet marry with that route to market for a closed loop system, but we are having some interesting conversations.”

The pack for grocery is currently a doorstep recyclable poly bottle, which Moore acknowledges “isn’t ideal” but is “preferable to the category standard multi-layer cartons” which can be difficult to recycle, dependent upon geography.

Water

Water is essential for life - it is needed for ecosystems, for agricultural production and food security - but our freshwater resources are falling at a rapid rate.

The FAO, says that agriculture accounts for 70% of freshwater withdrawals worldwide, and pressure on water supplies for industrial, domestic and agricultural sectors is growing.

Eisberg changes cleaning process

In 2022, Eisberg Wine undertook a project to evaluate the amount of water it used during the cleaning process of its equipment and pipes in our facilities. Previously, the standard process required a 30-minute flush, consuming around 2.3 million litres of water each month.

Through testing, the business discovered that effective cleaning was achieved after just 10 minutes. As a result, it has reset the standard to 15 minutes to ensure consistency and safety, while significantly reducing water consumption.

This change has reduced its water use by around 1 million litres each month - equating to 12 million litres saved annually. In addition to the environmental benefit, this has also generated approximately €68,000 in cost savings.

PepsiCo sets standard for progress in water efficiency

In 2024, PepsiCo surpassed its 2025 water-efficiency target two years early, achieving a 25% reduction in water use at high-risk sites through innovations like membrane bioreactor systems, optimised corn-washing, and vapour recovery from potato cooking. These technologies have saved hundreds of millions of litres annually.

By embedding water stewardship into its broader pep+ strategy, PepsiCo demonstrates how large-scale water reuse and creative resource recovery can drive both sustainability and resilience, offering a replicable model for food and beverage manufacturers facing mounting climate and regulatory pressures.

Sharing clear progress updates ensures a high level of trust between operator and consumer. Offering timelines for sustainable improvements helps set clear goals while driving meaningful impact.

Lumina Intelligence analysis

Purina Europe launches its first Ocean Restoration Programme

Nestlé Purina PetCare Europe recently launched an Ocean Restoration Programme, which sees Purina Europe partnering with expert organisations to help restore 1,500 hectares – the equivalent of around 3,700 football pitches – of marine habitats by 2030.

Marine habitats provide a home to many species, including fish. Fish is part of Purina’s extended supply chain because it uses fish by-products, which are parts of fish that are not typically consumed by humans but provide a valuable ingredient in pet food, so that nothing goes to waste.

Purina is investing in its partners’ ocean restoration solutions across Europe, with the aim of making these effective and scalable. Each partner targets species that contribute to restoring the locally critical marine habitats that are being lost.

The first phase of the programme - which was launched in 2024 - lasts three years, and prioritises the development of research, a measurement framework and the conditions to scale up the restoration solutions efficiently. The second phase is planned to start in 2026, and will focus on scaling the proven solutions.

Nestlé is rewiggling rivers

For several years, Nestlé’s water business has been working with partners like Derbyshire Wildlife Trust to look at how it can support better water management in the landscape.

Our aim is to replenish water - we want to put more water back into the landscape than we take out.

Emma Keller, head of sustainability at Nestlé UK&I.

The company replenishes water this in a number of ways, including through the rewiggling of rivers, planting different grass and tree species to help capture water when it lands in the landscape, and by removing invasive species that negatively impact the natural biodiversity.

Keller explains the process of rewiggling further: “In Victorian times, a lot of our rivers were straightened to make them efficient or to make them look better in some cases. But actually rivers are naturally wiggly because that’s the way the water flows and it helps to manage species’ movements.

“We’re doing an exciting project in Cumbria with one of our dairy farmers, working with a partner to help us rewiggle that river to help it take its previous natural course. As you can imagine, that involves a lot of trying to understand the land and the hydrology of the river. But it’s incredibly important for both biodiversity and making it more flood-resilient in the future.”

Food waste

In 2021, WRAP estimated that the total amount of food wasted in UK amounted to 10.7 million tonnes.

By weight, most food waste comes from households (60%), followed by farms (15%), manufacturing (13%) hospitality and food service (10%) and retail (2%).

According to WRAP, the GHG emissions associated with wasted food and drink in the UK accounted for approximately 18 million tonnes of CO2 equivalent in 2021 and 2022.

Globally, the United Nations Environment Programme (UNEP) says food loss and waste generates 8-10% of annual GHG emissions – almost five times that of the aviation sector.

Tony’s Chocolonely teams up with Kumasi to open factory using entire cocoa fruit

The Chocolonely Foundation and Kumasi Drinks, together with ETG/Beyond Beans, have taken opened the first factory in Ivory Coast that processes cacao fruit juice at scale.

The white pulp surrounding the cacao bean, which is usually discarded, is now being used as an ingredient. This not only rescues food waste but offers thousands of farmers a new and sustainable source of income.

For us, sustainability isn’t a box to tick, it’s how we drive real change.

Nicola Matthews, UK&I head of marketing, Tony's Chocolonely

The project kicked off this month, with the facility set to deliver its first 30,000 litres to its first major customer, the Ivorian juice brand Ivorio. By next year, production will rise to 300,000 litres.

The two organisations share a vision for a fairer cacao industry.

The Chocolonely Foundation supports projects and organizations that contribute to a dignified livelihood in cacao communities in Ivory Coast and Ghana, focusing on activities outside Tony’s direct supply chain.

Kumasi was founded in 2021 by journalist Lars Gierveld, after he witnessed West African farmers struggling to make a living from selling only cacao beans.

Modular frozen meal kits reduce food waste

Belgium-based start-up Winning Foods is reimagining dinner prep with a modular, frozen food concept described as “culinary LEGO”.

Customers choose from 16 frozen meal elements (bases, carbs, veg, proteins), stored in the freezer with alphanumeric codes for easy usage. Using an accompanying app, home cooks follow simplified instructions to combine these blocks into meals.

Winning Foods positions itself as a sustainable alternative to meal kits, the frozen nature ensuring nothing goes to waste if plans change.

Operators can continue to create products that make sustainability a built in, rather than extra task. Products directed at time poor consumers should offer flexibility without forgoing convenience.

Lumina Intelligence analysis

Raynor Food’s S3 Project

The S3 Project from Raynor Foods is an integrated suite of digital technologies to decarbonise manufacturers and reduce substantial costs.

The project is the business’ primary tool for addressing food waste. It works by optimising its processes to reduce overproduction and improve product design for a lower carbon footprint.

The system provides a comprehensive approach to managing its throughput and minimising waste, resulting in an overall lower carbon score, with Raynor Foods having achieved a reduction of more than 400 tonnes in carbon emissions and realised energy savings of over 30%.

Predicting food waste with AI

Nestle is in a partnership with a group called Zest which has brought together a range of charities and AI providers. Together, they are looking at how artificial intelligence can be used to better project and predict where food waste might occur before it happens.

Using these forecasts and identifying where in the process waste occurs and what kind of waste, Keller said the company can then “matchmake” itself with other stakeholders in the value chain to redistribute that waste to an organisation that can use it.

Sourcing

Sustainable sourcing is not just important for the future of one’s business (if we diminish supply, there will be no business), but it’s likely to also be a competitive advantage with shoppers increasingly wanting to know how foods are made and where they come from.

Five Farms Irish Cream Liqueur focuses on biodiversity

Five Farms Irish Cream Liqueur is working closely with its farming partners to reduce environmental impact. One key initiative is the use of white clover pastures for grazing, which naturally fix nitrogen in the soil and significantly reduce the need for artificial nitrogen fertilizers. This not only lowers greenhouse gas emissions but also helps protect local waterways from runoff.

In addition, it is also expanding the use of biodiverse, environmentally friendly mixed-sward pastures, which improve soil health, increase carbon sequestration, and support greater biodiversity on the farms.

Red clover swards are also being developed specifically for silage, further reducing reliance on synthetic inputs while improving the nutritional value of feed.

“These changes are helping us to create a more regenerative farming system that supports soil and water health, reduces waste, and strengthens the long-term sustainability of Irish dairy farming,” said Tara O’Reilly, brand manager, Five Farms, McCormick Distilling Company.

ADM’s humongous regenerative farming project

ADM’s re:generations regenerative agriculture programme takes a farmer-centric approach, offering them a variety of options, such as educational opportunities, financial incentives and technical innovation, that meet their varied needs and empower them in the ways that work best for their specific situations.

The programme works to ensure supply chain resiliency and improve soil health as well as supporting ADM’s goal of reducing Scope 3 emissions by 25% from a 2021 baseline.

“In 2024, we partnered with more than 28,000 farmers and delivered more than 5 million regenerative acres globally, surpassing our 2024 goal and achieving our 2025 goal a year early,” said Ana Yaluff, Director of Sustainability, EMEA, ADM.

“Farmers in the programme reduced their GHG emissions by more than 1 million metric tons of CO2e, and models show they sequestered more than 363,000 metric tons of carbon in the soil.”

McCain Foods ‘Regen Fries’

McCain’s Regen Fries are a new product made exclusively from potatoes grown using regenerative agriculture including farming methods that aim to restore soil health, boost biodiversity, and capture carbon.

Available in familiar formats like Extra Crispy Crinkle and Straight-Cut, the fries are designed to make sustainability both accessible and appealing to consumers. The launch positions McCain as a leader in making sustainable farming scalable and visible on mainstream menus.

With Lumina research showing more than half (59%) of consumers don’t know what ‘regenerative agriculture’ means, using a product launches as a platform to introduce and explain it alongside other emerging sustainability practices is a bright move.

Workplace engagement

Businesses can set all the goals and ambitions they like, but a huge part of making it a success is ensuring your workplace is on board - that they know their responsibilities, they’re encouraged to actively be sustainable, and they understand the progress and aims of their employer.

Training and targets

Baker & Baker has a continuous improvement plan in its factories to raise awareness of energy saving. Its teams also collaborate to deliver initiatives that incrementally save energy. All of its factory colleagues are required to go through this training.

Colleagues who have a clear responsibility for delivering or collaborating across sustainability topics also have specific targets built into their objectives.

“We expect this cohort of colleagues to rise as we further embed our ESG strategy,” said Bevan.

Like many manufacturers, some of Baker & Baker’s sites (in the UK) are not easy to access without a car.

“Public transport is limited at a couple of our [UK] sites, and we therefore encourage carpooling to help address this. Elsewhere, such as in the city of Bremen in Germany where we have a large office, cycling is extremely prevalent in the city in addition to a wealth of public transport options.”

A one-size-fits-all approach across our sites is not appropriate.

Nicolas Bevan, director of sustainability, Baker & Baker

Monthly green awards and gamification

Meanwhile, Greencore runs a monthly awards which recognises and celebrates employees which exemplify its values and are working towards achieving its purpose and goals.

For the awards, colleagues nominate each other and the winner receives a cash prize and recognition. The awards include a category for ‘Sustainable Choices’, which is also a pillar in its model that it calls ‘The Greencore Way’.

“We have put sustainability into Greencore’s bonus metrics and short- and long-term incentives programmes. Scope 1 and 2 carbon, water and waste are included in the annual bonus plan for Executives and colleagues eligible for the bonus scheme,” said Nathan Mills, group people director at Greencore.

“Scope 1 and 2 carbon reduction is included in the three-year executive incentive programme and reduction in Scope 1 and 2 emissions have a 5% weighting in our performance share plan.”

Similarly, Raynor Food’s is providing incentives and recognising employees through its gamification platform.

A portion of the financial savings generated from its S3 technology (20p for every pound saved) is allocated to a fund that supports the game’s reward system.

Mentoring programme

Meanwhile, Nestlé has been running a reverse mentoring programme where it’s had some of its younger colleagues (typically 20+) who are really passionate about sustainability, mentoring its senior leadership team (typically 50+) on sustainability.

Keller described it as “a really lovely opportunity” for those young people to “challenge the leadership” and ask questions around why the business has made certain decisions, as well as a chance for the SLT to engage with potential future leaders of the business and understand what’s on their minds.

Incentives and insight

Suntory offers Electric Vehicle Salary Sacrifice Scheme and Cycle to Work Schemes as financial incentives, but it also has a ‘Green Month’ where it lays on debates, panels and seminars for everyone in the business on the burning issues within sustainability. The initiative started off as a green week and then fortnight, before becoming a month-long project due to demand.

“We are also rolling out climate education incrementally with an ambition to have all colleagues ‘Climate-Fresked’ over the next few years. Early sessions with our leadership teams have been really well received,” said McIntosh.

Communicating goals

Greencore communicates its sustainability goals and progress through its quarterly Sustainability Webinars, which every colleague is encouraged to attend.

“We also produce weekly staff videos from our CEO, Dalton Philips, which highlight key developments and areas of focus across the business, including sustainability initiatives,” added Mills.

“Every quarter, we cover the progress we have made against one of our three primary sustainability pillars (‘Sourcing with Integrity’, ‘Making with Care’ and ‘Feeding with Pride’). We also share our year-end performance with colleagues as part of the final webinar in the calendar year.”

Oato’s commercial director said that the business is currently reviewing how best to communicate its sustainability goals and achievements with its employees as an SME.

“One of the key challenges for us as a small business is navigating best-practice; particularly when it comes to quantitative measurement of emissions,” Moore said.

“Large companies often have the luxury of dedicated resource and budgets to comprehensively manage this, but the unique nature of smaller enterprises presents challenges which are often missed by something resembling a one size fits all approach from government.

“It needs to go beyond simple regulatory frameworks and recognise that as a nation of small businesses, the UK needs a lot more in the way of practical tools and incentives to encourage the right behaviours.

“We know we are making progress and we do our very best to measure and communicate, but it is far from easy and it does sometimes feel like regulatory approach needs a more nuanced, tiered approach to encouraging all small manufacturing businesses to do absolutely everything we can to move towards a genuine low-carbon economy.”

Methodology

The research that forms this report is from six different major sources, including:

Convenience Tracking Panel

Lumina Intelligence’s UK Convenience Tracking Panel (CTP) - Interviews with shoppers and non-shoppers at an annual sample size of 40,000+ weekly data collection in all major UK convenience groups. Continuous data captured online and in-store 2020-2025

Top of Mind Report 2024

Lumina Intelligence Top of Mind business leaders survey is an online questionnaire targeted at industry professionals across the eating out and grocery retail markets, focused on understanding the current trading environment, challenges and growth opportunities.

It is based on responses from c.71 leaders working in senior management positions.

The survey was carried out from June-August 2023 and data has been compared to the previous two waves, collected in June- July 2021 and June-July 2022.

Eating & Drinking Out Panel

Lumina Intelligence’s UK Eating & Drinking Out Panel (EDOP) tracks the behaviour of 1,500 nationally-representative consumers each week, building up to a sample of 78,000 every year, across all eating out channels and day-parts (including snacking). Data is sourced between 2020-2025.

William Reed Sustainability Survey 2024

William Reed’s simple online survey with 1500 participants of a nationally representative sample looking into opinions on the sustainability efforts by food and drink brands that are available in the UK in August 2024.

Food Manufacture Business Leaders Poll

We polled attendees at our Business Leaders’ Forum in February 2025 via an anonymous Slido. This event was made up of producers - both small and large - alongside a select few academia, independent consultants, government, and the event’s sponsors. Due to the nature of the poll and event, the number of people answering often differed. The mean number of respondents across the above seven polls was 40.

Industry interviews

Food Manufacture’s editor conducted interviews with a range of SMEs and big industry players across different categories of food and drink and its supply chain. Data is has been sourced between August to September 2025.