This drinks report is based on electronic point of sale (EPOS) for the year ending March 2025, gathered by Circana. It also features case studies and expertise from the industry sourced by Food Manufacture to provide further analysis. Any other data references are indicated/provided by industry figureheads.

You can read the full drinks report here.

Low and no drink trends

The No- and low-alcohol drinks in Great Britain monitoring report from Sheffield University showed that retailers sold a total of 57,301,400 litres in Great Britain in 2021. Meanwhile, data published by CGA showed that in 2022, 88% of on-trade venues offered no and low alcohol alternatives.

Today’s growth in alcohol-free reflects a growing interest in health as opposed to a cost saving measure; with recent YouGov data showing an increasing shift towards mindful drinking, especially among younger consumers.

According to the YouGov survey results, more than a third of 25-34-year-olds reported actively seeking to reduce their alcohol intake due to the negative effects the following day.

Low/no beer

Alcohol-free beer is the most established category within the low and no space, followed by spirits. Recent Circana data reveals strong growth for the former.

The origins of low alcoholic beer date back to ancient Egypt around 5000 B.C.E and was known as ‘zythos’. It was consumed by everyone, including children, and believed to be a healthy drink that provided essential vitamins and minerals.

Later in medieval Europe, the working class would drink ‘small beer’ – these brews contained a very small percentage of alcohol and were made for everyday consumption. The idea was that the beer would kill off any bacteria in the often-polluted water.

There have also been more ‘recent’ occasions in history (namely the 1900s) when, for a time, alcoholic drinks that contained more than 0.5% ABV were banned from production, importation, transportation and sale in the US. This led to the creation of beers under this threshold.

As with all trends, they come and go, are forgotten and then usually return. Alcohol-free and low ABV drinks are among those making a comeback.

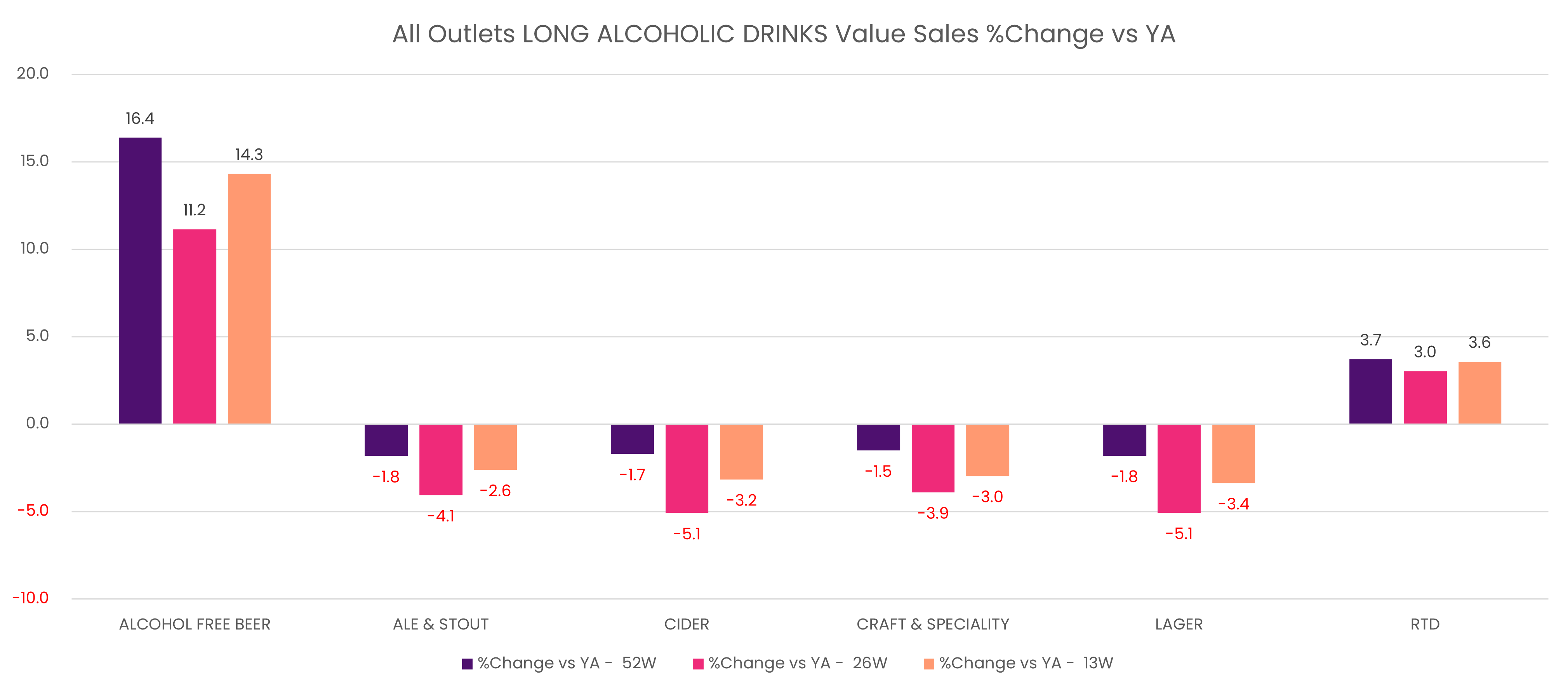

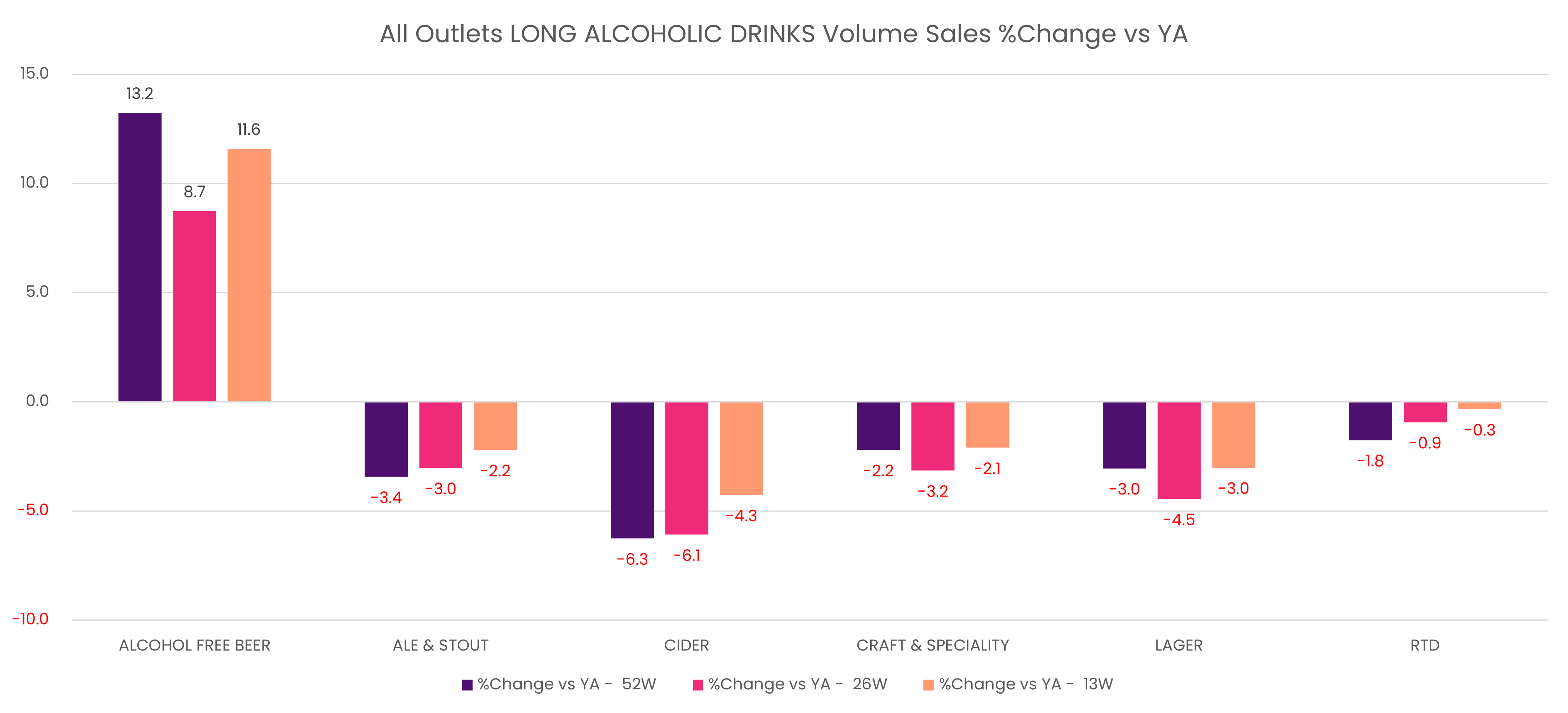

Compared to its alcohol counterparts, such as ale and stout, cider, craft and speciality, and lager, data gathered by Circana shows alcohol-free beer has seen significant growth in the last year in both value and volume (ending March 2025) of +16.4% and +13.2% respectively. This has accelerated in recent months.

However, despite its growth, alcohol-free beer represents just 2% of the overall value and volume sales of the long alcoholic drinks market. So the market is still relatively small.

Recent periods show an increase in the average volume price, with alcohol-free beer seeing an uptick of 2.8%.

Alcohol-free beer has seen range gains (e.g. listings and NPD) but only marginal at +1.7%.

However, promotional investment for the category is static, with recent months showing a decline of 1.1% over the last 13 weeks ending March 2025.

Forecourts and travel outlets have seen huge growth in alcohol-free beer, with value and volume sales rising by 37.4% and 35.9% respectively vs a year ago.

As well as alcohol-free, low ABV beer has been witnessing growth. The aforementioned YouGov study showed that when given the choice, more than 37% of adults aged 25-55+ said they would prefer a 2-3% beer, compared to just 29% who would opt for a 4-5% beer.

Alcohol-free wine

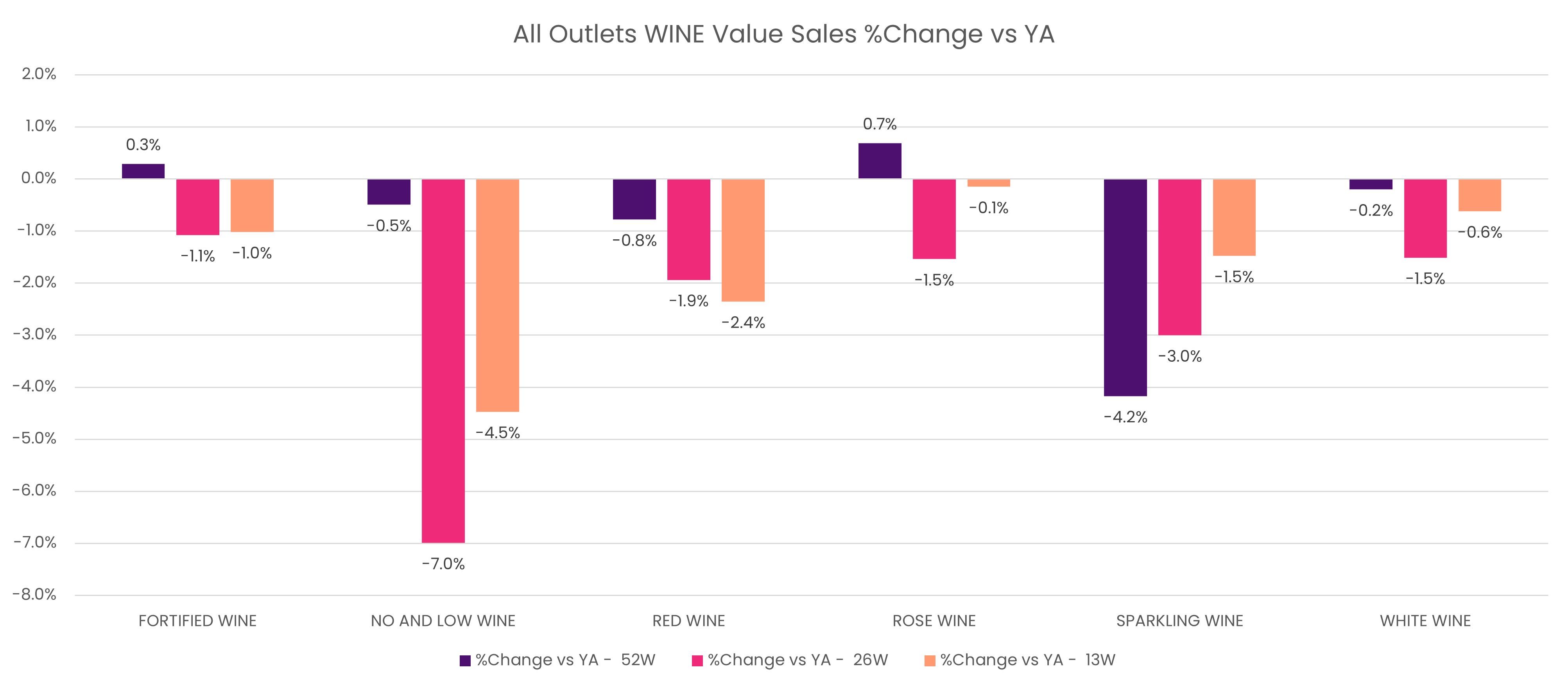

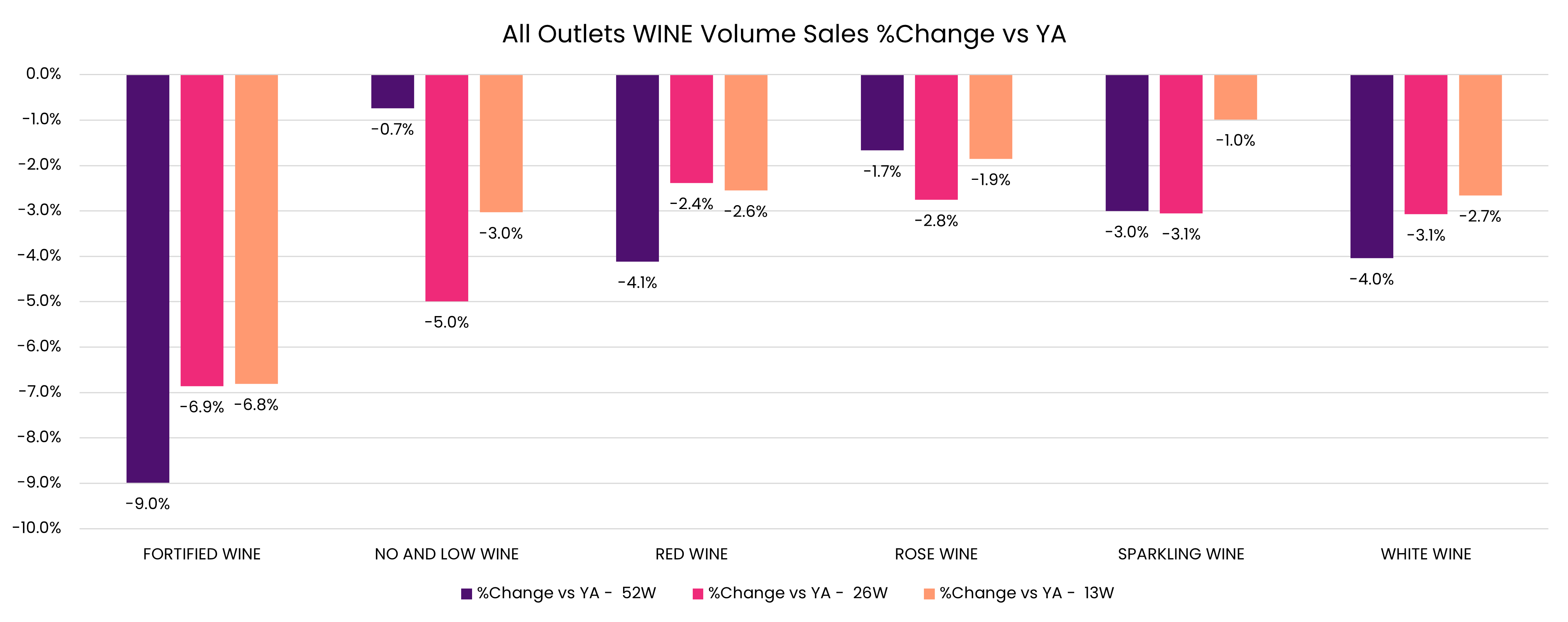

Unlike beer, the alcohol-free wine category is not seeing the same kind of response.

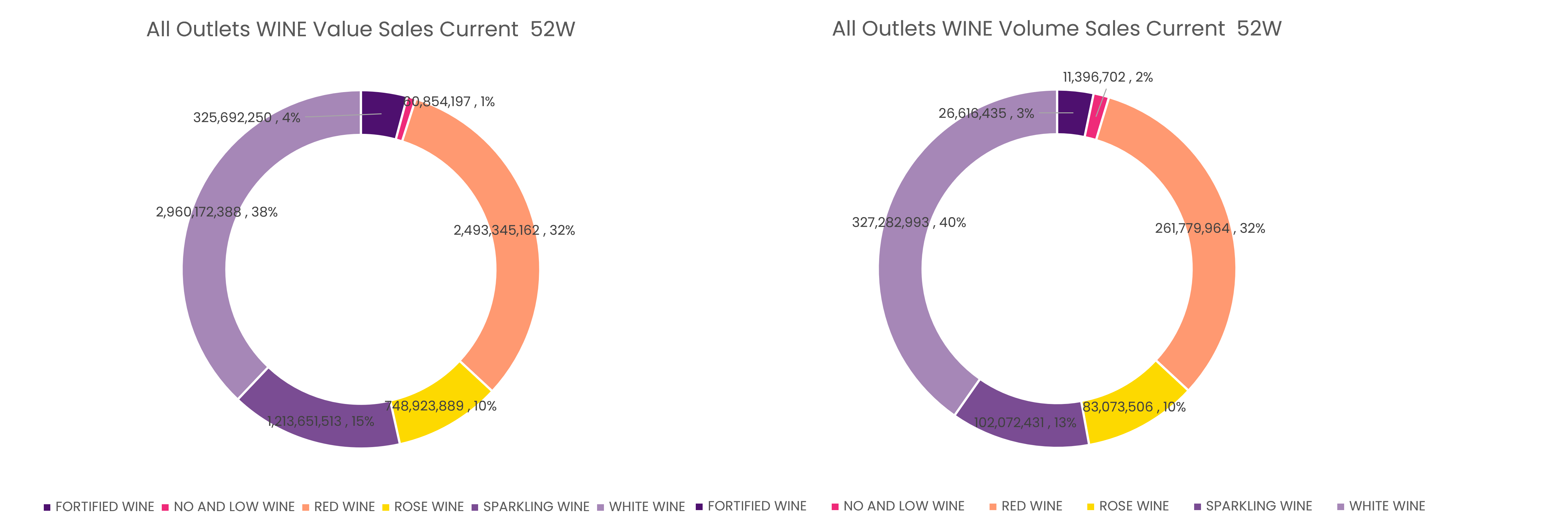

The value and volume sales for alcohol-free wine has fallen by 0.5% and 0.7% respectively on the year, with more recent months seeing a significant plummet in line with its alcoholic counterpart.

The dips seen for traditional red, white and sparkling are more significant however – especially for the latter in terms of value sales.

Still, alcohol-free wine represents a very small proportion of the overall value and sales of the wine market at 1% and 2% respectively.

Price growth has slowed for no and low wine, but on the year, it is up marginally by +0.2%. Meanwhile, promotional investments have also risen but this does not seem to have offered much respite to the category.

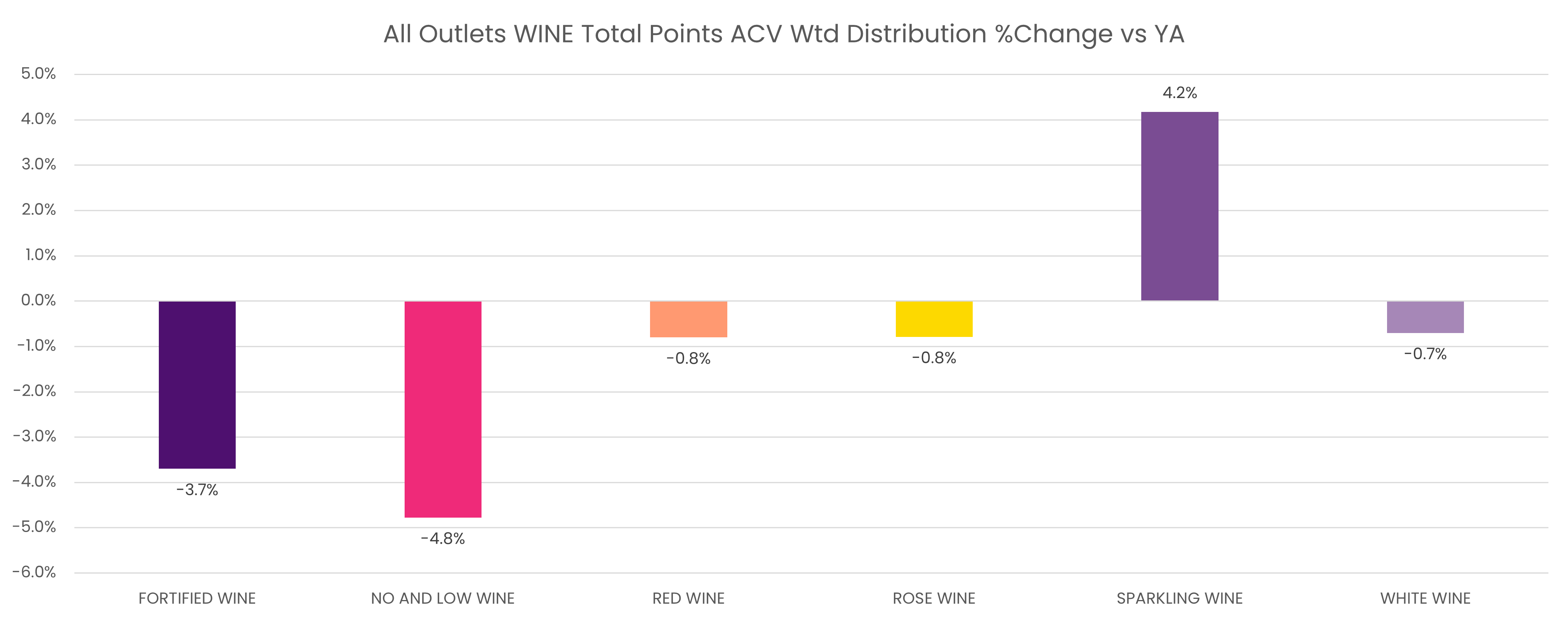

Alcohol-free wine has also seen a big drop (and the biggest in the overall wine market) in range growth vs last year by -4.8%.

Alcohol-free spirits

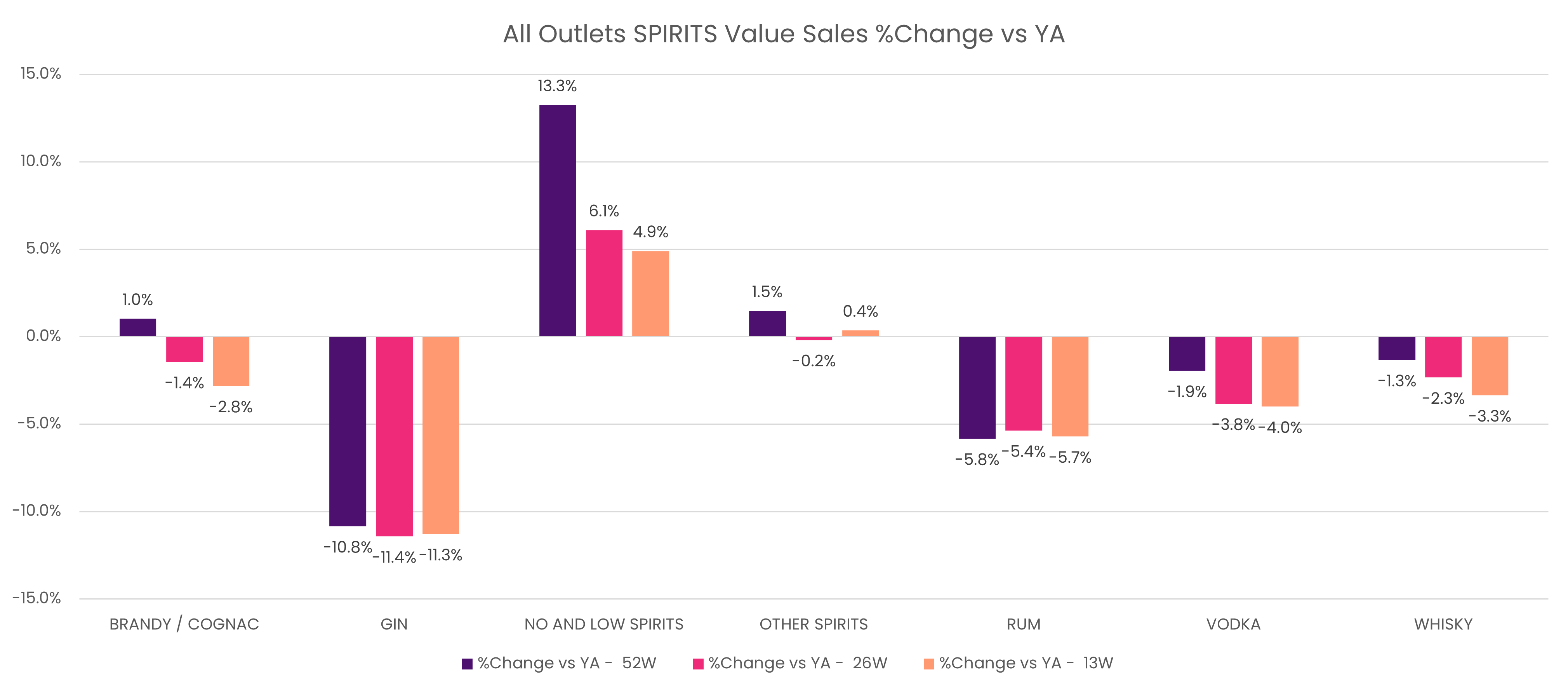

Similar to alcohol-free beer, the alternative spirits category has seen healthy growth of +13.3% in terms of value in the last 12 months (ending March 2025). Although this has fallen in recent months.

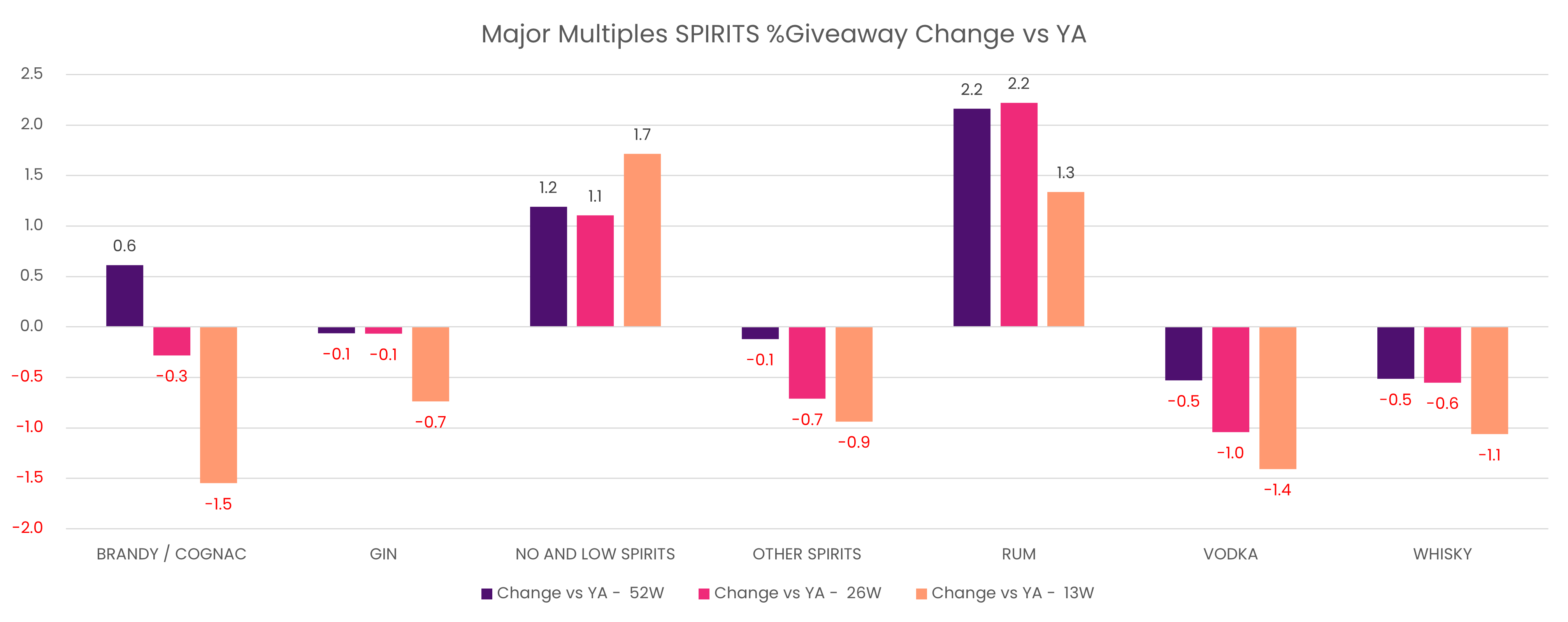

Compared to its alcohol counterparts, the only other category to see any kind of growth is ‘other spirits’ (e.g. Tequlia Rose, Morgan Spiced).

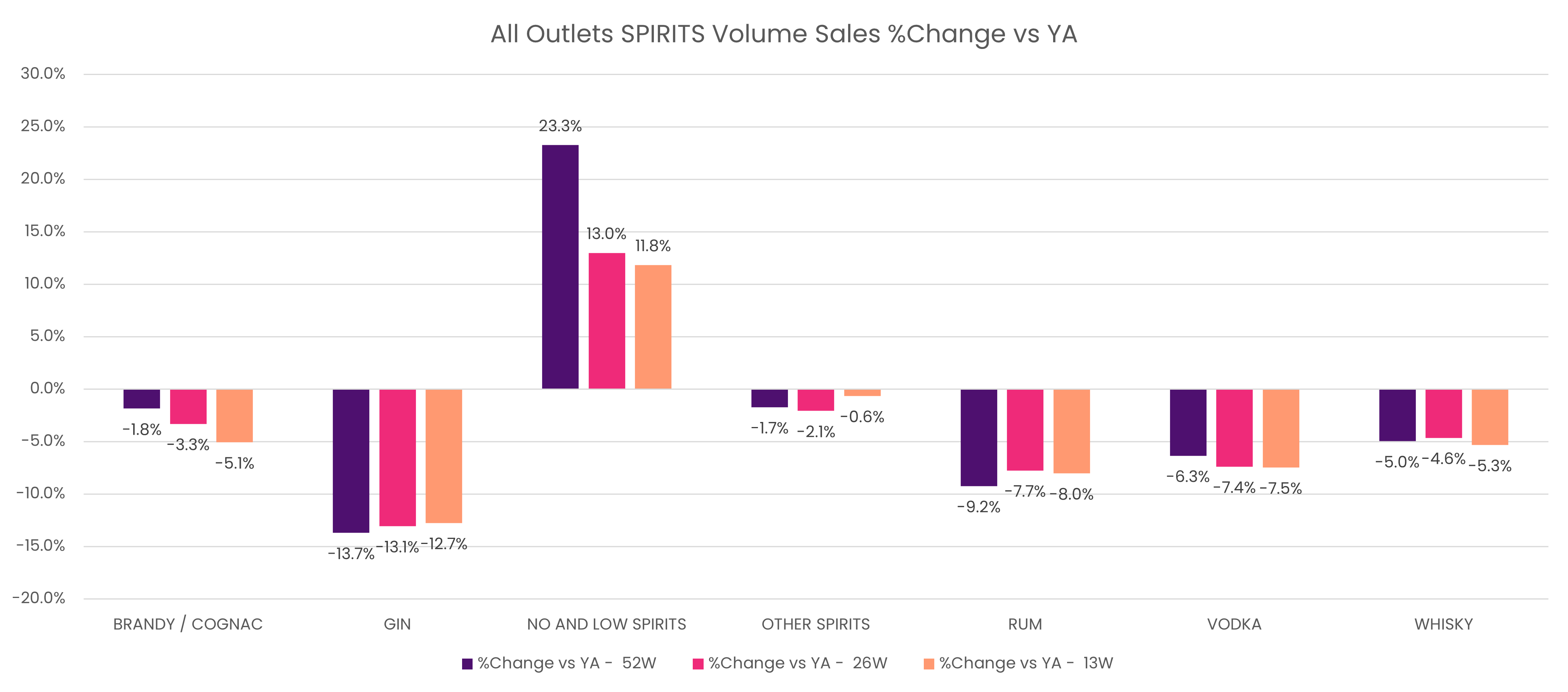

Alcohol-free spirits have also been performing well in terms of volume sales – seeing +23.3% growth Y-o-Y. This is in sharp contrast to all other alcoholic spirits categories which are in decline.

However, whole low and no spirits are in growth, they represent just 1% of the spirit volume and value.

With the exception of no and low, all spirit categories have seen price growth Y-o-Y start to slow. Still, the average volume price change for no and low is overall down at -8.1% and promotional investment up by +1.2%.

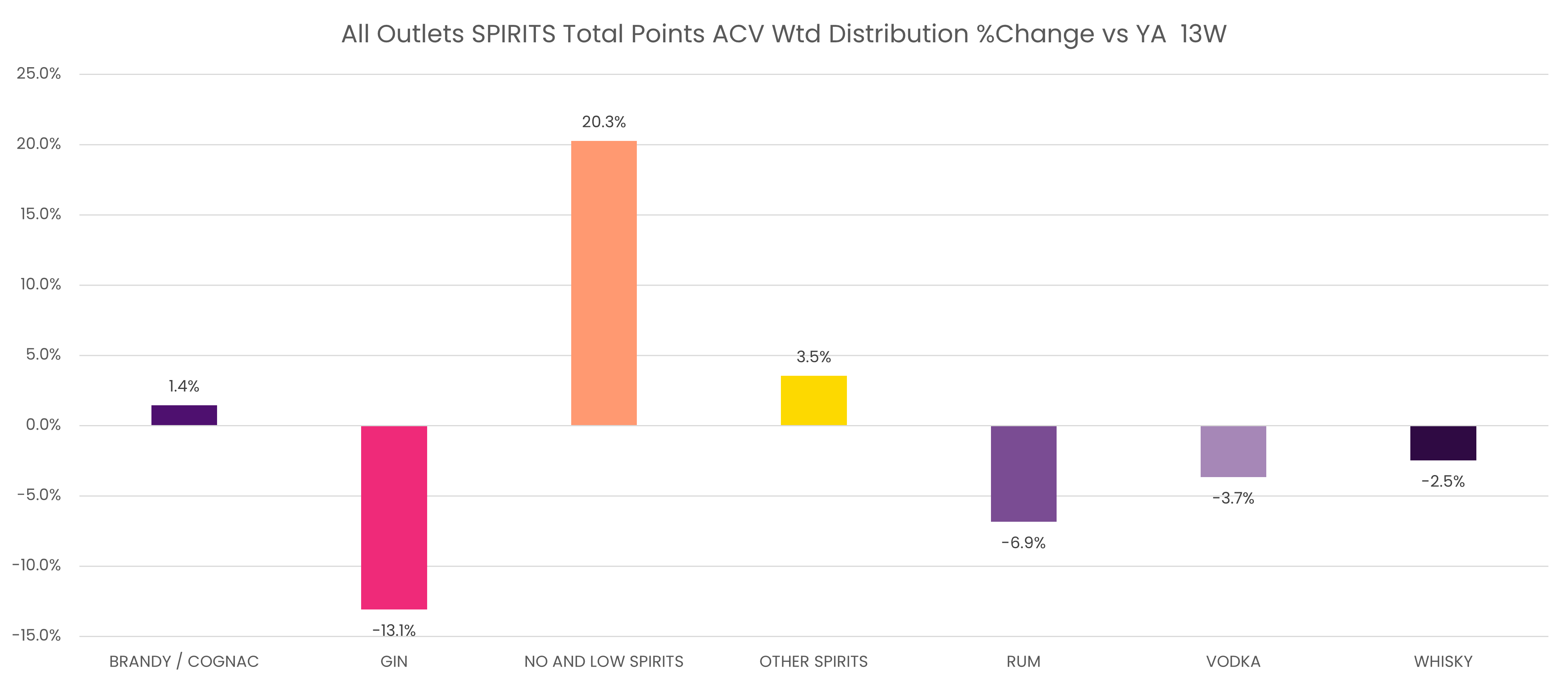

Innovation and listings within no and low is growing, with the category seeing a 20.3% lift in range additions. Most alcoholic spirits have seen a reduction, with only ‘other spirits’ and brandy and cognac seeing marginal rises.

Trends in action

Diageo

Diageo has a sizeable portfolio of non and low-alcoholic drinks, including Seedlip and Gordon’s 0.0%.

“The no/low alcohol market is having a notable impact on the broader drinks landscape, as consumers look to moderate their drinking without giving it up entirely,” Annabel Holroyd, senior consumer planning manager at Diageo, told Food Manufacture.

We’re seeing a trend toward ‘zebra striping’ – where people alternate between alcoholic and non-alcoholic drinks depending on the occasion.

Annabel Holroyd, Diageo

“The category is growing because it complements, rather than competes with, traditional alcohol consumption.

“Importantly, consumer understanding of no/low has evolved, with expectations for quality rising. As a result, we’ve seen an expansion in the range and calibre of offerings – from more sophisticated mocktails in the on-trade to elevated at-home choices. Our own portfolio reflects this trend, featuring leading no/low brands like Seedlip, Tanqueray 0.0%, Gordon’s 0.0% (including Pink), and Captain Morgan 0.0%.

“These options appeal not just for their alcohol-free credentials but for their flavour, complexity, and versatility in mixed drinks. By offering no/low versions of familiar brands, we help ensure consumers don’t have to compromise on experience or taste.”

Eisberg

Eisberg is an alcohol-free wine brand in the no and low alcohol space. It uses traditional winemaking methods followed by the gentle removal of alcohol.

“Our mission is to provide a credible alternative for those looking to moderate their alcohol intake, while still enjoying the social ritual of wine,” Dan Harwood, wine expert and managing director for Eisberg’s SW Wines Europe said.

Overall, Harwood said the no and low alcohol category continues to show strong growth.

We’ve seen increasing consumer awareness and demand, especially from younger demographics who are embracing mindful drinking.

Dan Harwood, Eisberg

“Our retail data shows year-on-year growth of 9.1%, with increasing listings and significant uplifts particularly around key seasonal occasions and wellness-led periods such as Dry January and Sober October.

“Eisberg has maintained a leading position within the alcohol-free wine category in the UK. Our portfolio has expanded and so has our distribution footprint across major retail chains and online channels.

“Over the past 12 months, we’ve seen solid growth in both sales volume and consumer repeat purchase rates. This is a reflection of our continued focus on taste, quality, and innovation in response to evolving consumer needs.”

The alcohol-free market is being driven by cultural lifestyle shifts, and Harwood says there is now “an expectation for more inclusive drinking options at social occasions”.

“According to research by Club Soda, 57% of consumers state that the selection of low and no-alcohol drinks affects their decision on which venues to visit,” he added.

Flavour innovation is key

“Consumers are increasingly looking for complexity and sophistication in their alcohol-free options,” Harwood informed.

“That’s one of the driving forces behind the launch of our new Grenache Rosé this summer – crafted to appeal directly to fans of Provence style rosé.

“This lighter, delicate wine, with floral and red fruit notes, aligns with the growing trend for premium dry rosé, mirroring the popularity of Whispering Angel.

Sparkling, authenticity, convenience

“Sparkling formats continue to perform exceptionally well across the category, especially for social occasions.

“Today’s no and low consumers are looking for authenticity, convenience, and value. The industry is consistently working towards a more authentic mouthfeel as our de-alcoholisation methods become more sophisticated.

“There’s also a growing appetite for RTD formats, including cans and small bottles, that suit on-the-go lifestyles or solo occasions.”

To this end, the company has launched a new sub-brand, Be Free cans.

“Designed to embrace a new younger generation of consumers - those who prioritise moderation and convenience - the cans allow for on-the-go enjoyment without the constraints of traditional wine consumption.

“Offering a fresh take on alcohol free wine, we collaborated with acclaimed artist Samuel Thomas on the can design, bringing a vibrant and contemporary aesthetic to the range.

“His signature bright and beachy landscapes encapsulate the essence of freedom that the Be Free cans range represents, ensuring an eye-catching presence on shelf.”

Direct to consumer

While mainstream supermarkets remain the largest sales channel, especially for impulse and planned purchases, online is rapidly catching up, reports Harwood.

“Eisberg products are now available at Tesco, Morrisons and Ocado, as well as smaller vendors like Majestic Wines and Club Soda,” he said.

“Having said this, we’ve seen strong growth in both DTC and e-commerce platforms, particularly around key events or promotional campaigns. Online retail provides a space for discovery and education, which is crucial for a still-emerging category like alcohol free wine.”

CleanCo

CleanCo was founded in 2019 by Made in Chelsea regular Spencer Matthews, after he decided to go tee-total.

CleanCo is listed with a range of retails including Tesco, Sainsbury’s and Waitrose.

In 2024, its range of spirit alternatives were served in 8.8 million drinks, while Nielsen figures show that CleanCo is the only independent brand among the top six alcohol-free spirits players in the UK and US, with the rest owned by drinks giant Diageo.

The portfolio includes alcohol-free versions of rum, gin, tequila and whiskey.

This year, the business gained backing from England Cricket star Ben Stokes and opened a London Clean Cocktail pop-up bar.

The cocktail menu includes:

- Clean Paloma - Clean T 0.0% Tequila Alternative and Fever Tree Pink Grapefruit Soda

- Clean G&T - Clean G 0.0% Gin Alternative and Clearer Twist Tonic Water

- Clean & Stormy - Clean R 0.0% Rum Alternative and Clearer Twist Ginger Ale

- Clean Rhubarb Spritz - Clean G Rhubarb 0.0% Gin Alternative and Clearer Twist French Twist

Small Beer

Small Beer is a UK mid-strength brewer based in London.

The business has recently launch of its first-ever 4-pack offering in the UK, available exclusively in Marks & Spencer (M&S) across 450 locations.

The new product launch features Small Beer’s Lager (2.1% ABV) and Hazy (2.6% ABV) beers in packs of four for a RRP of £7.50

The new partnership with M&S will more than double Small Beer’s existing retail distribution in the UK, making mid-strength beer more accessible to customers than ever before as ‘mindful drinking’ becomes more trendy.

Commenting, Rob Grimes, M&S beer buyer said: “Mid-strength beer is such an exciting category and one that is meeting the lifestyle demand of so many of our customers. We believe that this is a trend that’s here to stay, and we know consumers are increasingly mindful of their alcohol intake but don’t want to sacrifice on flavour, experience or enjoyment.

“This shift in drinking behaviours is why we’re launching Small Beer at M&S – we’re thrilled to have them on our shelves as we know their quality and values align with our own. It’s an exciting time for innovation within the drinks category and these are pioneering beers for a modern drinker."

The founders of Small Beer, James Grundy and Felix James, echoed this sentiment: “We’re witnessing a clear shift in how people approach drinking. As lifestyles evolve, consumers are prioritising well-being without sacrificing the enjoyment of social occasions. More and more, people are turning to mid-strength beers that offer balance – full taste without the heavy alcohol impact. Small Beer was created to meet this demand and provide a refreshing alternative that fits the modern drinker’s values.”