Welcome to the soft drinks chapter of Food Manufacture’s Drinks Report, which includes still and sparkling water. This is kindly sponsored by Blended Products.

This report is based on electronic point of sale (EPOS) for the year ending March 2025, gathered by Circana. It also features case studies and expertise from the industry sourced by Food Manufacture to provide further analysis. Any other data references are indicated.

You can read the full drinks report here.

Soft drinks trends

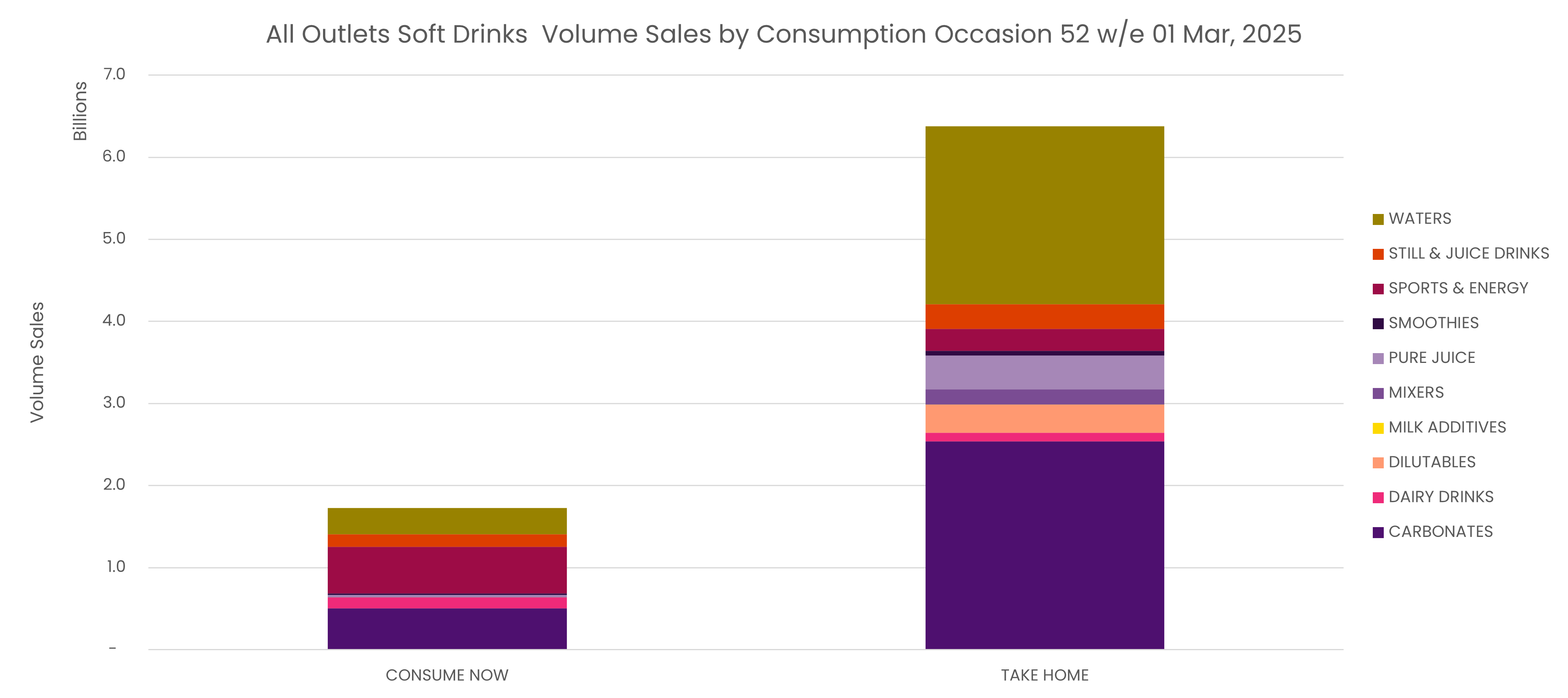

Soft drink volume is dominated by take-home consumption, with 3.7 times more volume drunk at home.

Despite access to tap water at home, packaged water (e.g. bottled) has one of the highest at-home consumption by volume sales.

Offering a hypothesis, Alex Lawrence, senior strategic insight director, Circana, said the preference could be due to a lack of confidence in tap water purity.

“The recently lifted boil water order in North Yorkshire pushed bottled water volume up by 16% over last year in the last 3 months, well above the national average and it is likely these scares have longer term consequences for where people source their drinking water,” he observed.

Carbonates dominate the category with the former seeing 34% value share and 38% volume share for the year ending March 2025. This is followed by still water, which has seen 19% and 26% value and volume share.

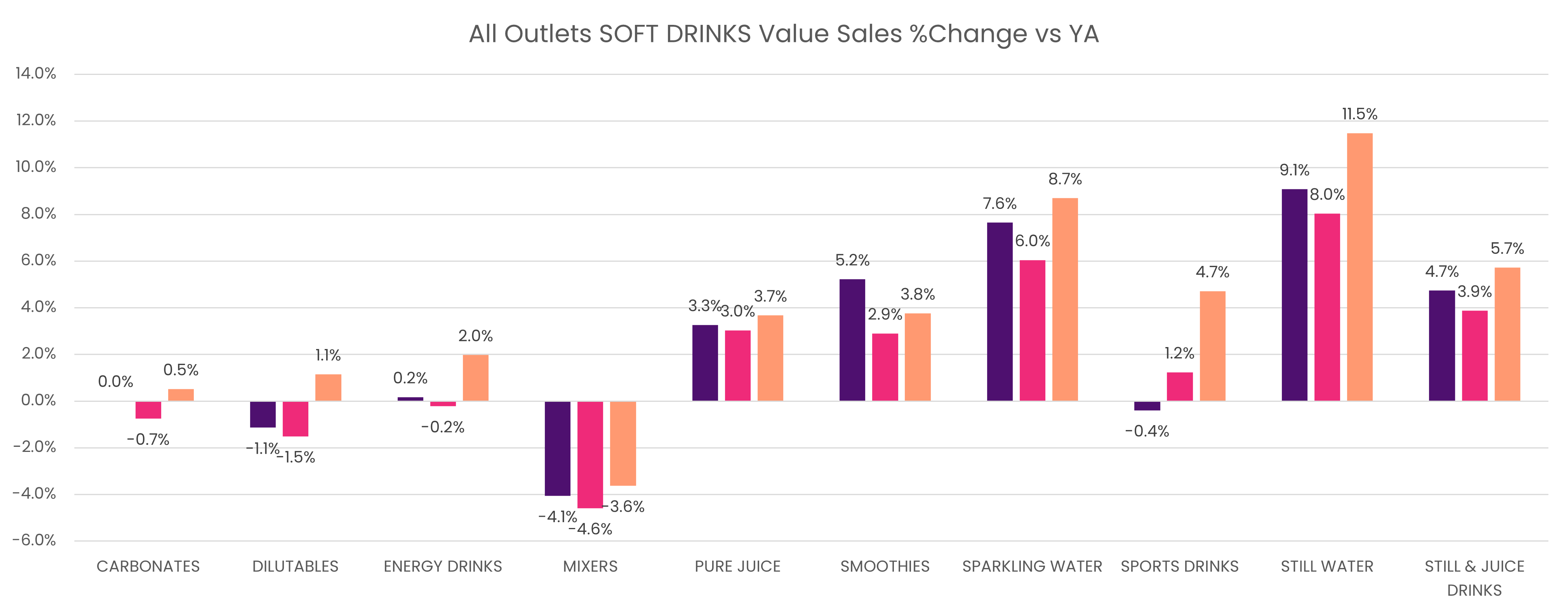

The cost-of-living crisis has made a dent on the soft drinks market, with water the clear frontrunner. Overall, still water has seen a 9.1% increase in value sales on the year and a +11.4% in volume sales.

Keep drinks cool, crisp and carbonated – Blended Products Ltd

At Blended Products, we’re proud to support the drinks industry from production line to perfectly poured pint .

We supply food-grade CO₂, essential for carbonation in soft drinks, lager, cider and sparkling water. Whether it’s creating the perfect fizz or maintaining pressure in dispense systems, our CO₂ ensures consistency, quality and refreshment in every sip.

Behind the scenes, drinks need to stay cool — and that’s where our expertise in refrigeration gases and system support comes in. We provide anhydrous ammonia for industrial-scale chilling and freezing, and a full range of secondary refrigerants to suit different cooling applications across bottling plants, breweries and cold storage.

To keep things running smoothly, we also offer maintenance chemicals including corrosion inhibitors and glycol blends, helping customers protect their systems and meet hygiene and safety standards.

From craft producers to major manufacturers, Blended Products helps keep the drinks industry chilled, carbonated and always ready to serve.

Cheers to that!

Find out more about Blended Products here.

Sparkling water is following on its heels with +7.6% value growth Y-o-Y and then smoothies at +5.2%.

All categories with the exception of carbonates, dilutables, mixers and sports drinks have seen growth on the year. Carbonates has remained static on the year, although it appears to be on an upward trajectory. Energy drinks, which only saw a 0.2% value sales lift on the year has also picked up.

Mixers, dilutables, and sports drink are in decline, with mixers hit most hard with a 4.1% decline in value.

“Weak performance in mixers represents weak spirits performance and growth in RTD spirits,” summarised Lawrence.

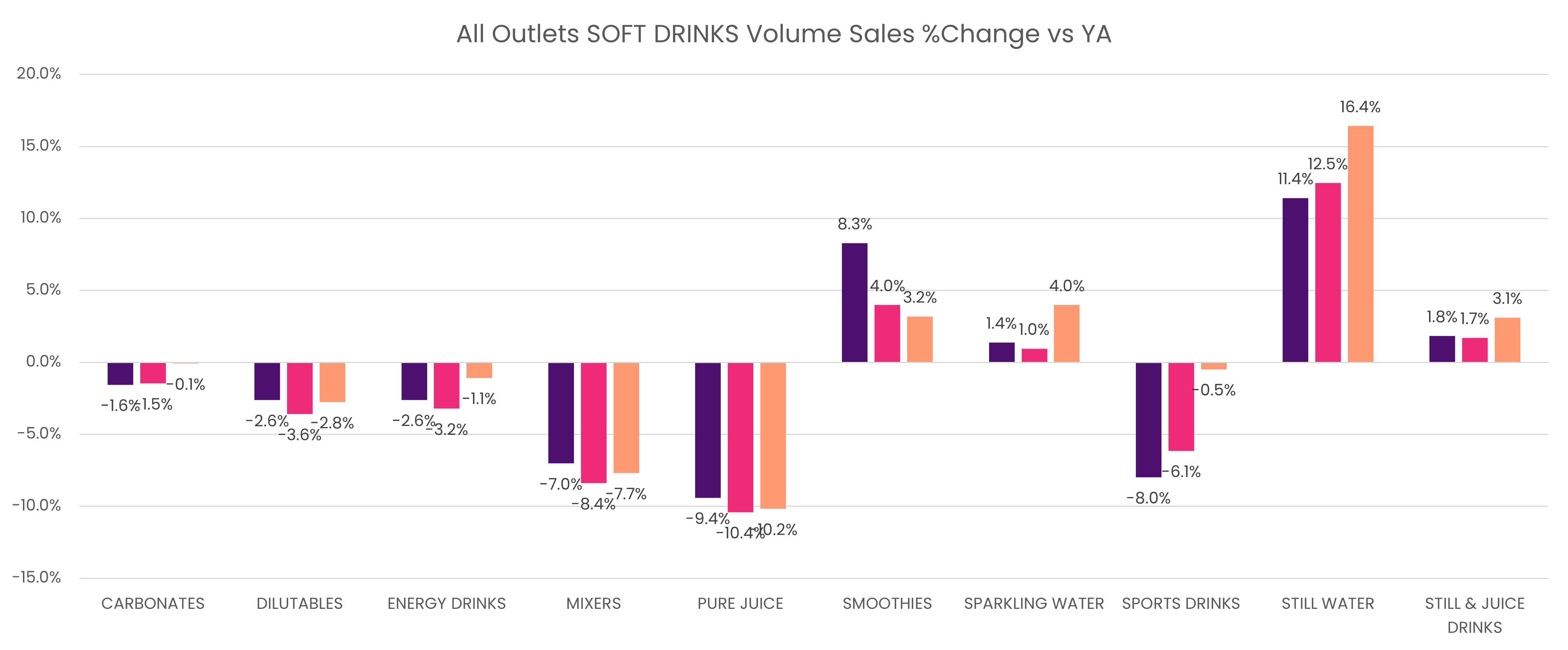

In terms of volume sales, all categories are falling, except for four: smoothies, sparkling water, still water, and still and juice drinks. Most harshly impacted is pure juice at -9.4%, sports drinks at -8%, and mixers at -7%.

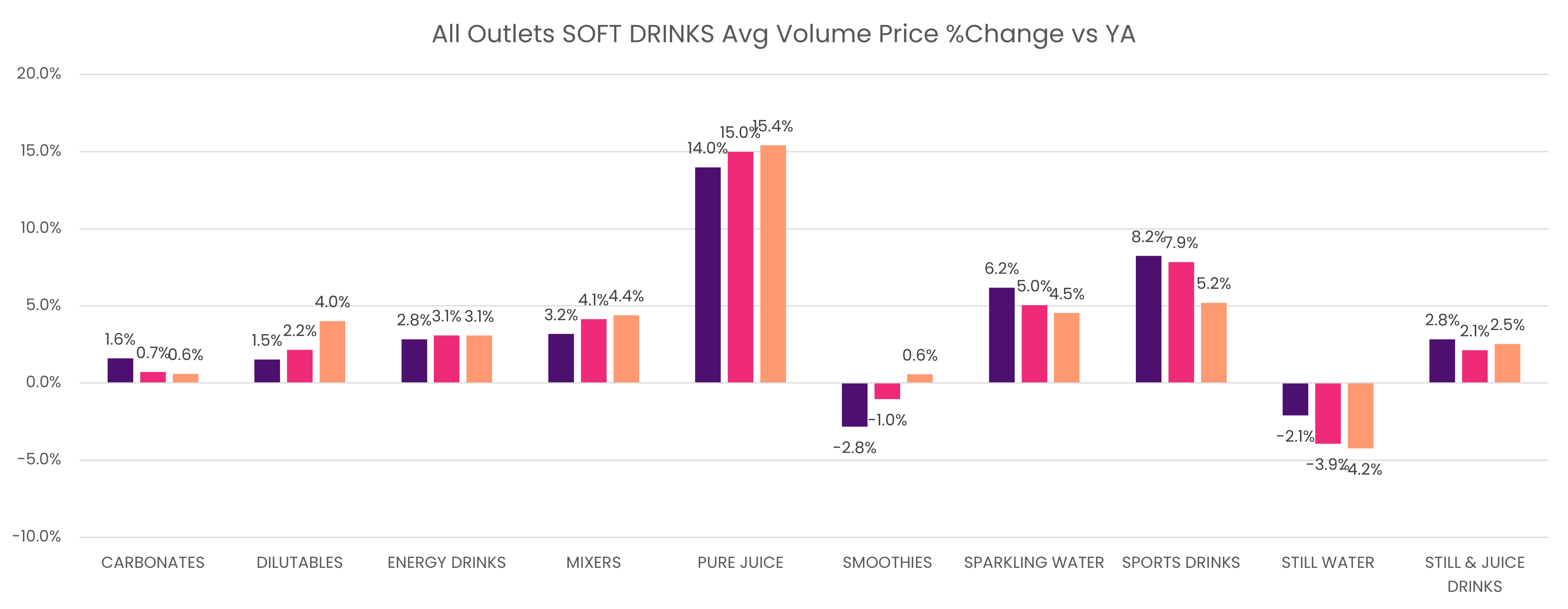

The average volume prices are up across all categories expect smoothies (-2.8%) and, notably, still water (-2.1%) on the year. Over the course of the year, still water has become significantly more price competitive, falling by -3.9% last 26 weeks and -4.2% in last 13 weeks (ending 22 Feb 2025).

All categories with the exception of sports drinks and pure juice have seen significant increases in promotional investments Y-o-Y. Carbonates’ promotional investment growth, albeit slowing, is still significant ahead of last year in recent time periods.

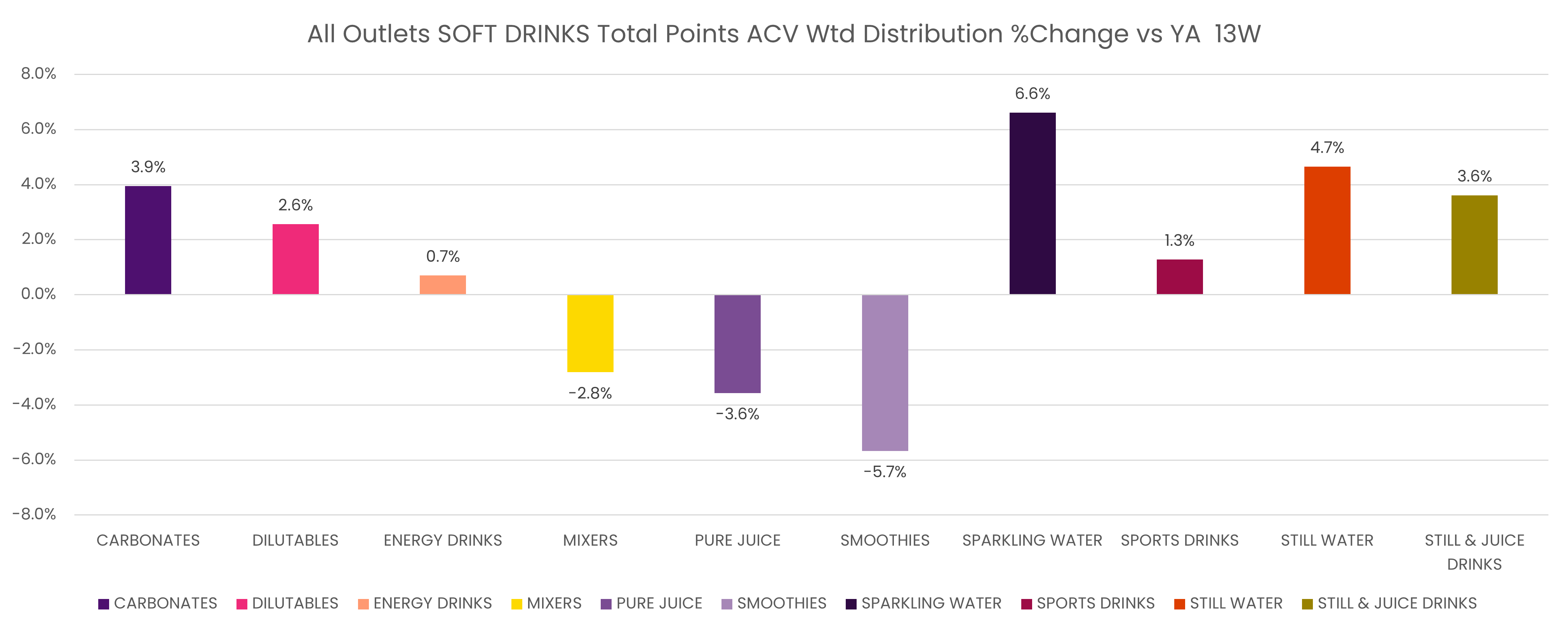

Meanwhile, water (both sparkling and still) has seen the biggest range gains (i.e. NPD, new listings) with carbonates also gaining. Mixers, pure juice and smoothies, however, have been in decline.

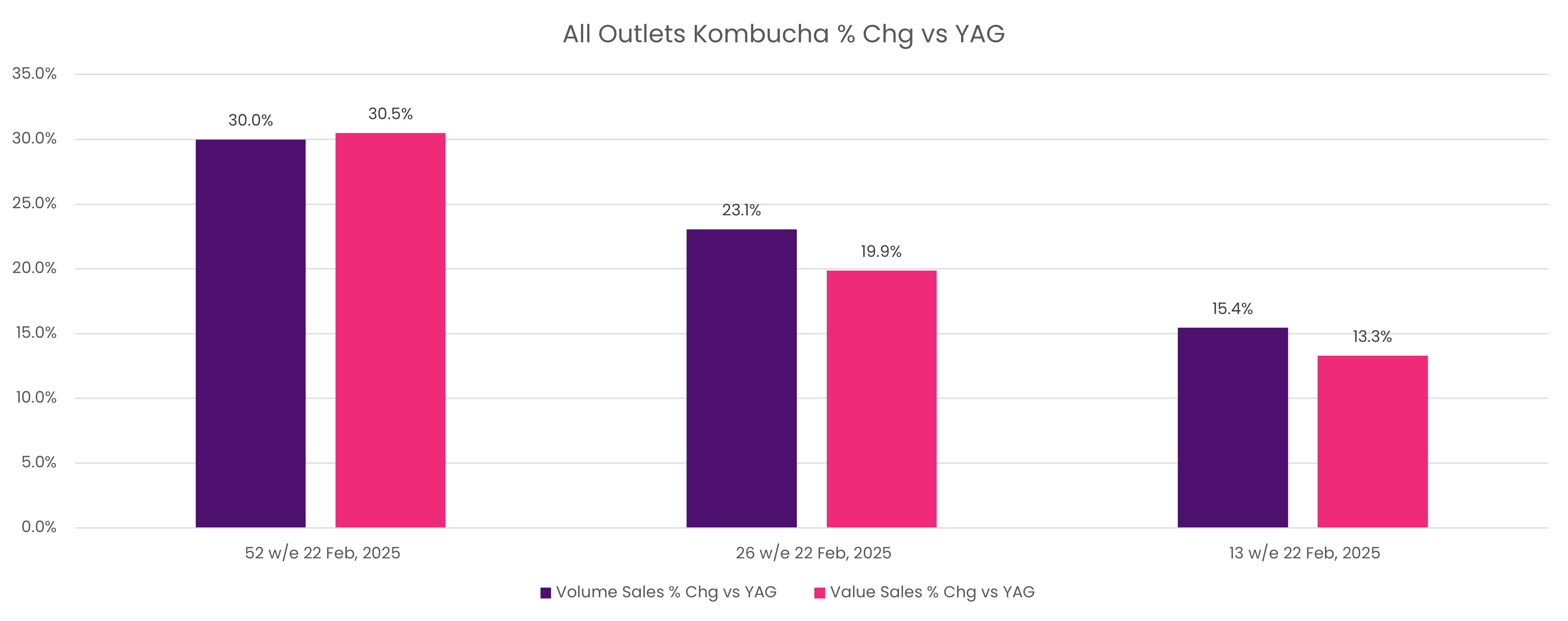

Health has had a big sway on soft drinks, with growth being driven by functional options such as kombucha (+30% on year) and health shots such as ginger and turmeric (+92% on year) for the w/e 22 February 2025. Growth within this shot category has been a great key driver for still and juice drinks – a market already worth £37 million.

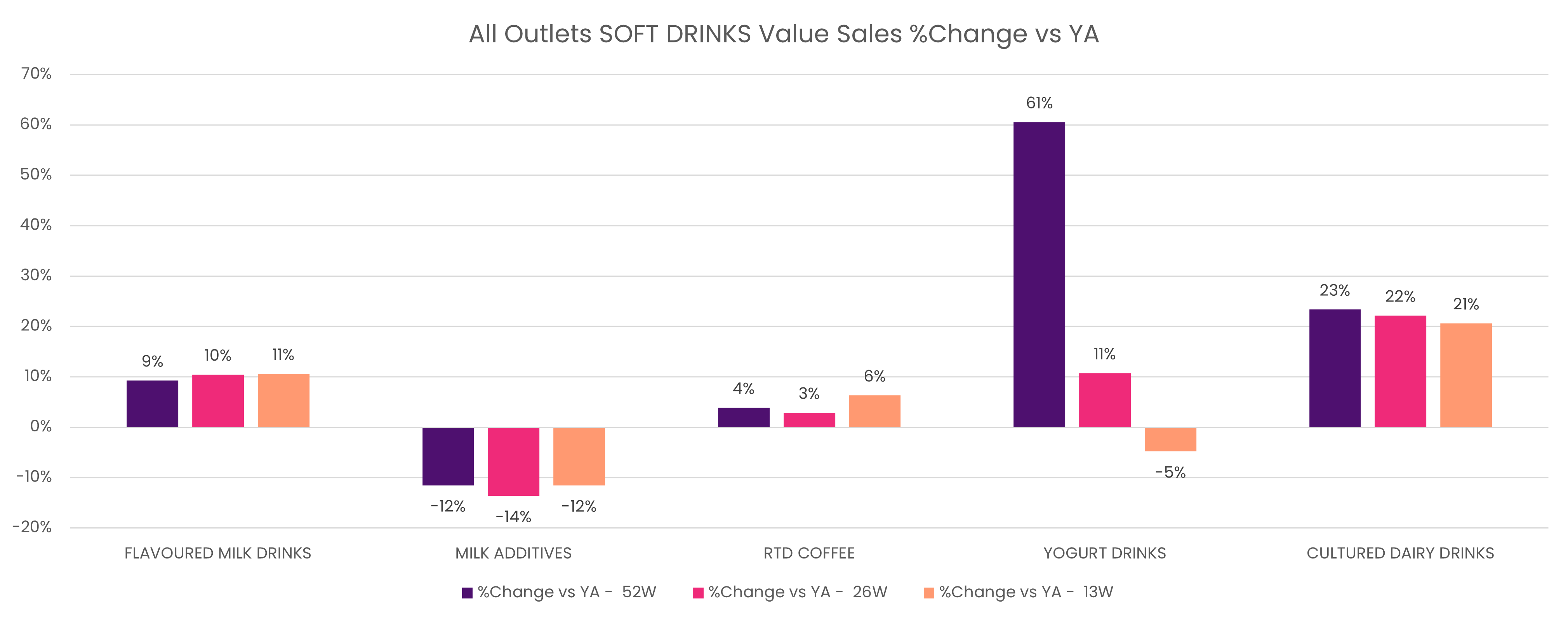

Those targeting digestive health are also operating in a particularly lucrative market and this has also translated to growth in dairy-based drinks.

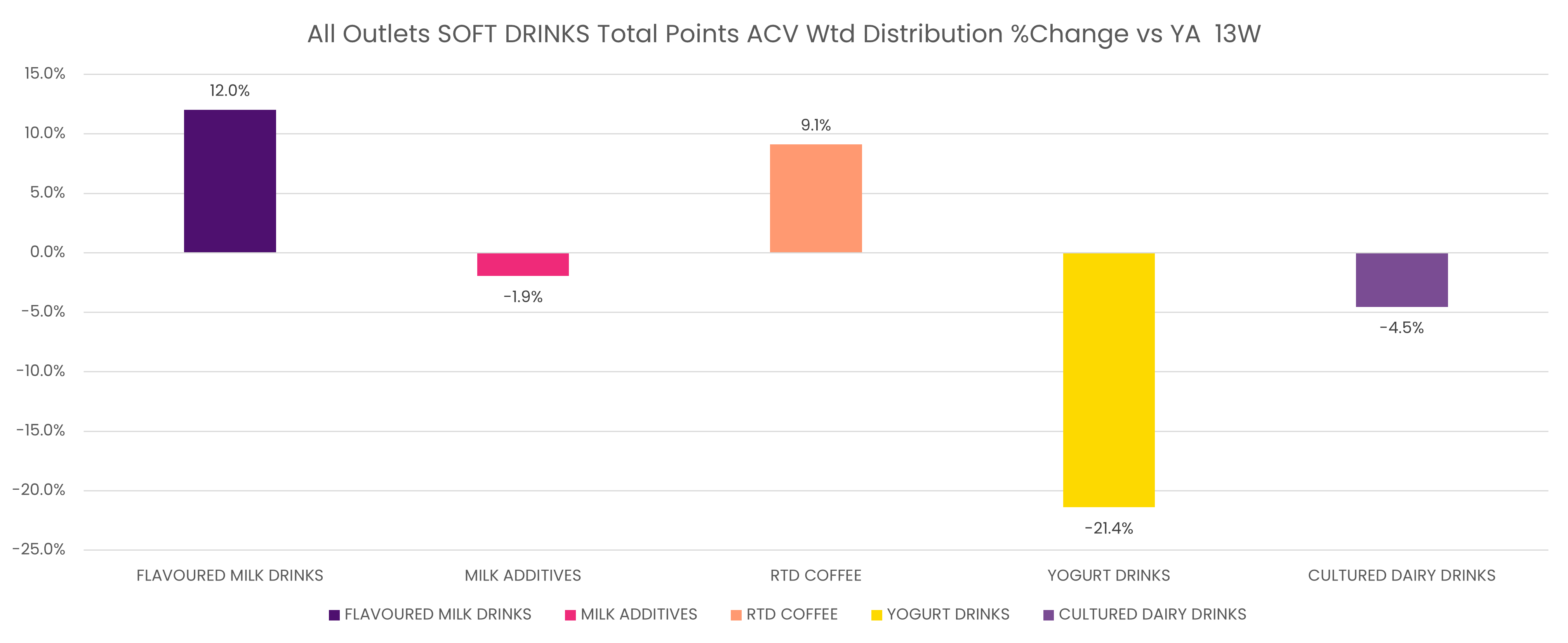

Flavoured milk (49% value and 62% volume) and RTD cold brew coffee (38% value and 26% volume) dominate the dairy-based beverage market.

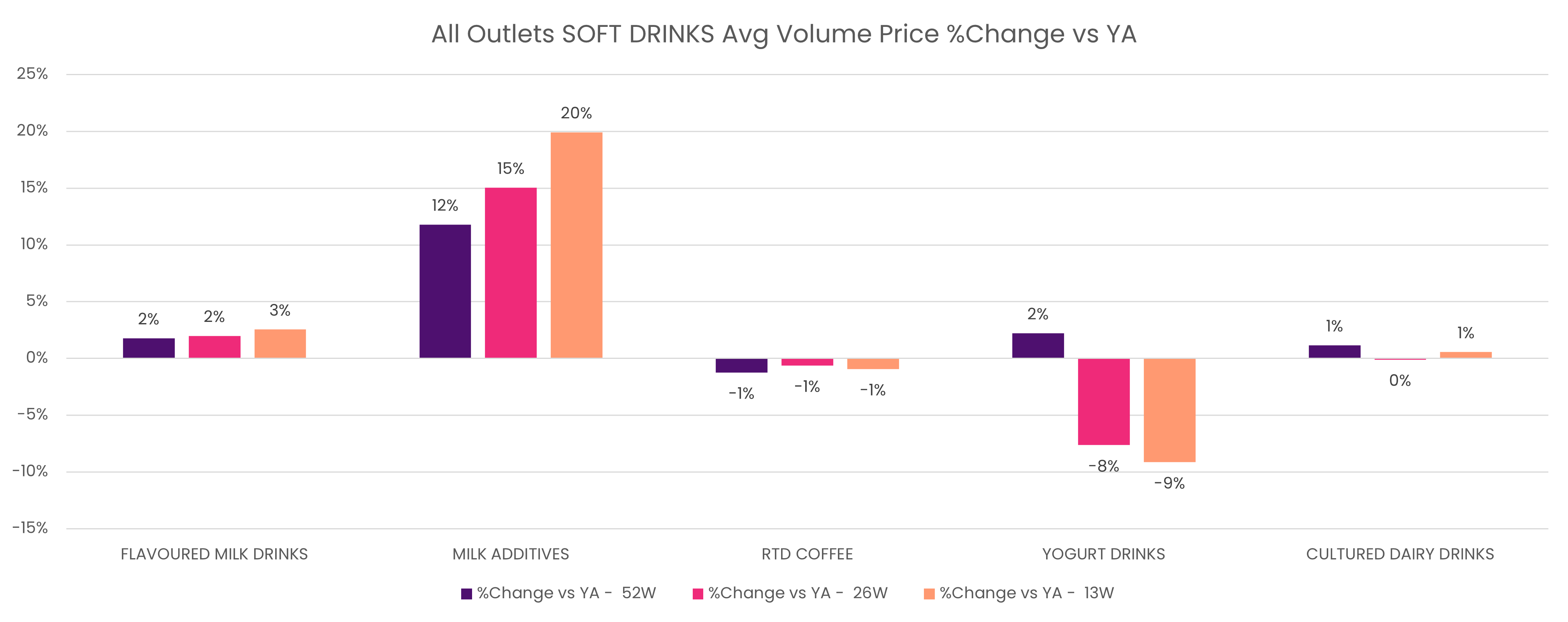

Flavoured milk has seen Y-o-Y price increases, yet this has not curbed continued volume growth.

“RTD iced coffee has a much higher average volume price which is contributing to category value disproportionately,” said Lawrence.

There has been significant growth in yoghurt drinks at 61% value sales on the year. This has been driven by brands including Danone, GetPro and Yoplait. While growth in cultured dairy drinks (+23% value sales on year) is coming from Kefir products, notably Biotiful.

Both these categories are also seeing momentum in volume sales, with yoghurt drinks seeing +57% on the year and cultured dairy drinks +22%.

Flavoured milk and RTD coffee have made big range gains, with new listings and NPD growing. However, only RTD coffee has seen an increase in promotional investment in recent months; growth is slowing or in decline elsewhere. Yoghurt has lost over a fifth of its range in the last 13 weeks vs the year.

Supermarkets have dominated market share over the last 12 months, with water driving its growth.

Hybrid working and average weather patterns have continued to dampen symbol and independent performance, with major multiple convenience winning share in more recent weeks with range growth in convenience and the rise in ‘impulse’ buys.

Water has also help push volume growth here, although still and juice drinks is another category where grocers are gaining substantial share. Grocers are also outperforming on value and volume sales in RTD coffee.

Trends in action

Yoplait – healthy yoghurt drinks

Yoplait was launched in 1965, entering the UK market in 1991. Under its umbrella, it has a number of iconic brands including, Petits Filous, Frubes, Wildlife, and Yop. The business is owned by Sodiaal– the largest cooperative of dairy farmers in France.

Its products are generally targeted towards children and are fortified with vitamin D and calcium – which many kids in the UK are deficient in. Meanwhile, its drinkable yoghurt brand Yop, which is also a source of vitamin D and calcium, is for the next age group up, geared towards teenagers.

Overall, Antoine Hours, general manager for Yoplait UK, said the dairy drinks market is “performing very well – around double digits in value”.

He added: “We expect this category to be close to £700 million in the next few years.

“Yop is particularly driving the growth. We are growing faster than the market, at +40% annual growth.”

Format is very important, it needs to be fit for on-the-go and suitable for younger people with smaller hands.

Antoine Hours, Yoplait UK

Hours believes much of this growth is being fuelled by Yop’s appealing taste and texture, claiming that it performs much better than competitors under blind tasting. But whilst the brand is doing very well, he added that there are also a lot of other players witnessing strong growth in dairy, particularly in the kefir space.

Interestingly, Hours has noticed that many Yop drinkers are new to the category.

“Most of the consumers (>80%) we are attracting for Yop are incremental to the category and that isn’t something I’ve seen very often in different categories and other countries. Usually there’s always a little of market share stealing from one manufacturer to the other,” he said.

On-the-Go format

In terms of NPD, the brand has been focused on format and packaging: “The format for packaging is very important – something which is fit for on-the-go and suitable for younger people with smaller hands.”

But it has also seen big success in Europe with its Yop sharable 825g fridge bottle.

Much of the focus recently for the business has been in sustainable packaging, with Yop bottles having moved from PET to a recyclable material with a pre-cut sleeve (easy to remove and recycle).

The bottles currently have around 35% recycled PET and the brand is keen to continue upping this.

Plain and natural

Regarding wider consumer trends, Hours says plain and ‘natural’ are sought after qualities around the world, alongside high protein.

Speaking on how this may influence the brand, Hours said plain yoghurt is an “interesting territory to play with” and this may be an area the business looks at for drinks in the future.

Actiph – functional water

Actiph is a rapid growth functional drinks manufacturer that produces the brands: Actiph Water – an innovative alkaline ionised water; Activit – a sugar-free, low calories vitamin water; and Acti+ - a nootropic enriched, natural, clean energy drink.

The business was founded in 2017 by 15-time Guinness World Record holder, Jamie Douglas-Hamilton.

“The Actiph brands straddle several key subcategories which are all in strong growth and outperforming the wider water category: premium, flavoured, and functional,” Barnaby Hughes, Actiph’s chief marketing officer said.

“With these segments growing at more than double the rate of the category as a whole, they are simultaneously driving the total category forward, and illustrating the continued consumer trend towards healthier, high quality, great tasting drinks products.

“Actiph and its brands continue on an exciting growth trajectory that sees unit sales growth outpacing the category by more than 8x over the past 52 weeks. This is further supported by an explosion in our online business, with DTC sales up 300% over the past 2 years as more and more consumers opt to make Actiph Water and Activit part of their regular purchasing habits.

Simple swaps, less jargon

Hughes said the brand is seeing consumers prioritising “simple swaps” that support a healthier lifestyle, without compromising on taste or price.

“As such, the growth area we see is in healthy drinks that are flavour and lifestyle-led, as opposed to overtly functional, jargon-heavy products that may deliver health benefits, but deliver a poor taste and whose messaging may feel inaccessible or irrelevant for most consumers,” he said.

Consumers are looking for healthy drinks that are flavour and lifestyle led.

Barnaby Hughes, Actiph

“In a turbulent macro-economic environment, consumers are also looking to make their spend go further, not necessarily by cutting back or switching to own label products, but by ensuring the brands they do choose to invest in deliver not only exceptional quality, but also exceptional bang for their buck. This could be through value-adding mechanisms and promotions, the brand aligning with the consumer’s core values, or bigger pack sizes that offer greater volume per pound spent.”

The brand has been seeing growth across the board in terms of channels, but online is becoming an “even greater part” of its total business where previously in-store was much more dominant.

In terms of NPD, it has recently finalised a refresh of its Activit brand and packaging to align more with current consumer needs and trends. This prioritises flavour-led design with simple, accessible messaging around the health benefits of the product.

“The goals is to further set ourselves apart from competitors in the space who, for the most part, are more functional in their approach and subsequently lack distinction from one another and don’t best serve consumer needs. This rebranded product has begun filtering onto shelves and should be in full circulation by mid-Summer.”

The business is also in the final stages of developing a PET bottle version of its Activit product intending to offer consumers “a better value, more convenient format”, as well as opening the Activit brand up to distribution opportunities which may previously have been closed off to products only available in cans.

Tenzing – natural energy

Tenzing entered the market in 2016, led by Huib van Bockel, who, after spending eight years as the UK and European Marketing Director for Red Bull, spotted a gap in the market to create a healthier (for human and planet) energy drink option.

He was inspired by traditional Himalayan brews used by Sherpas, like Tenzing Norgay, to fuel their high-altitude expeditions; and launched the Original recipe in 2016.

Today, the brand offers a range of seven ‘all-natural’ plant-based drinks, along with exciting Limited Editions, all delivering on a triple hit of natural caffeine, vitamin C and electrolytes. Flavours include Line & Mint, Apple & Seaberry, Pineapple & Passionfruit, Raspberry & Yuzu, and Fiery Mango.

“The energy drinks category in the UK is worth £2.2bn and growing at 6% Y-o-Y. Within that, Tenzing has become the No.4 functional energy drink in UK grocery and the only brand in the top 10 made entirely from natural ingredients. We’re also now the No.3 functional energy drink in Tesco, the UK’s largest supermarket,” Bockel told Food Manufacture.

“Our +30% value sales growth this year is three times faster than the overall category — proof that consumers are actively seeking natural energy alternatives.

Health is an expectation

“The biggest driver in the energy drinks sector right now is the demand for real flavour, real ingredients and a growing rejection of ultra-processed foods. More than ever, consumers are scrutinising what’s in their drinks and artificial sweeteners have become one of their top concerns. They want transparency. They want ingredients they don’t have to feel guilty about.

There’s a demand for real flavour, real ingredients and a growing rejection of ultra-processed foods.

Huib van Bockel. Tenzing

“Yet the majority of energy drinks on the market are still filled with artificial ingredients, artificial sweeteners, or excessive sugar. At Tenzing, our mission is to prove you don’t have to compromise to get your energy fix. You can have great flavour, effective functionality without the junk.

“One of the most significant shifts is that health is no longer a trend — it’s an expectation, particularly among younger consumers. This audience is highly informed: they read labels, avoid artificial sweeteners, and are sceptical of ‘zero sugar’ drinks that replace one problem with another.

Plant-based functional drinks

“We’re also seeing an increased need for plant-based, functional drinks that support focus, immunity, and energy. These shoppers want products that do something — but without compromising on ingredients or values.”

Energy drinks are very much an impulse-driven category, tied to specific moments of need – whether it’s the morning commute, the post-lunch slump or a quick energy boost between meetings.

“Therefore retail, especially convenience retail, take the biggest chunk of our sales. Online has been increasing year over year as consumers also want to stock up at home and make sure they have their favourite drink always available in their fridge.”

TRIP – mental wellbeing drinks

TRIP was founded in 2019 by Olivia Ferdi and Dan Khoury after the couple both started taking CBD.

The CBD-infused beverage brand holds listings in a range of stores, including Sainsbury’s, Ocado, Harrods, as well as many hospitality chains such as The Ivy and Brewdog.

In August 2022, the business secured a £10 million investment to drive growth, having already witnessed a 500% rise in sales Y-o-Y in the first half of the year. It’s now on track to see a Q2 2026 run rate of £60 million and is the largest privately owned soft drinks company in the UK.

Mental well-being

Its latest launch is TRIP Wild Strawberry which sees the company teaming up with mental wellness app, Calm. This follows the brands’ USA partnership with Target, which launched with a celebrity campaign fronted by American model, Ashley Graham.

Each can unlocks three months of free Calm Premium and can be found in Tesco, Sainsbury’s, Waitrose, and online, either direct from its website or via TikTok Shop or Amazon. It is also stocked in franchises including Young’s Pubs and Leon.

Lightly sparkling with no-added sugar, the flavour balances sweet wild strawberry with tangy grape and a touch of aromatic sage. It’s also infused with magnesium, chamomile, Lion’s Mane, and lemon balm – botanicals trending for their perceived stress-reducing, mood-boosting benefits.

Coca-Cola Europacific Partners – big moves in ‘Big soda’

When it comes to drinking occasions, Rob Yeomans, vice president (VP) of commercial development at Coca-Cola Europacific Partners (CCEP) GB, told Food Manufacture that preferences and choices in young adults are shifting – especially when it comes to choosing a soft drink accompaniment for different mealtime occasions.

“[Young adults] are more likely to have a soft drink during a meal and with food than other any age group,” he explained.

“Notably, young adults have a broader soft drinks repertoire compared to other consumer groups, enjoying colas and flavoured carbonates alongside growing segments like energy, and ‘adult special’.

“Although young adults as a group still prioritise taste over health compared to other age demographics, they still show a marked preference for sugar-free options across both traditional and non-traditional soft drinks segments.”

The Coca-Cola portfolio, which alongside its namesake includes the likes of Fanta, Dr Pepper, and Monster, among others, is leading the way in a number of key segments.

“The Coca-Cola portfolio accounts for more than two-thirds (69.3%) of value sales in cola, the largest soft drinks segment in retail,” said Yeomans.(1)

“Coca-Cola Original Taste remains the largest soft drinks brand in GB and continues to grow in value; Coca-Cola Zero Sugar is worth more than £477 million. While Diet Coke is the original sugar free cola and is worth more than £495m in retail, with a customer base so loyal that 32% of its drinkers are not only brand-exclusive but say they would drop out of cola if Diet Coke wasn’t available.(2,3)

“Fanta is the leading flavoured carbonate brand in GB retail, valued at 1.5 times more than its nearest competitor, and accounting for nearly one in every five flavoured carbonates sold in GB.(2)

“Dr Pepper is the second biggest flavoured carbonates brand in GB. This consistent performance demonstrates the role ‘traditional’ soft drinks segments continue to play for shoppers.(2)

“While the energy segment continues to move from emerging status to a mainstream staple in the soft drinks category, it has significant growth opportunity through innovation and extended portfolios focused on flavour, to unlock new occasions, new consumers and drive frequency of purchase.

“Energy drinks are the no.2 deliverer of value growth in soft drinks. Monster remains a major driving force behind this growth, adding more sales value than any other brand as GB’s fastest-growing energy drinks brand.(2,4)

“Flavour innovation and marketing activity both have a part to play in keeping the category exciting and ensuring it appeals to new and existing shoppers.”

Low and no sugar

“Powerhouse brands like ours that sit across ‘traditional’ and ‘non-traditional’ or ‘emerging’ segments all have a role to play in bringing credible flavour innovations to market – to complement a strong core range, deepening loyalty from existing shoppers and attracting new consumers into the category. Our innovation strategy remains focused around low and no sugar – while protecting shopper choice,” continued Yeomans.

“Flavoured colas currently account for 10.7% of growth in GB’s £2.88 billion colas sector, as consumers look for new twists on their favourite drink. We expanded our portfolio at the start of this year with the launch of Coca-Cola Original Taste Lime and Coca-Cola Zero Sugar Lime, bringing a refreshing zesty twist to the classic Coca-Cola taste, with or without sugar. Coca-Cola Lime is already worth £1.84m, and our flavoured colas range, is up in value by 3.1%.(2)

While younger consumers still prioritise taste over health, they still have a marked preference for sugar-free options.

Rob Yeomans, Coca-Cola Europacific Partners

Innovative variations on fan favourites can create a sense of intrigue and excitement that benefits the whole range; Coca-Cola has seen this with its zero sugar Oreo-collaboration (part of Coca-Cola Creations).

“One in five shoppers that bought our Coca-Cola Creations in its first year were new to the Coca-Cola Zero Sugar brand, and there was a sustained volume sales increase for the overall brand in the months that followed each launch,” added Yeomans.(5,6)

Building on Fanta’s popularity within flavoured carbonates and catering to the demand for zero sugar options, Coca-Cola launched a trio of zero sugar flavour variants earlier this year.

Fanta Zero Apple and Fanta Zero Raspberry rolled into stores from late February, joined by limited-edition Fanta Tutti Frutti Zero Sugar from mid-March.

“We also added a limited-edition cherry twist on the popular Dr Pepper zero sugar variant at the end of January, with the addition of Dr Pepper Zero Sugar Cherry Crush, capitalising on the 6% of cola value sales growth delivered by cherry’ variants over the past year,” Yeomans said.(7)

“While still on their journey to being considered mainstream within the soft drinks category, energy drinks are worth more than £2.1bn in retail.(4)

“Monster has added an extra £78 million worth of value sales to the energy drinks category over the last year, remaining the fastest-growing major energy brand in GB in value terms, against a backdrop of high single digit volume growth.(8)

“Monster’s NPD has driven more than half of energy drinks’ innovation sales in the last year. In January, Monster Juiced Rio Punch joined the Juiced range, which is growing by 12.8% in value and now worth over £115 million in GB. In September, Monster Ultra Strawberry Dreams joined the HFSS-compliant Monster Ultra range – the No.1 zero sugar energy brand in GB, up 11.9% in value, adding £29 million in sales over the last year.”(9)

Personalisation and relevancy

Coca-Cola has been particularly creative with its marketing campaigns, teaming up with influencers and linking its products to pop culture, alongside offering interactive and personalised experiences.

“We know how important it is to keep investing in our brands across both traditional and emerging segments within soft drinks, responding to consumer behaviours and demands to remain relevant and drive growth,” Yeomans said, offering four key examples.

1. Share A Coke

To celebrate 125 years since the Coca-Cola brand arrived in GB, Coca-Cola has brought back its ‘Share a Coke’ campaign.

“This time, the campaign, which sparked a global phenomenon first time around by swapping iconic Coca-Cola logos for personalised names, has an even greater focus on shareability and customisation, reflecting young adults’ desire for authentic experiences,” explained Yeomans.

“QR codes on packs link to a digital hub with fun, personalised experiences. And consumers can use the interactive ‘Share a Coke Memory Maker’ to create personalised videos with their own content. Plus, the Coca-Cola app lets people customise bottles with more names than ever before.”

2. ‘Summon What You Wanta’

Last year, Coca-Cola introduced a new Beetlejuice-themed Fanta Zero Afterlife variant in time for Halloween. This came alongside limited-edition packs, featuring characters from the Beetlejuice movie.

“Alongside this, we unveiled the ‘Summon What You Wanta’ campaign – helping retailers create fun and theatrical in-store experiences, alongside out-of-home, digital, cinema and social media advertising.

“Fanta took 23.8% of flavoured carbonates value sales over the Halloween period.”(9)

3. Dr Pepper campaigns

In January 2025 – leading up to Valentine’s Day – the business drove engagement with Dr Pepper Zero Sugar Cherry Crush through an integrated Valentine’s-themed marketing campaign, using the tag line ‘Follow your tastebuds, not your heart’.

“This included influencer partnerships, in-store sampling and experiential OOH advertising encouraging young adult consumers to step into the Dr’s billboard-office for some romantic ‘advice’.”

5. Marketing to make energy mainstream

“Monster continues to deliver epic marketing campaigns aligned with young adults’ interests such as gaming and high-octane sports. Its approach to marketing means that Monster doesn’t just have consumers that enjoy the product; it has loyal brand fans that buy into the Monster lifestyle,” Yeoman said.

This includes its partnership with popular game Call of Duty, with an on-pack promotion that returned last September to tap into the enduring popularity of gaming nights in the home.

“2025 is another exciting year of innovation and fan engagement for Monster, including a recent UFC promotion that tapped into energy drinkers’ passion for extreme sports.”

Kaytea – cold brew

Kaytea was founded by Kevin Tang in 2020. Having lived in many parts of Asia and Canada, Tang grew up experiencing many traditional and modern twists of tea cultures. When he first moved to the UK, he absolutely loved the afternoon tea experience but wanted more variety and flavour.

“Emerging cold-brew products like Twinings Cooler and Kaytea Hydro Infusions, though still under 5% of total tea value, are growing at high teens in trial-driven channels, fuelled by on-the-go demand and premium positioning,” Tang explained.

“Collectively, the [tea] market is rebalancing around premiumisation, own-label value, and health-focused innovation rather than contracting outright.

RTD iced tea and cold infusions

“While still a small segment compared to hot tea, ready-to-drink (RTD) iced and cold-infusion teas are among the fastest-growing categories.

“This is driven by three factors. Firstly, health and wellness trends, as consumers swap sugary carbonates and juices for low-sugar, functional alternatives. Secondly, premiumisation and innovation, with brands like Twinings launching fortified, vitamin-enriched canned lines (e.g. ‘cooler’ and sparkling teas) designed for chilled consumption. Thirdly, on-the-go convenience, which appeals to younger, urban demographics seeking portable refreshment. Together, these dynamics position iced tea for sustained expansion.”

Botanical and functional tea

In terms of flavour, botanical and functional infusions are trending and expanding beyond hot teas into RTD formats, suggests Tang. He notes the use of adaptogens like lion’s mane and ashwagandha appearing in brands such as Cheerful Buddha and Yogi Tea’s Mental Clarity line as examples.

DTC tea growing fast

“Supermarkets still dominate sales volumes for both RTD and bagged teas, particularly through chilled aisles in major retailers,” Tang continued.

“However, online channels are growing fastest for direct-to-consumer (DTC) and speciality teas, including subscription models and limited-edition launches. Premium and wellness-oriented RTD brands often leverage DTC platforms for initial sampling and engagement before expanding into broader retail distribution.”

References

- Nielsen & CGA Total GB value data: Value share of Total Cola: MAT to 25.01.25

- Nielsen Total Coverage incl. discounters value data MAT to 22.03.25

- Kantar World Panel 01.10.23

- NIQ, Value Sales, Total Coverage, MAT to 22.03.25

- Kantar Take Home Purchasing Panel – 1yr continuous panel, over the 3 launches in 2022

- Kantar bespoke halo effect analysis of Coca-Cola Creations | P12 2021 to P5 2023: Period = 4 weeks. Halo impact is based on volume. Looking at two periods post, four periods post and six periods post each launch

- Nielsen Total GB: MAT to 22.03.25 (Cherry Cola variants value % growth)

- NIQ, Value and Volume Sales, Total Coverage, MAT to 22.03.25

- Nielsen, Total GB, sales val MAT w/e 28.12.24