This report is based on electronic point of sale (EPOS) for the year ending March 2025, gathered by Circana. It also features case studies and expertise from the industry sourced by Food Manufacture to provide further analysis. Any other data references are indicated/provided by industry figureheads.

You can read the full drinks report here.

Hot drink trends

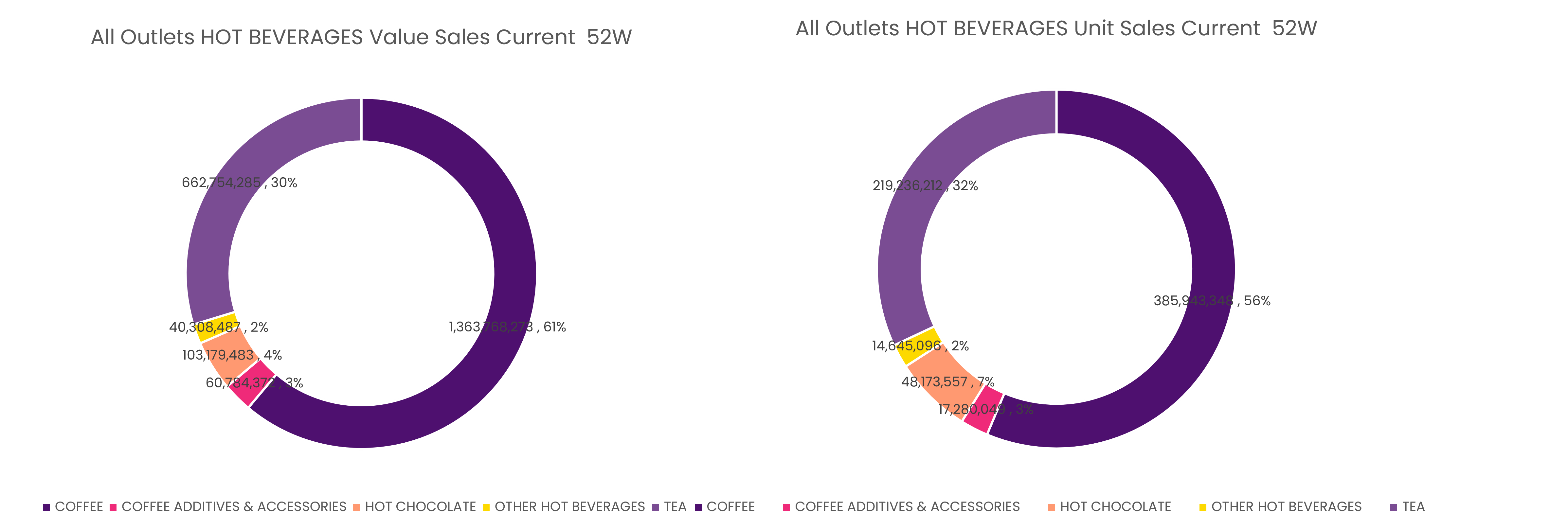

According to Circana’s findings, the hot beverage market is dominated by tea and coffee, accounting for 88% of volume and 91% of value. Between them, coffee drives the higher average volume price.

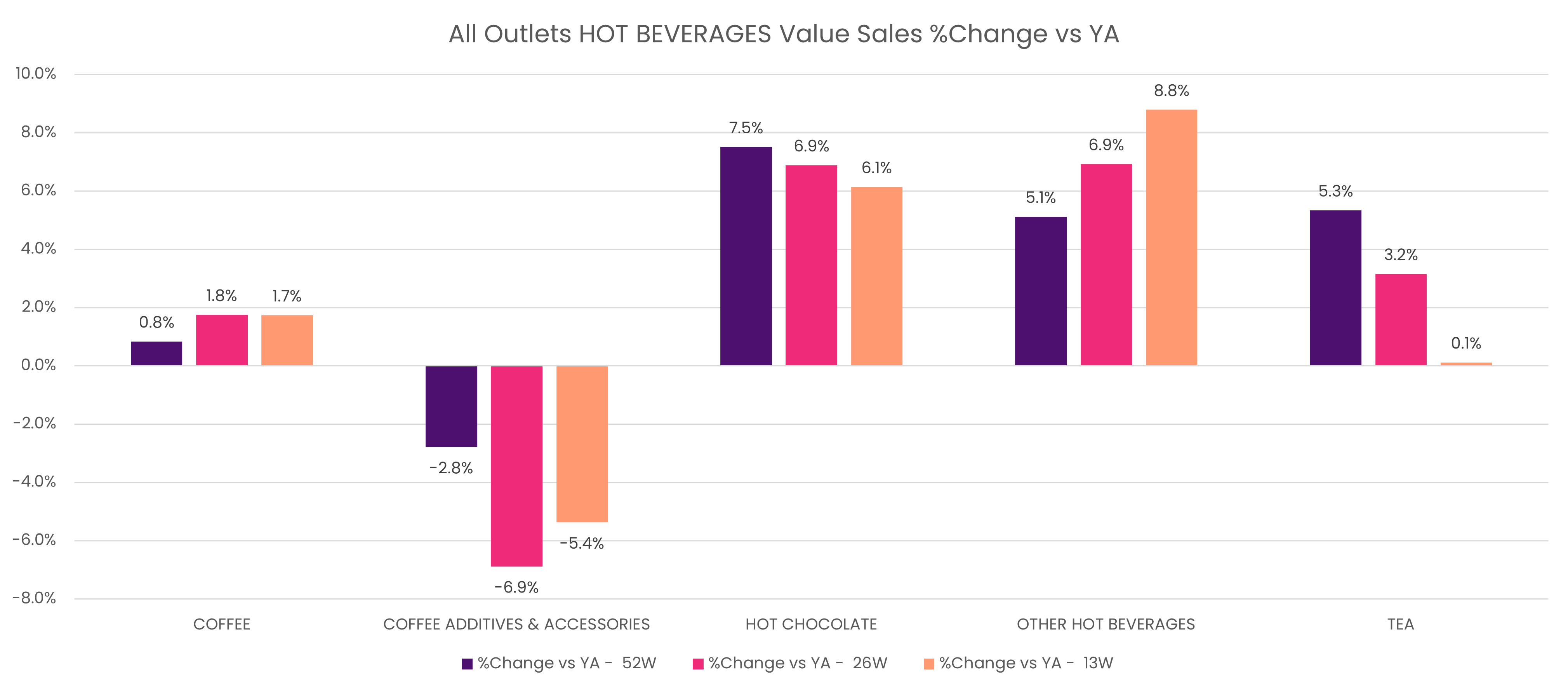

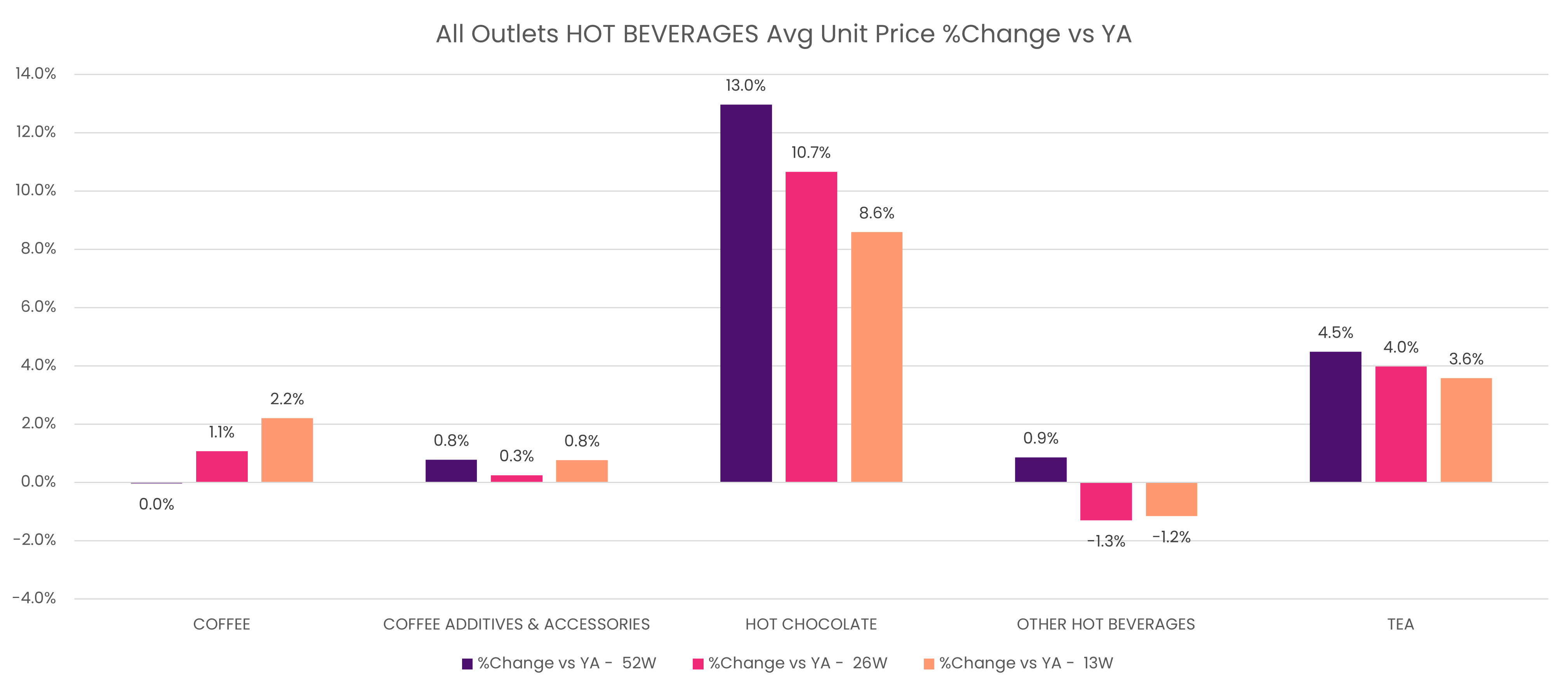

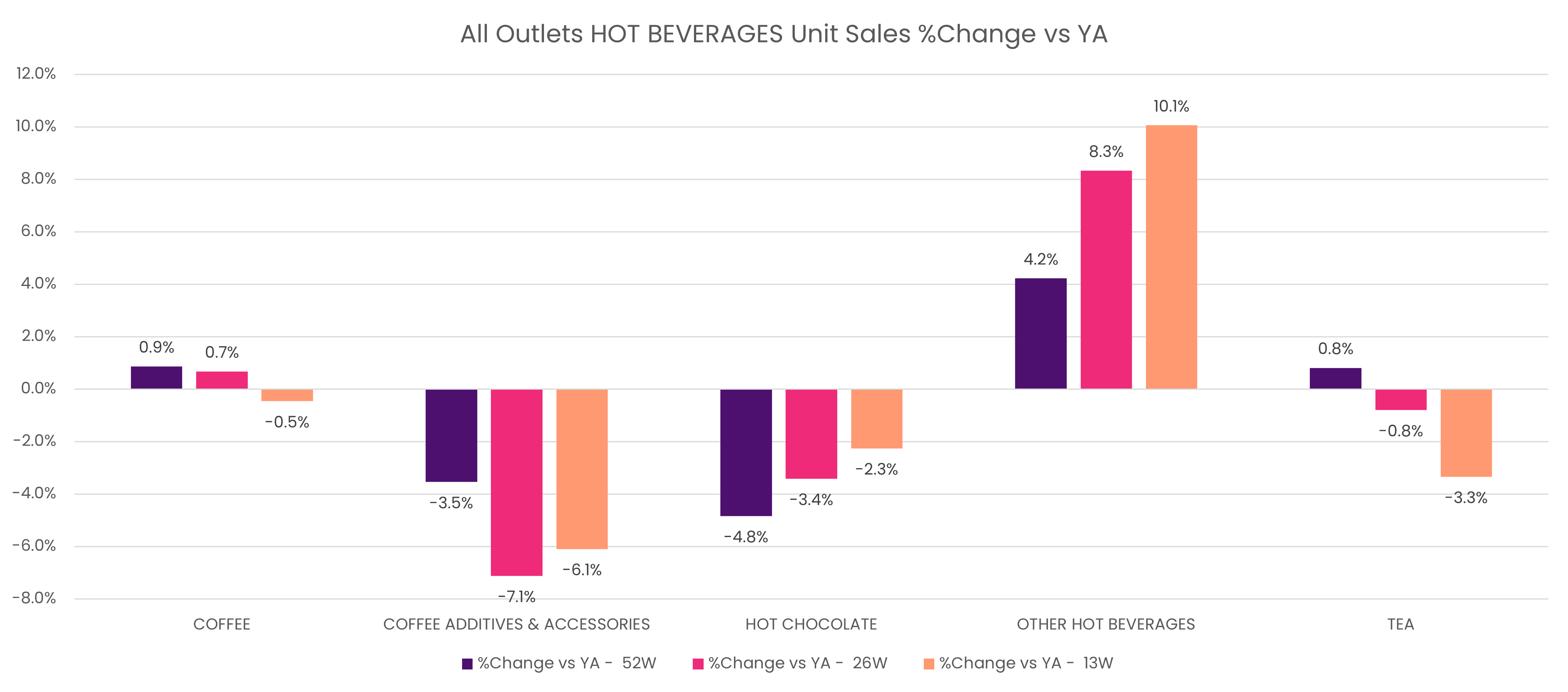

The hot drinks market is growing exclusively through price with volumes down Y-o-Y. The cool winter did little to boost volume in the short term, which remained down on last year during the last 13 weeks (w/e March 2025).

Among the big two – coffee and tea – the latter is underperforming, with value sales just above last year in the last 13 weeks as unit sales slipped to a 3.3% Y-o-Y decline.

Meanwhile, the category of ‘other hot drinks’, which includes the likes of warm malted drinks is seeing strong growth.

Overall, the hot beverage category is dominated by the supermarkets, which are increasing their value and volume share year-on-year (Y-o-Y).

Tea and coffee

Compared to last year, both tea and coffee unit sales have been in decline, with coffee seeing a -0.5% drop and tea a -3.3% fall in the last 13 weeks.

Coffee prices, whilst remaining stable over the last 12 months compared to last year, appear to be heading upwards in recent months seeing a +2.2% lift in the last 13 weeks. This is contributing to this slow in unit growth.

However, tea’s average unit price growth is weakening, dropping by -3.6% in the last 13 weeks compared to the year prior.

Tea has seen a Y-o-Y drop in promotional investment of -2.3%, and whilst coffee has seen a +1.2% lift on the year prior it has followed suit in more recent weeks, with a decline of -0.2% in the last 13 weeks.

Big growth for malted hot drinks

Although a small category, the growth of unit sales within ‘other drinks’ is fast and continuous. Compared to last year, there has been a +4.2% uptick, with +10.1% growth in the last 13 weeks.

This has been primarily propelled by Horlicks – a product crafted using malted wheat and barley and enriched with 14 vitamins and minerals, including dietary fibre, iron and vitamin D. The brand was founded by two brothers James and William Horlicks in 1873 as a nutritional supplement for infants and those in poor health. Horlicks was first made in the UK in 1906, with its UK division owned by Aimia Foods since April 2018.

Best known for its original malted drink the brand, the Horlicks portfolio also includes hot chocolate, pods and pudding flavours.

In 2023, the brand released a trio of pudding flavours including Apple Pie, Cherry Bakewell, and Banoffee Pie. A year later it launched a new addition with a Jam Roly Poly flavour alongside introducing its ‘Horlicks Kids, Chocoland’ product.

Commenting on the brand’s growth, Alex Lawrence, senior strategic insight director for UK CPG at Circana ventured that it may be “benefitting from a re-positioning as a vitamin fortified drink with digestive health benefits.”

Unit prices for this category have slowed but seem to be on a marginal uplift in recent weeks. Fellow malted hot drink Nestle Milo has seen the biggest increase in range (e.g. listings and NPD) but this has not translated into significant growth.

Monin syrups has also been a big ‘range winner’ but, likewise, this has done little to stimulate sub-category growth.

Alternative vs dairy in hot drinks

In 2019, almost a quarter of Brits (23%) were using plant-based milk alternatives in the three months to February 2019, up from 19% in 2018.

In 2021, Kantar data(1) shows 36.5% of households in England, Scotland and Wales were buying plant-based milk – this rose to 73.6% in 2023.

Rude Health saw its profits double in 2024 before being promptly picked up by Nordic plant-based company Oddlygood.

Whilst this brand is doing well, the rest of the category has seen a slowdown with Kantar showing overall volumes fell more than 2% last year.

Trewithen Dairy’s head of marketing, Emma Lawes, said there is now a strong resurgence in consumer interest in high-quality dairy – especially in the context of taste, texture and performance.

“Barista-style dairy milks, such as our Trewithen Dairy Cornish Barista Milk, have become increasingly popular both in retail and foodservice with volume up 43% Y-o-Y,” said Lawes.

“Recognised for their high-quality attributes within hot drinks including flavour, texture and consistency, consumers are increasingly choosing barista style dairy milks for their lattes, flat whites and other café-style drinks. This popularity in the OOH market is translating into retail sales with our own Barista Milk recently securing national retail distribution with Tesco – a sign of growing demand and renewed confidence in dairy.

“At the same time, we’re noticing a gradual but clear plateau – and in some cases a decline – in non-dairy milk uptake, particularly among flexitarians who are returning to dairy for its taste and nutritional profile, especially as we see an increasing interest in wholefoods amongst consumers.

“We’re also seeing a shift in innovation within the non-dairy sector. Compared to previous years in which the likes of potato milk were hitting the shelves, we’re now seeing fewer launches for the sake of novelty, and more targeted innovation around function. Today’s consumers are more discerning and health conscious and so products with added functional benefits relating to protein, gut health or lower sugar are entering the market.”

Overall, there’s a clear return to quality dairy products, particularly whole and barista milks, as a foundation for taste and performance, even as health-forward non-dairy options continue to carve out more specialised niches.

Emma Lawes, head of marketing, Trewithen Dairy

Mindful matcha drinking

There has been a growing appetite for non-coffee drinks, leaning towards a more mindful way of enjoying caffeine.

“Matcha was an immediate hit in our bakeries, so we have extended our menu from matcha lattes to matcha tea (made with water rather than milk) and we have now added a seasonal iced matcha with cucumber and elderflower, which we will change up in autumn,” a spokesperson from café chain Gail’s told Food Manufacture.

We find people prefer their matcha iced – the iced matcha latte is consistently one of our most popular barista-made drinks.

Gail's spokesperson

“Our matcha has well-balanced sweet, umami and grassy notes, so we only wanted to add a flavour which would enhance these – rather than overpowering them. We add a splash of elderflower and cucumber cordial, and the finished drink is quenching, herbaceous and floral. Think elderflower blossoms at dawn, wet grass crushed underfoot – summer in a cup.

“Matcha has brought new customers into bakeries and existing customers have taken to it as well. They’ve been very complementary about our choice of supplier and our commitment to quality – using ceremonial-grade matcha which is rooted in cultural context and craft."

Trends in action

Good & Proper - Matcha tea

Since launching the business from a converted van in 2012, Emilie Holmes has built Good & Proper into one of the UK’s most respected independent tea brands.

Proud to be B-Corp certified, the company is rooted in transparency, quality sourcing, and a strong sense of purpose, now supplying over 1,500 cafes, hotels, workspaces, among others.

Good & Proper carefully sources single-origin teas and herbal infusions, focusing on traceability and sustainability.

Matcha is one of the most dynamic growth areas in tea right now, with iced matcha particularly booming.

Emilie Holmes, founder, Good & Proper

“Its health appeal, vibrant visuals, and versatility make it a high-impact, all-day serve for cafés, appealing to customers who want function and flavour, as well as strong margins. We’ve seen matcha move from niche to mainstream fast, driven by younger consumers seeking trend-forward, healthier alternatives to coffee,” commented Holmes.

Good & Proper has championed matcha for over a decade, first introducing it in its tea bar in 2016, where customers queued for lattes whisked to order.

“Demand has never been higher, and many cafés are now placing matcha front and centre on their menus. This is welcome news for hospitality, where matcha presents a growth area with good margin potential and limited at-home replication.”

Matcha is now one of the fastest-growing parts of its business, accounting for around 15% of total revenue, with sales more than doubling year-on-year. Good & Proper is on track to deliver over £2 million in revenue this year, with strong year on year growth.

“The recent relaunch of our House Matcha marks a key moment and a clear sign of our long-term commitment to the category.”

Holmes says she is seeing an increasing demand for drinks offer functionality alongside great taste and this has been propelling the rise of matcha.

“Matcha’s caffeine provides a smoother, sustained energy boost, thanks to the amino acid L-Theanine, which promotes calm focus and reduces jitters common with coffee. This functional benefit resonates strongly with health-conscious consumers and workplaces seeking better-for-you alternatives.”

Moreover, visually, matcha’s vibrant green colour and versatility, is making it especially appealing to younger audiences, fitting into multiple formats and lifestyle preferences.

Good & Proper’s House Matcha is a latte-focused blend crafted in Kyoto by one of Japan’s most respected tea masters, Hiroshi Kobayashi. Kobayashi-san, a 10-Dan rank master, carefully selects the finest shade-grown leaves from the spring harvest and blends them batch by batch to create a creamy, smooth matcha with a delicate umami finish.

Designed specifically for pairing with milk, hot or iced, it delivers rich flavour, vibrant colour, and consistent texture, tailored for both professional and home baristas. It is priced at £24.50 for 100g tins in foodservice and £40 direct-to-consumer (£36 on subscription).

Oatly - Dairy-free matcha latte

Matcha has also made its way into alternative options, with Oatly recently launching its new Matcha Latte Oat Drink in a 1L carton.

With the signature matcha colour, the drink offers a green tea taste with a hint of vanilla, blended with Oatly’s oat base. It is 100% plant-based, dairy-free and made with finely ground Tencha matcha.

“Matcha has been around for some time, but only in the last year have we seen a real surge in its popularity,” Toby Weedon, barista development director EMEA at Oatly, noted.

“This in part comes down to the depiction of the drink and how it’s been presented in the media. Beyond its taste and ever-growing menu to enjoy it, Matcha has been the green colourful drink in the centre of TikToks and Instagram posts, inviting scrollers to be a part of a ‘look’ and buy into not just a beverage but a movement that is hard to say no to.”

TrueStart – Private label coffee

Truestart was founded by husband-and-wife team Helena and Simon Hills, with its first product – Barista Grade Instant Coffee – launched in 2015. The data stats cited in this section refer to Circana 52 w/e 19th April 2025.

“Overall, the total coffee category is static, showing only 1.5% value growth over the last 52 weeks, but there are pockets of growth in both volume and value terms in coffee beans, which is experiencing 22% value growth and 13% volume growth as shoppers look to recreate the coffee shop experience at home,” said Glesni Owen, head of sales at TrueStart Coffee.

“There is also growth in smaller sub-categories, such as coffee bags, where we can see a 5.7% value growth and 6.2% volume growth, driven by the desire for premium quality coffee, with the convenience of a single serve, sustainable format.

“TrueStart has contributed a huge amount of growth into a declining instant coffee sub-category. Total instant coffee is declining by -1% value and -1.6% volume, but we’ve grown by a whopping 134.6% value as we offer shoppers great tasting, premium instant coffee that’s ethical, sustainable and fairly priced.

“Private label coffee is showing growth at a total value level of 2.6% Y-o-Y but it’s branded coffee that is driving innovation and category growth overall, with premium brands such as TrueStart (134.6% value growth), driving total category growth.

Shoppers are becoming more discerning about what they buy, as they look to recreate a premium coffee experience at home. To this end, TrueStart offers a full spectrum of caffeine levels, so shoppers can choose the right level of caffeine and coffee strength for them.

“Our Lightly Caffeinated is our most prominent piece of NPD – it was launched in 2023 as a UK first in instant coffee in 2023. It’s made up of 50% decaf and 50% caffeinated which gives each serve of our Instant Coffee 38mg of caffeine per serve.

“This product proved to be incredibly popular via our online sales and Co-op listing and completes our caffeine controlled range of instant coffees (also listed in ASDA, Morrisons, Booths, Ocado). So, in May we rolled out our Lightly Caffeinated Beans, Ground and Coffee Bags.

“The Fresh Coffee is Mexican mountain water decaffeinated so there are no chemicals (our Instant Coffee is also natural, using an organic solvent to decaffeinate) from Mexican beans, and our caffeinated part is Arabica coffee from Brazil & Ethiopia.”

When it comes to purchasing behaviours, Owen said consumers are looking for taste and quality at a good price, but certifications such as b-corp and using sustainable packaging are also important too.

“At a total market level a big proportion of sales will always come from supermarkets as coffee is a grocery staple and frequently features in shopping baskets,” she added.

“Our online sales have continued to grow though and form an integral part of our business. In 2024 our online sales grew 227% vs 2023 and are on a similar trajectory for 2025 vs 2024 too.”

Pact Coffee – speciality grade coffee

Established in 2012 by Stephen Rapoport, Pact Coffee is a UK-based speciality coffee company that offers a flexible subscription service allowing customers to choose their coffee, frequency and quantity. The CEO Paul Turton joined the business in 2017.

“We believe there’s still plenty of room for growth in the UK, not just in direct-to-consumer, but in B2B and grocery too. But rising green coffee prices are creating real pressure across the industry, and we’re likely to see price increases becoming more common,” Turton told Food Manufacture.

“Thankfully, Pact Coffee’s proposition is genuinely robust, and we’re in a strong position to grow our share across all our chosen markets. That means we can keep pushing forward with our mission: making speciality coffee more accessible, whether someone’s just beginning to upgrade their coffee or is already a connoisseur.

Turton explained that the increased price tag attached to coffee, whilst challenging, has helped Pact become a more favourable choice with shoppers who are willing to trade up for quality and high ethical values as the price difference become more comparable.

Pact Coffee is on track to achieve 15% growth in 2025, despite it being a particularly turbulent year for coffee.

“Already, we’ve seen an increase in demand for our speciality-grade coffee at home, as well as a boom in sales of home and office coffee machines. There’s also been a significant increase in speciality coffee shops popping up on the high street,” he continued.

“I believe speciality coffee will continue to grow quickly over the next few years – and we’re ready for it. More people than ever are moving away from instant coffee and pods to high-end beans and ground, driven by the quality they’ve come to expect from their local coffee shops. Pact Coffee gives them a simple way to bring that same standard into their own homes.

“This is a big win for coffee drinkers, farmers and the planet. Not only is speciality coffee a huge leap in quality compared to commodity beans; when we buy it directly from the farm, we can make sure it’s the farmer, not the intermediaries, who makes a prosperous income.”

“Focusing on expanding into grocery and hospitality has accelerated our growth. Our relationship with Waitrose has gone from strength to strength since we launched in its stores 18 months ago. Since then, we’ve also partnered with other like-minded grocers such as Ocado, Whole Foods and Abel & Cole.

“And our subscription service has only gained momentum. Currently, we have 45,000 regular subscribers in the UK; 30,000 of whom have bought more than 20 bags of coffee from us.”

Turton expects speciality coffee to gain further momentum, with consumers looking for roasts that contain new or more unique flavours.

“Our menu is always changing and our consumers typically have the opportunity to choose from more than 200 coffees over a year – each with their own flavours, characteristics and innovative processing methods, varying from rich and velvety, to bright and fruity.

“We regularly develop limited edition coffees throughout the year, too. Most recently, we worked with Colombian farmer Oscar Hernández and his farm, Los Nogales, to bring a limited-edition low-caffeine coffee which used kombucha yeasts in the fermentation process to create heady hints of mandarin and violet - all completely natural in the coffee bean.”

Lincoln & York – Insta-worthy RTD coffee

Established in 1994 by buyer James Sweeting and trader Simon Herring, Lincoln & York has been roasting coffee in Lincolnshire for almost 30 years. From humble beginnings operating from a garden shed, the business now supplies 250 customers in the out-of-home market from its 6,000m2 factory.

Richard Milner, category & insight manager at Lincoln & York agrees there has been a shift towards premium coffee but with whole beans a big focus and flavours such as Dubai chocolate inspiring NPD.

“In retail, demand for good quality coffee remains high and continues to grow. We’re seeing consistent growth in whole bean coffee purchases, with whole bean sales in growth across both value and volume and 11.7% increase in volume sales at the end of last year,” he said.(2)

“Coffee also continues to outperform the wider food and drink sector across a range of out of home (OOH) channels. Now valued at over £8 billion, the OOH coffee market has grown 10% year-on-year,(3) driven by increased consumer penetration and frequency. In simple terms, more people are buying coffee, and they’re doing it more often.

“Much of this momentum is being driven by younger consumers. Our recent research shows that 40% of 18– 34-year-olds are drinking more coffee out of home than they were five years ago.(4)

“Amongst this age group, we are also seeing a boost in demand for iced and RTD coffee. Iced coffee is worth £237 million(5) and is now the third most popular drink for those aged 18-35(4). It’s also similar story for RTD, with 80% of 25–34-year-olds purchasing an RTD coffee in the past year(6) and RTD in retail reaching £328m.(7)

“In RTD, vanilla and chocolate are the fastest-growing flavour profiles, up 12% and 10% respectively.(8) Meanwhile, in iced coffee, dessert-inspired creations continue to reflect a consumer demand for drinks that taste and also look like an indulgence.

“Recent research by Allegra found that 45% of under 35-year-olds shared a picture of their beverage on social media in the last 12 months.(9) From this, we’re seeing increased interest in social media-led flavours such as ‘Dubai chocolate’ and pistachio alongside a general trend towards more indulgent and extravagant options such as gold-leaf cappuccino and strawberries and cream iced lattes.

“But it’s not all style over substance when it comes to consumer preference in coffee. According to our research, the most important consideration for consumers when choosing where to go for their coffee is quality, closely followed by price.(10)

“This presents a great opportunity for own brand coffee to provide great quality at a potentially lower price point than more well known, premium brands. If own brands, particularly amongst ‘premium’ ranges, can strike a balance between great quality and an accessible price point this would play directly into what consumers are looking for when purchasing coffee.”

Clipper Tea – Flavoured tea

“Clipper is now the fastest growing tea brand in the UK – and thriving with 12.4% Y-o-Y value growth1 led by both our Everyday and Infusion blends,” Gemma Grange, Clipper Teas brand manager at Ecotone noted.

“In terms of value, our Infusions range is booming with almost 30% growth.(11) We attribute this growth to the launch last year of our new dual-flavoured infusions. The range is fully organic and consists of four products designed to suit specific need states, such as ‘soothing’, ‘uplifting’, and ‘unwinding’, and support wellbeing through the power of pure and natural ingredients.”

The Infusions range includes Peppermint & Spearmint, Chamomile & Peach, Blackcurrant & Blueberry, Orange & Turmeric, and Ginger & Turmeric and taps into two key trends: the growing demand for clean and natural ingredients to support health, and evergreen interest in sustainably sourced tea.

“Following our hugely successful campaign ‘There’s Tea, Then There’s GOOD Tea’, shoppers are discovering the benefits of choosing Fairtrade and organic tea,” added Grange. “This has supported our brand to outperform the tea category as a whole –cementing Clipper as a household name.

“This year, we invested £1.5 million – our biggest spend to date. With a catchy tune and our iconic Clipper bird, we’ve managed to reach new audiences as we playfully encourage consumers to rethink their tea choices through connecting them to nature.”

When it comes to private label versus brand, Grange said: “Tea is a habitual category and consumers are loyal when it comes to their black tea, especially. While pressures like rising inflation has increased market share for own-label tea in recent years – what we’re now witnessing is a positive shift towards ethical and sustainable products, backed by strong branding and valuable certifications, such as the Soil Association, Fairtrade Foundation, and B Corp. Consumers are actively seeking products made in harmony with nature, which is evident in the growth of the organic market doubling last year to 7.3%.”(12)

In terms of what’s trending, Clipper Organic Sleep Time is Ecotone’s best-performing infusion, with value growth of 94%.11

“Infusions on the whole are a growth area in the market, driven by modern consumers seeking powerful flavour combinations and products that support specific needs. Sleep is the top need state within this, as we know that people turn to tea to unwind and relax.”

Kaytea – value driven vs premium and confectionery-inspired tea

Founded in 2020, Kaytea’s organic, Fairtrade-certified RTD teas are gaining traction across both mainstream and premium channels. The brand has secured strong distribution partnerships with retailers like Sainsbury’s, M&S, WHSmith, Eurostar, Waitrose (Dubai UAE), and over 500 corporate offices.

Its pricing strategy positions it above own-label options but below mass-market giants like Lipton RTD, creating a compelling value proposition. Brand equity is bolstered by ethical sourcing credentials and innovative, on-trend flavours, which Kevin Tang, co-founder of Kaytea claims has enabled the business to outperform legacy competitors in both loyalty and trial metrics.

“The UK tea market is undergoing a notable transformation. After years of double-digit volume declines, 2024 marked a period of recovery and stabilisation, with total category sales reaching £759.0 million – a 10.4% increase in value – while volume declined only 0.5%, the smallest drop since 2019. This signals a clear stabilisation of at-home tea consumption,” Tang said.

“A key trend is the polarisation between premium and value tiers: premium brands like Yorkshire Tea saw a 17.3% value increase (+£27.9 million), while mid-market heritage brands such as PG Tips suffered a 16.5% value decline (-£15.1 million) and a 37.8% volume collapse, reflecting both ‘affordable indulgence’ and austerity-driven trading down.

“Retailer own-label teas are accelerating rapidly, surging 19.6% in value to £134.3 million, driven by competitive pricing, larger multipacks (e.g., Asda’s 440-bag packs at £4), and heavy promotions. Decaffeinated black tea also bucked broader trends, growing 13.1% in value (£66.8 million) and 4.7% in volume as health-conscious consumers seek caffeine-free evening options.”

In terms of flavour, Tang notes a move towards nostalgic and confectionery-inspired blends.

He notes collaborationslike the Swizzels-inspired ‘Love Hearts’ and ‘Parma Violets’ teas, as well as Yorkshire Tea’s ‘Biscuit Brew.’

Global fusion styles remain popular too, with sustained demand for yerba mate, matcha, and other internationally inspired profiles.

In terms of consumer priorities, Tang descried them as “bifurcated”.

“Ethical credentials – such as organic, Fairtrade, and transparent sourcing – are critical for trial and loyalty, as seen in Clipper’s ethical branding and Tetley’s shift to compostable bags,” he said.

“Health-and-wellness claims like low-sugar, antioxidant-rich, and decaf resonate strongly with sleep- and wellness-focused shoppers. Meanwhile, the market is split between value-driven purchases (e.g. own-label decaf averaging £1.14 per pack) and premium-seeking tea aficionados willing to pay upwards of £3 for unique blends or provenance stories.”

References

- Kantar’s GB Grocery Consumer Panel, 52w/e December 2021, 2022, 2023, penetration %, repeat rate % for plant-based meat alternatives (meat analogues) and plant-based milk

- NIQ data 52 w/e 28 Dec 2024

- Kantar Out of Home Panel, Coffee, 52 w/e 23 February 2025

- Lincoln & York VYPR research 10-17 July 2024

- Kantar Out of Home Panel, Coffee, 52 w/e 23 February 2025

- Lincon & York VYPR research 16 April 2025

- NIQ Scantrack – MAT WE 22.03.25

- Lincoln & York; NielsenIQ Defined RTD Coffee for the 52 week period ending 22/03/25 for the UK total retail market (Copyright © 2025, NielsenIQ)

- Allegra project Cafe 2025

- Vypr Lincoln & York research 15/01/25

- Circana data to 22 February 25 value sales

- Soil Association Organic Market 2025