This drinks report is based on electronic point of sale (EPOS) for the year ending March 2025, gathered by Circana. It also features case studies and expertise from the industry sourced by Food Manufacture to provide further analysis. Other data referenced will be indicated.

The data for alcoholic drinks has been divided into three: Long alcoholic drinks, spirits, and wine.

You can read the full drinks report here.

Long alcoholic drinks

This part of the data captures insights on:

- Ale & stout

- Cider

- Craft and speciality

- Lager

- RTD spirits and cocktails

Lager dominates the long alcoholic drinks (LAD) market, accounting for 65% of the volume and 60% of the value.

However, the high average volume price for the ready-to-drink (RTD) spirits and cocktails category means that although the sector accounts for just 4% of the volume, it delivers 9% of the value.

The low and no market has made an impact on the alcoholic sector, with alcohol-free beer seeing particularly positive growth (more on no/low in this chapter).

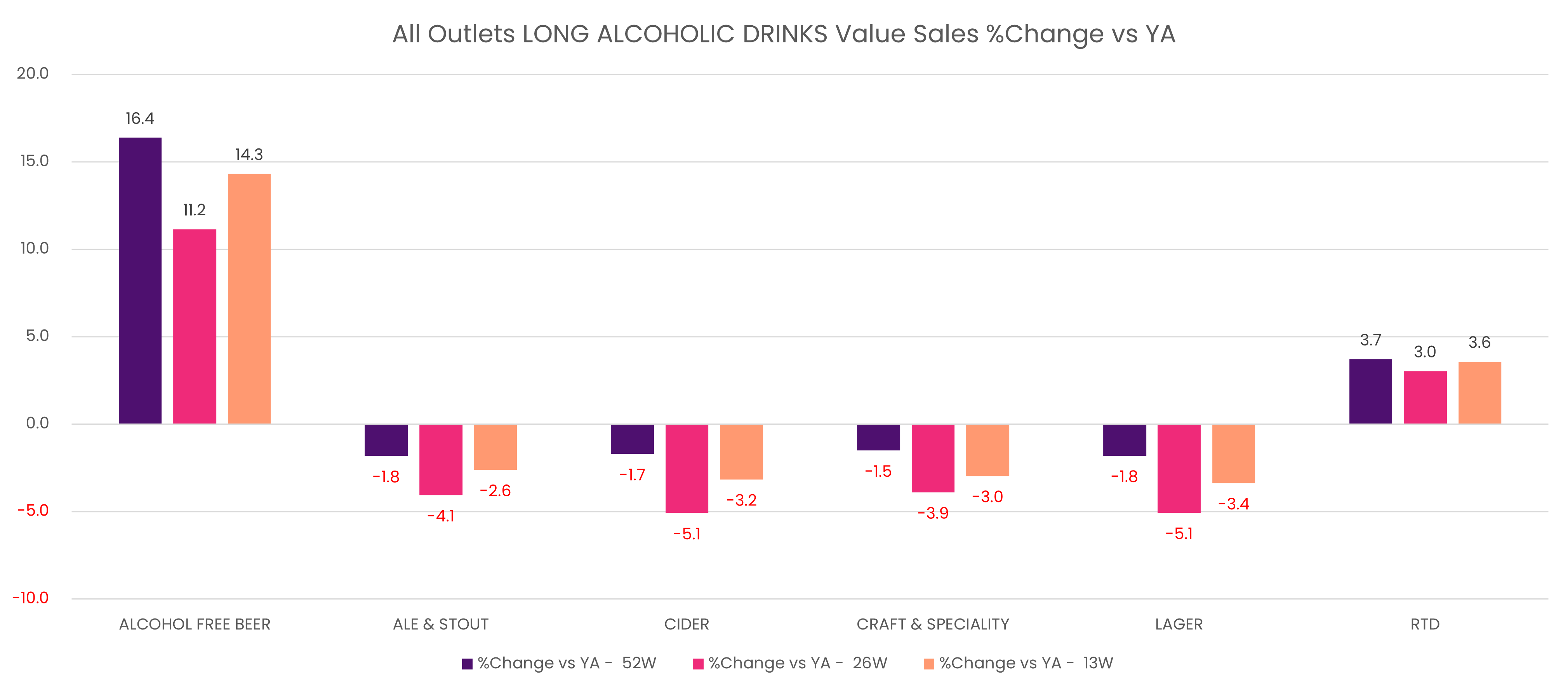

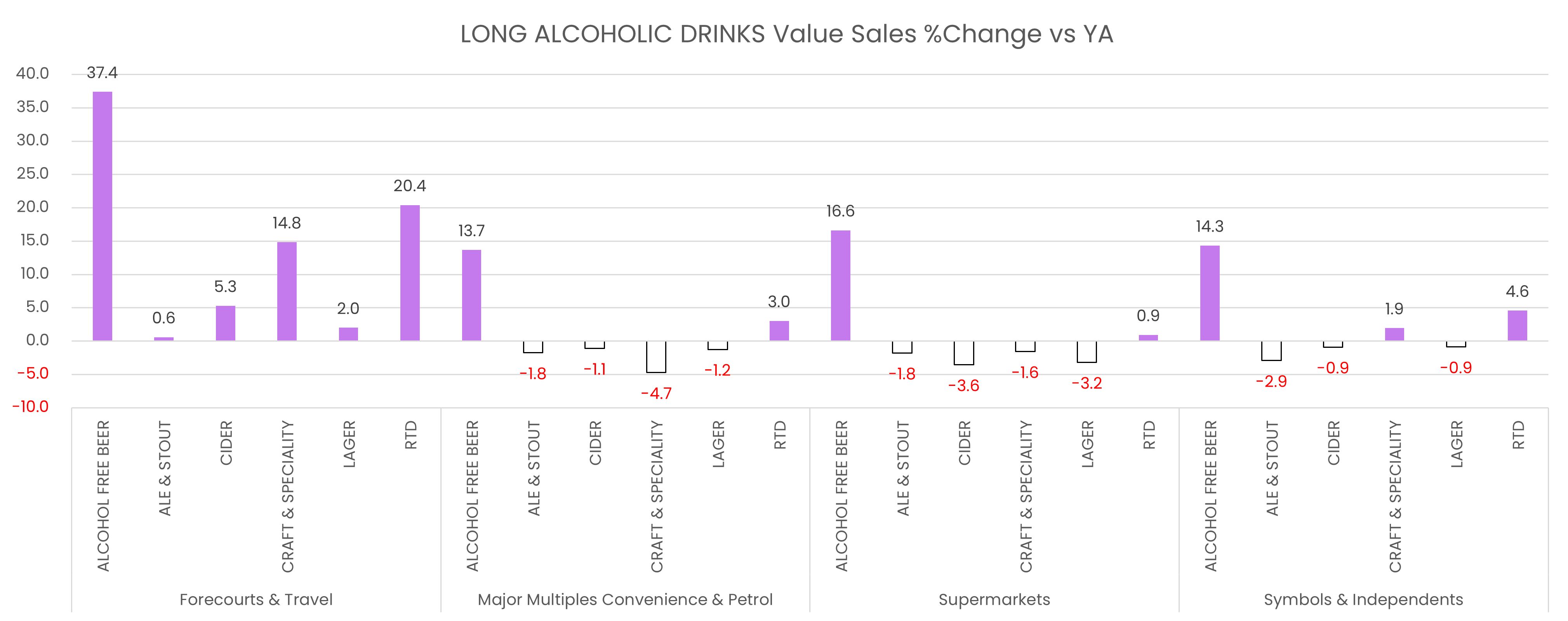

On the other hand, alcoholic drinks such as ale and stout, cider, craft and speciality, and lager are in the red. These four categories all saw a big dip halfway through the year, with the last 13 weeks showing a small recovery. But, overall, value growth is down, with the percentage change vs the last year varying between -1.8% and -1.5%. Among these declines, craft and speciality had the softest blow.

Meanwhile the RTD spirits and cocktails category has bucked this trend, with steady growth in terms of value over the year, at +3.7%.

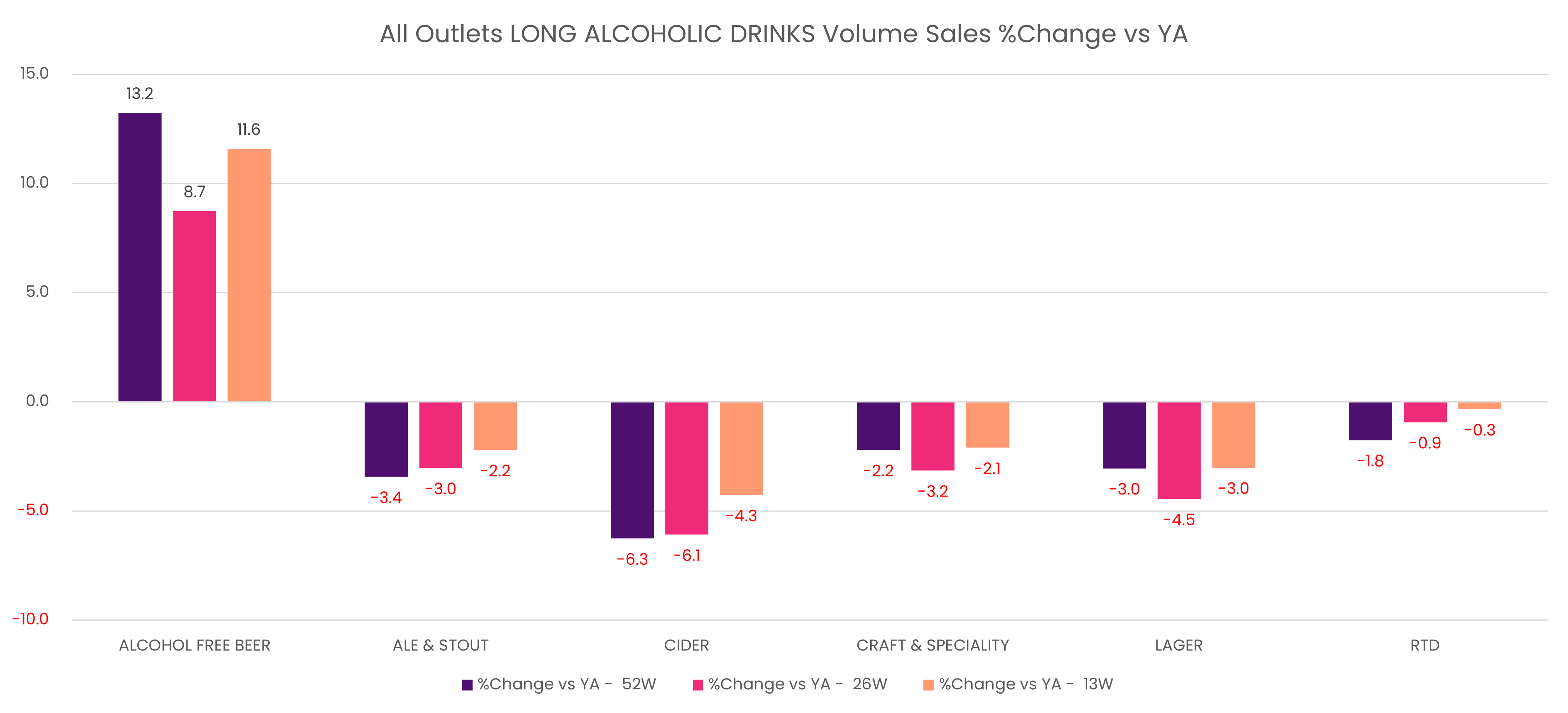

In terms of volume, the above-mentioned categories, with the exception of alcohol-free beer, are all well down on the last year. The RTD category, whilst in decline, appears to be the only one with an upward trajectory.

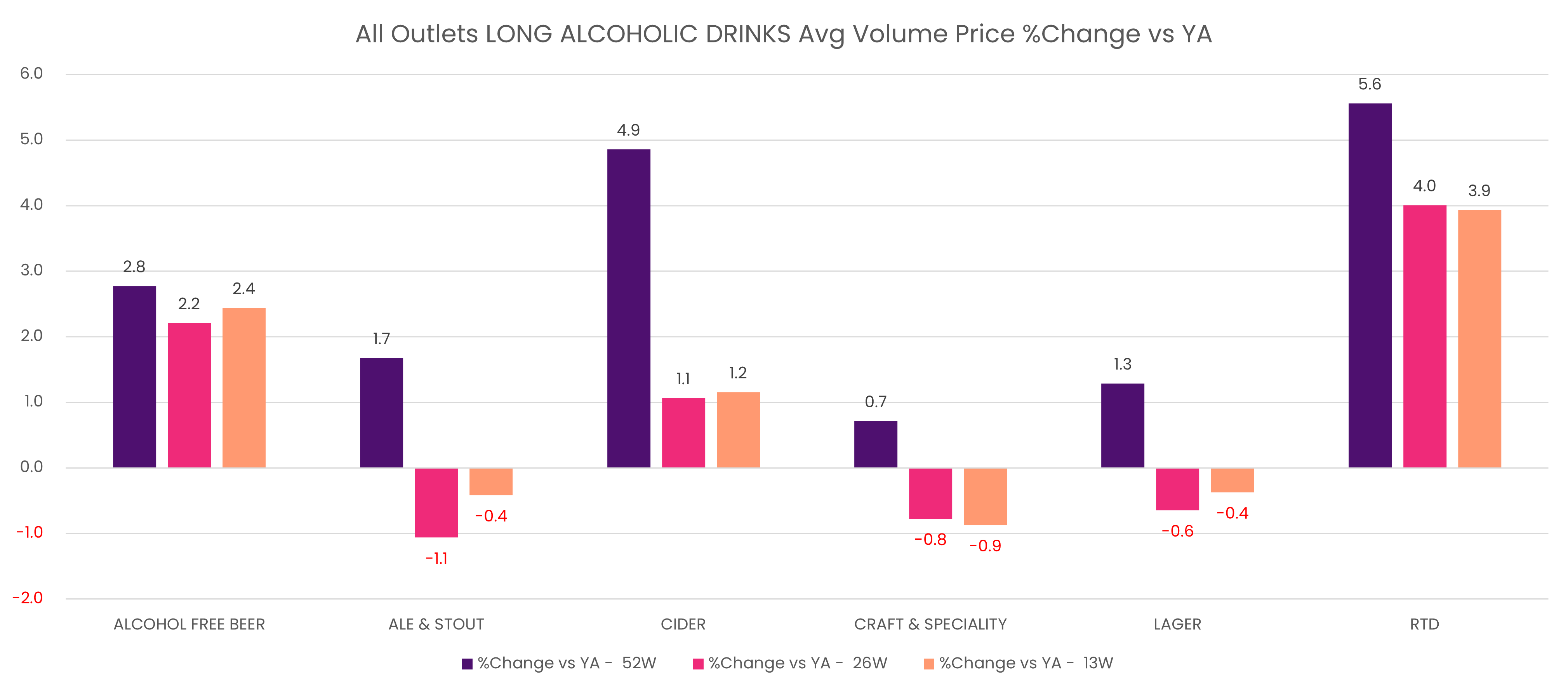

Recent period price drops in lager, ale and stout have failed to boost volumes year-on-year (Y-o-Y) for these categories. However, it has benefitted cider, and RTD spirits and cocktails.

Whilst promotional investment is up on the year for cider, craft and speciality, lager and RTD, recent weeks has seen it slow or even decline.

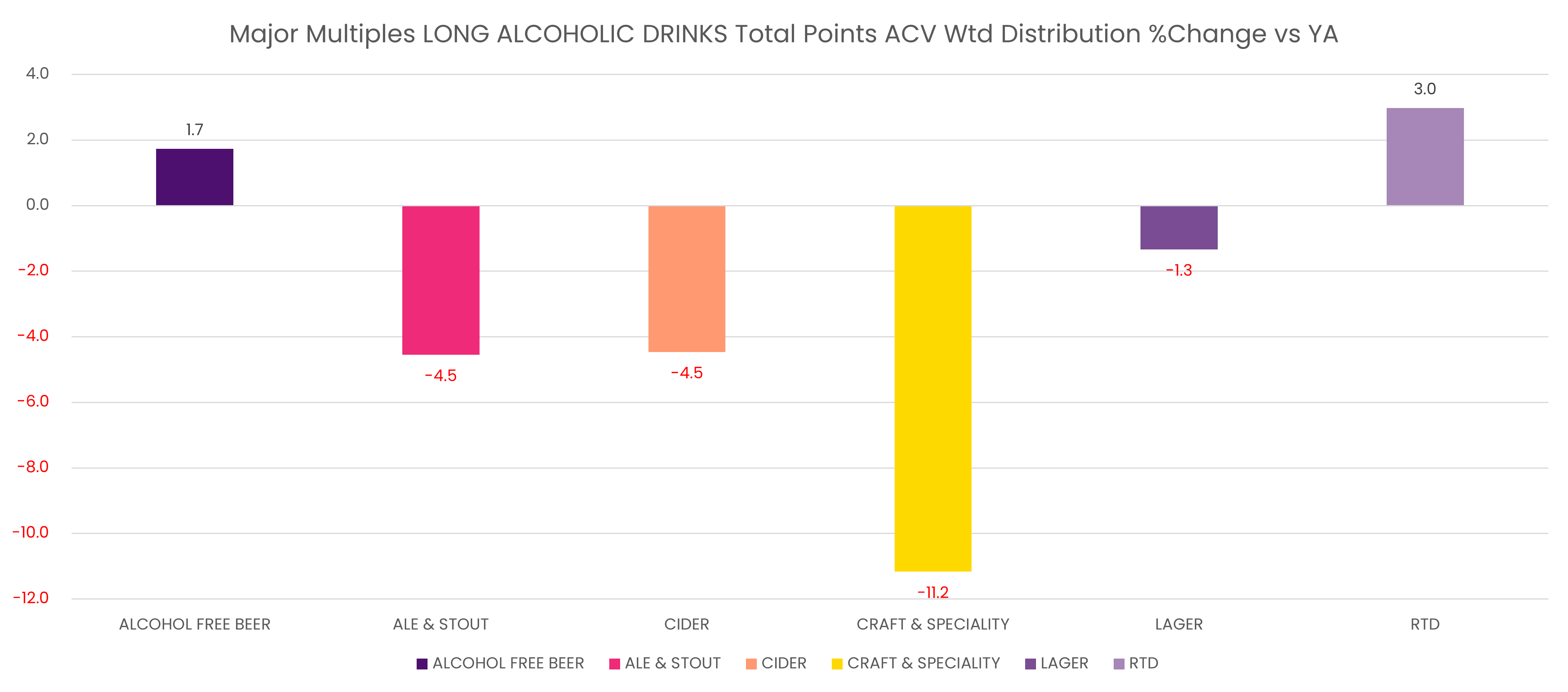

Only RTD and alcohol-free are witnessing range gains, with craft and speciality ales hardest hit at -11.2%.

Supermarkets are seeing decline in both volume and value sales of alcoholic drinks, with symbols and independents gaining value despite losing significant volume share.

Forecourts and travel shops are the only retailers to see growth across all drink alcoholic categories in the last 12 months. This is volume driven.

“LAD manufacturers will not welcome volume moving the higher margin symbols and independent channel to the lower margin Major Multiple Grocer channel,” said Alex Lawrence, senior strategic insight director for Circana.

Trends in action

Diageo - long alcoholic drinks

“Within beer, stout has enjoyed a sharp increase in popularity in recent years, attracting a whole new legion of fans with its distinctive taste, with Guinness at the forefront of this,” Annabel Holroyd, senior consumer planning Manager at Diageo told Food Manufacture.

Guinness’ strong heritage has made it more than just a drink, but a cultural phenomenon, which the beverage business has built on through partnerships with the likes of the Six Nations and Premier League.

“Innovation has also been key to Guinness’ ongoing success,” added Holroyd. “Whether that’s Guinness 0.0, appealing to even more consumers on more occasions; Guinness MicroDraught, a pioneering dispense technology that has facilitated more installs in on-trade venues; or Nitrosurge, which enables consumers to deliver the perfect pour from the comfort of their own home, opening up more opportunities for retailers to drive sales.”

Holroyd said Diageo has also seen a significant rise in RTD mixed drinks, which she explains is gaining traction due to its convenience and variety.

“We’ve responded by expanding our RTD portfolio, including innovations like Captain Morgan Original Spiced Gold and Pepsi MAX, which expertly blends each brand’s distinctive flavour profile to create a perfectly-balanced classic serve that consumers can enjoy straight away.

“It joined our portfolio that already included RTD versions of iconic serves such as Gordon’s Gin & Tonic Gordon’s Gin & Diet Tonic, Gordon’s Pink Gin & Tonic, Smirnoff Vodka & Cola and Smirnoff Raspberry Crush,” she added.

“We only expect this category to continue growing and we are committed to exploring new ways we can innovate in order to deliver on the demand for more diversity of choice.”

Carlsberg Britvic - Hobgoblin

Hobgoblin Amber beer launched in Tesco earlier this year.

It’s described by the brewer as having floral and citrus notes on the nose, complemented by earthy, malted undertones and a zesty fruit finish on the palate.

The beer comes in four packs of 568ml (pint) cans (RRP £6.20) and single 500ml bottles (RRP £1.75) and is being rolled out into other retail outlets as well as in cask format in the On Trade.

“We know that when people shop for ales, they shop by either brand or style of beer, so we wanted to give them everything they are looking for with Hobgoblin,” explained Jo Marshall, director of marketing for ales and craft at Carlsberg Britvic.

“Amber is the best performing ale style in the market and Hobgoblin is the best performing premium ale brand with our market share having increased from 10% of total premium ale to a whopping 12.17% in the past year.”

Hobgoblin has outpaced the premium ale market with a rise in value sales of 13.9% in the past year – compared with a 6.4% drop for the total market. Lead product in the range Hobgoblin Gold has seen 20% volume growth and 21.7% value growth over the same period.

Molson Coors - Staropramen

Staropramen is owned by beer giant Molson Coors, which has a portfolio of beer and cider brands that includes Aspall Cyder, Atlantic Pale Ale, Cobra, Madri Excepcional, Pravha, Staropramen and Rekorderlig.

The brand has launched its first 4x440ml can price-marked multipack in the convenience channel.

The multipacks are price-marked at £6, with the cans packaged in a recyclable cardboard sleeve. Both the cans and sleeve include a scannable QR code directing drinkers to “exclusive Staropramen content”.

According to Circana data, 46% of convenience shoppers now use price-marked packs to inform their shopping decisions.

The rollout follows the introduction of Staropramen 10x440ml can ‘Fridge Packs’ in March of this year.

Commenting on the launch, marketing controller for Staropramen Jake Johnstone said: “The world beer category continues to grow, as does consumer demand for multipack formats. 4x440ml packs now represent 22% of total category sales, as consumers look to enjoy world beer during social occasions at home – particularly as the warmer months approach.

“Shoppers perceive PMPs as offering better value which in turn helps to drive sales for convenience retailers. It also offers a point of difference that shoppers can’t get in larger stores. The launch of Staropramen’s 4x440ml price-marked multipacks is perfectly timed to help convenience retailers capitalise on all these trends during the crucial summer months.

“To go that step further, retailers could create their own offers and bundle deals tied to summer occasions and events to generate interest and give shoppers everything they’re looking for when planning at home occasions.”

Asahi UK - Peroni

The Peroni brand in the UK is part of the wider Asahi UK portfolio, which is a subsidiary of Asahi Europe & International.

Peroni Nastro Azzurro has launched a new 10-can multipack of 330ml ‘stubby’ cans, designed to appeal to the younger and more affluent adult consumer.

The beer brand has responded to feedback by switching from a more slimline design to shorter and wider cans, which is being first made available in the 10-pack format via major supermarket retailers and wholesalers including Majestic and Parfetts.

Peroni has also redesigned its outer packaging which will be rolled out across the brand’s wider range shortly.

The new design sees the brand’s blue ribbon sweep across each side of multipacks, designed in a way that creates an ‘endless ribbon’ when the packs are seen together on the supermarket shelf. The main logo – the Amaretti – has also been refreshed to make it standout more.

“Historically, cans have been associated with the economy lager segment, but the format is becoming increasingly important to premium lager,” said Asahi UK’s marketing director Rob Hobart.

“For most premium brands such as Peroni Nastro Azzurro there is now a trend towards a more affluent and younger shopper demographic for cans.”

According to NIQ, cans have grown their share of lager in recent years, reaching a value share of almost 64% in 2023. Meanwhile, can sales within premium lager grew in the past year by 10.6% compared with 2023, almost double the growth rate in mainstream lager.

AB InBev - Kopparberg

Kopparberg UK is owned by the Swedish brewery Kopparbergs Bryggeri and distributed in the UK by the Budweiser Brewing Group (a part of AB InBev).

Fruit cider brand, Kopparberg, has launched Kopparberg Crisp Apple Cider (ABV 4%), which is describes as a ‘fresh take’ on traditional apple cider.

According to the brand, apple cider is seeing a revival – especially among younger drinkers – and this modern twist is designed to appeal to this new audience. The drink has landed in time for summer – which the brand calls ‘Kopparberg season’ and is available in pubs, as well as Sainsbury’s and Morrisons stores nationwide in 500ml single bottles RRP £2.55 and 4x500ml cans RRP £6.00.

Bacardi

Bacardi was founded in 1862 by Don Facundo Bacardí Massó in Santiago de Cuba. Its portfolio includes Grey Goose Vodka, Bombay Sapphire, Martini and others.

The brand has recently brought its Bacardi Breezer back into the UK market (June 2025 launch) following strong demand for fruity RTD beverages.

Sales of flavoured alcoholic beverages (FAB) are valued at more than £300 million in the UK, according to IWSR 2023 figures. This accounts for nearly half of the growing category and Bacardi anticipates the familiarity of the Breezer brand to help push that further.

The original Bacardi Breezer first launched in 1990 and became a popular ‘alcopop’ in the UK. Its return brings with it three flavours: Zesty Orange, Zing Lime, and Crisp Watermelon.

“The early response from our trade partners has been overwhelmingly positive,” said Steve Young, business unit director for Bacardi in the UK & Ireland.

The new Breezer is aimed at two distinct groups; first Gen Z (born 1997-2012) as it taps into the popularity of fruity flavours and house parties; and secondly, those who previously drank Breezer (most likely older Millennials and younger Gen Xers).

Breezer has an alcohol by volume (ABV) of 3.4% and is available in 27.5cl glass bottles in bars and stores nationwide.

Global Brands - Reef

Reef is own by Global Brands which purchased it from Molson Coors in 2023 alongside Hooch and Hooper’s.

Following its return last year, Reef has become the first UK alcoholic RTD brand to become available in Tetra packaging.

The exotic alcoholic fruit juice brand (3.4% ABV) is said to be experiencing growth in the UK Off-Trade of +207%, with the brand’s momentum shows no signs of slowing down. This has paved the way for the latest format expansion.

With the new packaging timed for the summer, the format offers a distinct functional advantage, with Global Brands claiming that it warms approximately two times more slowly than traditional cans under typical indoor conditions.

Reef Tetra comes in a 330ml, 100% recyclable and fully resealable carton, making it suitable for on-the-go, and also in 15x330ml packs – both with resealable lids.

In addition to its thermal and resealable benefits, this packaging format optimises shelf space, occupying approximately 40% less space than Reef’s traditional rounded packaging. Its compact, stackable design further enhances product visibility on-shelf with its 360 printable area.

“Since we relaunched Reef back into the UK market last year, the brand has delivered exceptional sales performance, and with customer demand at an all-time high, this new format range is set to reinforce Reef’s position as a dynamic force in the RTD category,” said Matthew Bulcroft, marketing director for Global Brands.

Spirits

This part of the data includes:

- Brandy

- Cognac

- Gin

- Rum

- Vodka

- Whisky

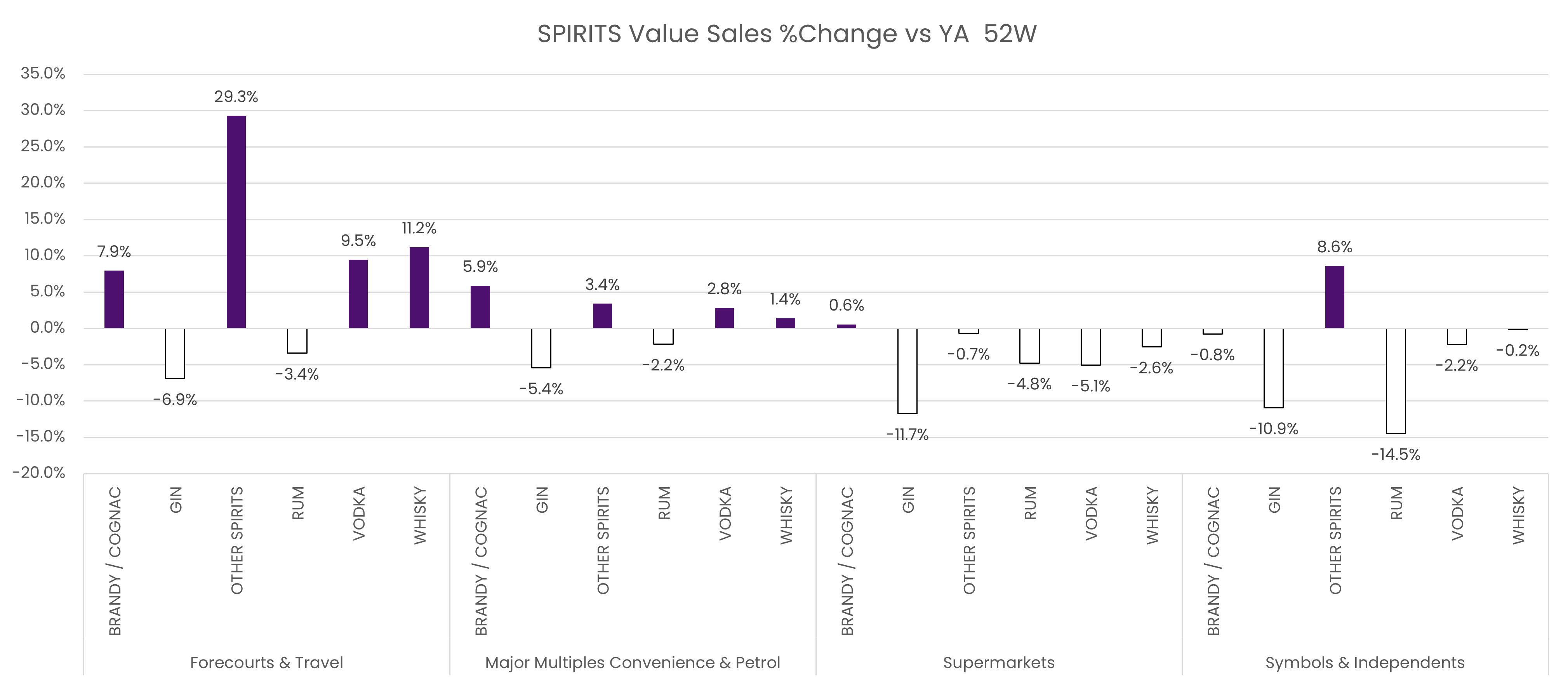

Whilst RTD spirits and cocktails are in growth, spirits in more traditional forms are the worst hit category within alcoholic drinks. The decline is volume driven, with only low and no spirits in volume growth.

Whisky is the biggest category in terms of volume and value sales. Still, compared to last year it is seeing a decline in both areas.

In fact, only ‘other spirits’ (e.g. Morgan Spiced, Tequlia Rose) and brandy have remained in growth in terms of value of the last 12 months. All other categories are down Y-o-Y in recent periods.

At a higher average volume price, the spirits category has been most impacted by the cost of living. Decline is volume driven and looking to be accelerating.

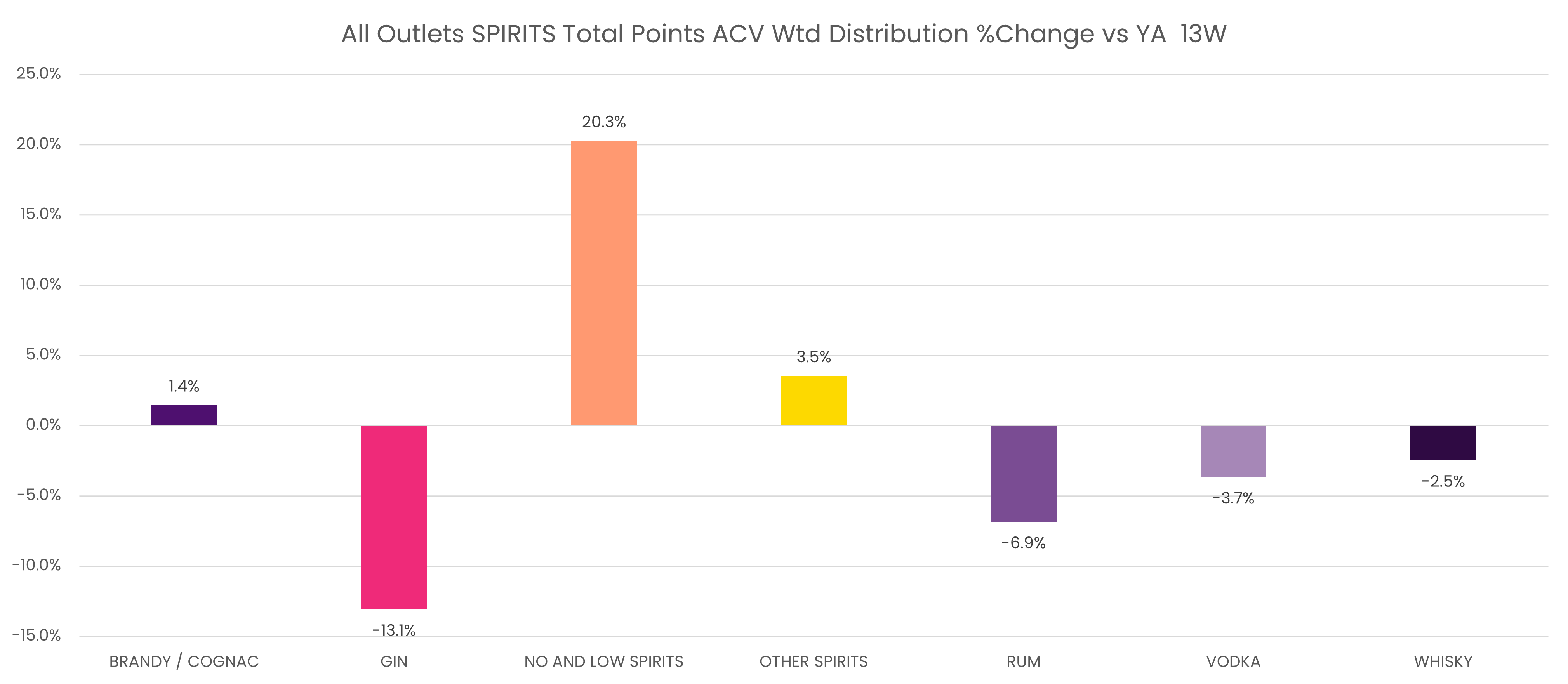

Gin in particular has especially suffered, seeing a -13.7% decline in volume sales on the year. It has also endured the most range reductions; well beyond other categories at -13.1%.

Rum has also seen a big drop in volume terms, with a -9.2% drop vs last year. This spirit has witnessed the largest increase in promotional investment Y-o-Y, with a +2.2 percentage point rise in activities such as giveaways over the last 12 months. Extra promotional support has done little to boost volume performance, however.

Spirits have seen the average volume price increase on the year, with vodka the most drastic at +4.7%, followed by whisky and rum (both +3.8%).

The supermarket has experienced the weakest performance in terms of channel, which is surprising since they generally offer spirits at lower average volume prices.

Forecourts and travel are growing strongly, notably in other spirits, with value and volume sales up on the year at a +39.3% and +25.3% respectively. This strong performance is being pushed by Captain Morgans Spiced and Tequila Rose.

Trends in action

Heroes and Heretics

Independent spirits bottler Heroes and Heretics (HAH) has been seeing a huge shift in consumer behaviour. The founder of the SME, Craig Chidgey, told Food Manufacture that he’s witnessed a big downturn in whisky and alcoholic drinks in general.

He explained that during the pandemic, the business had been doing well but with the introduction of alcohol duty, his margin was wiped out.

Whilst those buying cheaper bottles at £30-50 moved to more of the middle ground (£50+), consumers buying the very expensive bottles (several hundred) simply stopped.

Added to this, he notes a big trend towards non-alcoholic drinks and a negativity painted around alcohol.

“Characters that drink on popular TV shows like Eastenders are all [depicted as] alcoholics,” Chidgey continued. “Their life’s in a state. It’s like saying if you drink [in moderation], you’ll be a mess too.

“There’s so many factors that we’re battling here – tax rises, messaging, inflation.”

He underscored how much harder it is for smaller brands too: “If you’re a conglomerate business you can absorb the cost.”

Whilst HAH is experiencing difficulties in its bottling division, Chidgey is tapping into the rise of health and is working on a new functional canned water offering – Aquatonic.

Diageo – spirits

Like HAH, which has seen certain consumers trading up in the spirits sector, Diageo’s Holroyd said there’s been move towards premiumisation.

“We’re certainly seeing that people are willing to pay more for better experiences, whether that’s in flavour, format, or brand story. However, value still matters, and successful products often deliver both convenience and premium cues at a price point that feels justified.

“Casamigos is currently the number one tequila in grocery, and Ciroc the third largest super-premium vodka brand in the total off-trade. These brands are attracting consumers who want more from their drinks whether it’s craftsmanship, unique flavour profiles, or aspirational brand experiences.”

The drinks giant says it has also seen a continued interest in whisky – especially within luxury.

“It is a unique category in which consumers are often invested in the heritage of the product, favouring brands that are steeped in history. The Diageo portfolio includes some of the worlds most famed distilleries and brands, including Johnnie Walker, which has more than 200 years of heritage and craftsmanship.”

In terms of format, Diageo is seeing growth in smaller formats such as minis.

“These offer consumers an accessible way to try premium products or enjoy their favourite serves in a smaller size. This approach works well across multiple categories, from whisky to vodka, especially when gifting or exploring new brands.”

Holroyd continued: “We took a major step last year with the launch of the Diageo Luxury Company, uniting all of our premium brands – including Johnnie Walker, Casamigos, Cîroc, Don Julio and The Singleton – under one portfolio to help our customers accelerate growth.

“It will focus on growing bold and locally relevant brands and innovations across retail and hospitality, ensuring that we can best support our customers in catering to demand for more premium spirits.”

Declan Hassett, licensing manager at Diageo agrees that consumers are seeking moments of indulgence in food and drink, looking to treat themselves with small, accessible purchases as they remain cautious over the pennies

“The global treating category is expected to be worth $479bn in 2027,(1) and within that the adult treating market (for those 18+) is thriving – we’re seeing 4.5 billion digital searches for treats,(2) which tells us that consumers are regularly seeking out indulgent moments.

“Baileys is brand synonymous with indulgence, from adult treating gifts to limited-edition seasonal releases. The brand’s licensed products take the distinctive taste and quality of the original product into new areas of the store, such as the confectionary, desserts and frozen aisles, potentially driving up to 20% uplift in incremental sales for retailers(3) and subsequently for manufacturers. Additionally, we know that almost 1 in 10 households in GB buy Baileys licensed products, which equates to 2.5 million shoppers(4) with over 20% of Baileys shoppers not purchasing the spirit itself, instead only the brand’s licensed products.(5)

“This presents a key opportunity for manufacturers to work with popular brands and tap into existing brand saliency, leveraging the emotional connections and trust associated with iconic names, to craft offerings that resonate with consumers.

“Data also shows that Baileys licensed products tend to attract a wider audience than the core Baileys shopper,(6) meaning that manufacturers who partner with a hero brand such as Baileys can help cater to consumers with budgets of all sizes, ensuring that all customers have the opportunity to purchase the same top-quality flavours at a variety of price points.

“Under licence, manufacturers can take iconic brand flavours and adapt with favourite formats – Baileys recently launched Baileys flavoured popcorn with Joe & Stephs, and last year, expanded the partnership with Arla to launch Baileys Squirty Whipped Cream, taking coffee-flavour and blending festive with premium and convenient, to drive growth.”

In terms of flavour, the Diageo team says they’re seeing more experimentation with bold and unique flavour profiles, whether through cocktails, RTDs, or base spirits.

“Both consumers and bartenders are becoming more adventurous, using a broader range of ingredients and spirits to create new and exciting drinks experiences,” said Holroyd.

“Our response has been to evolve our flavour-led innovation across multiple brands. For example, earlier this year we launched Smirnoff Miami Peach, which combines juicy-sweet peach flavours with the smooth taste of Smirnoff Vodka that fans know and love. Peach is a delicious and versatile flavour making it perfect for creating a range of simple and impressive serves, tapping into that demand for experimentation.

“We’ve also recently launched a new limited-edition flavour in our growing Cîroc range: Cîroc Strawberry Limonade, bringing together two trending flavours – strawberry and lemon – in a super-premium vodka. Strawberry and lemon flavoured variants have high purchase intent among spirit drinkers, making it the ideal launch ahead of summer.”

Five Farms

Five Farms Irish Cream Liqueur is a cream liqueur handcrafted in County Cork, Ireland; made from single batches of rich dairy cream sourced from five family-owned farms and blended with triple-distilled Irish whiskey.

According to Tara O’Reilly, marketing and product specialist at McCormick Distilling, the company has seen tremendous growth since establishing the product in the UK.

She notes this has been driven by consumers looking for “authentic, high-quality products with a compelling backstory”.

“In the UK, we’re seeing encouraging growth in the premium cream liqueur space, both in volume and value,” she continued. “Shoppers are trading up, favouring quality over quantity, and looking for drinks with a rich backstory and real craft behind them.

“There’s also a strong trend toward seasonal and occasion-led purchasing – cream liqueurs continue to be a firm favourite for Christmas, but we’re increasingly seeing them enjoyed year-round as an after-dinner treat or weekend indulgence. The appetite for premium, indulgent drinks is there, and it’s helping to drive sustained momentum across the category.”

Global flavour trends are having a noticeable impact on the liqueur category in the UK, with consumers increasingly curious and adventurous and seeking out drinks that offer a sense of place or cultural flair.

“For Five Farms, our Irish heritage is a key part of our appeal,” O’Reilly added. “That sense of provenance - real Irish cream, real Irish whiskey, and a true farm-to-table story - resonates with consumers looking for authenticity in an increasingly globalised market. At the same time, our creamy, indulgent profile lends itself perfectly to the rise of cocktail culture and globally inspired serves, like espresso martinis with a creamy twist or dessert-style after-dinner drinks.”

Overall, she notes the cream liqueur category is experiencing a renewed sense of momentum.

“While the broader alcohol market has seen some shifts, indulgent, nightcap drinks like Five Farms continue to perform well. People are increasingly looking for treat-style beverages – something rich, delicious, and shareable, which plays directly into our strengths.”

Wine

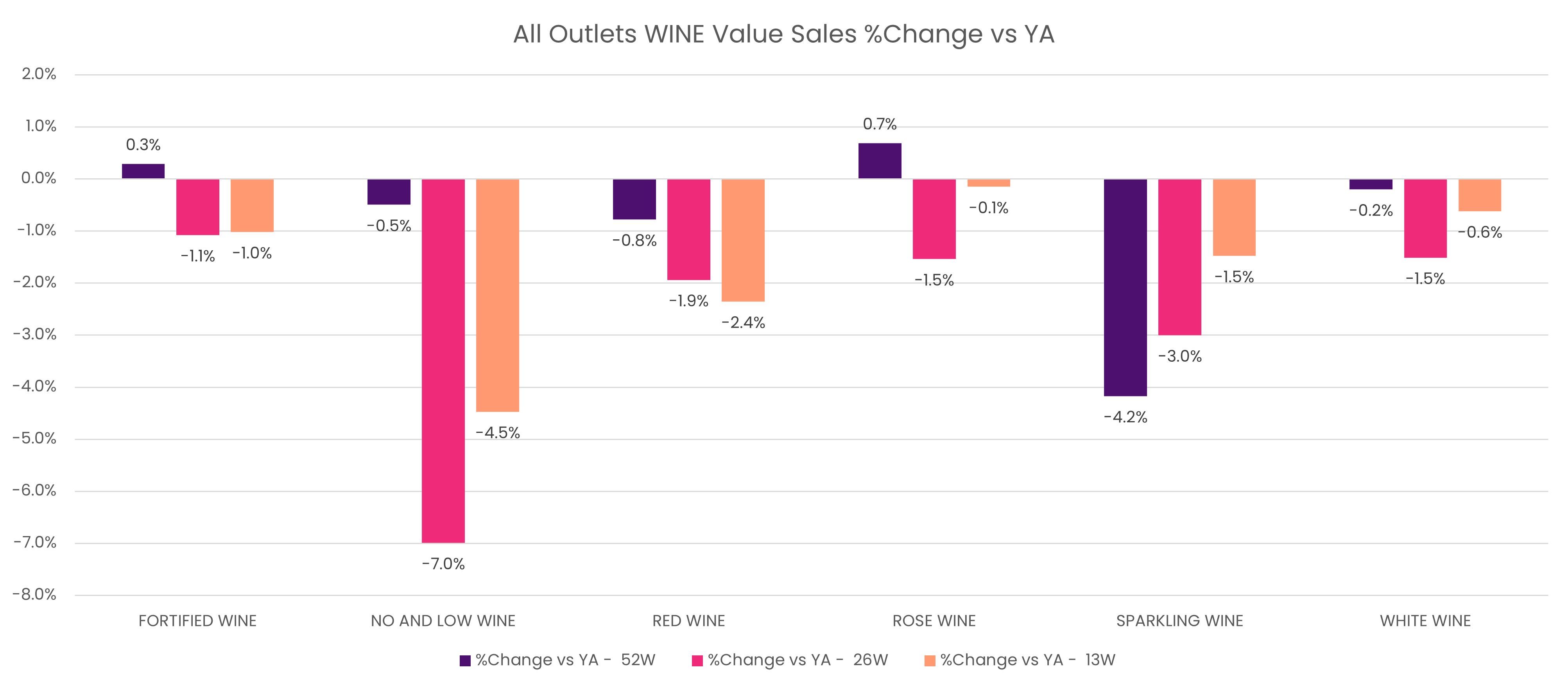

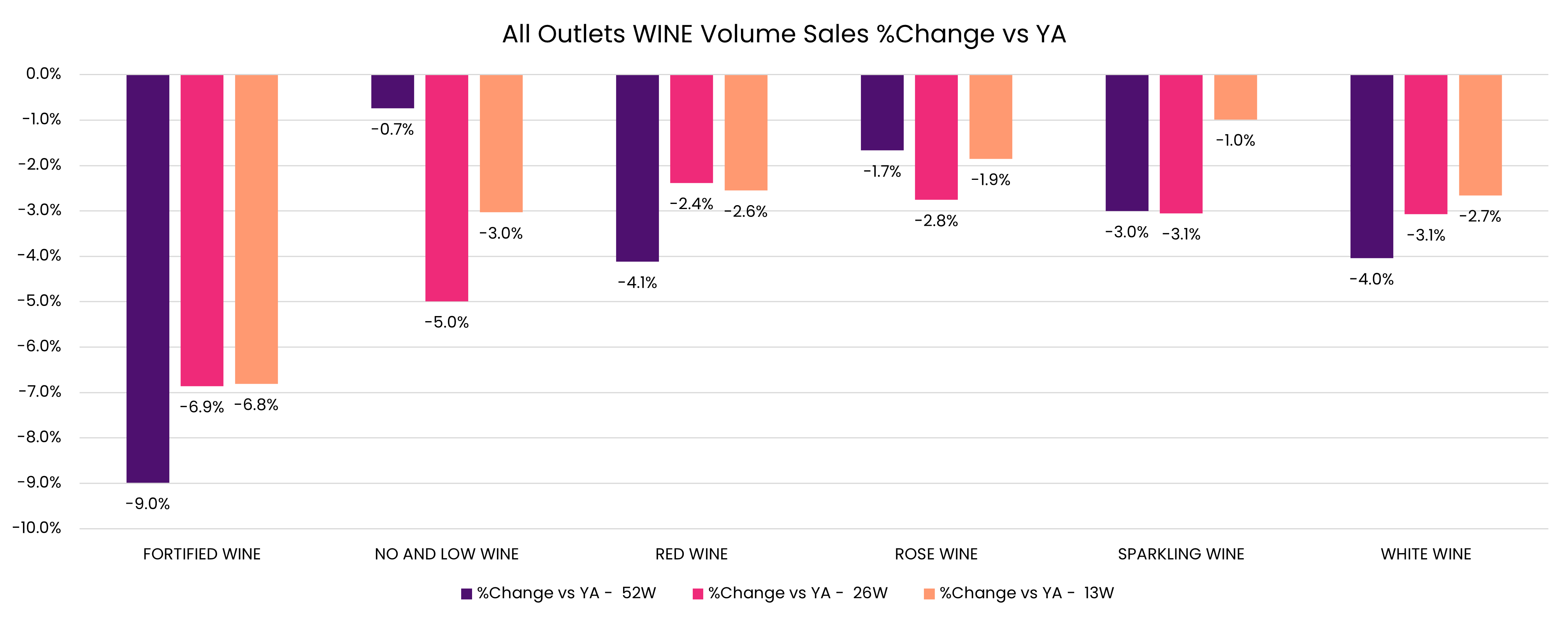

Wine has also been impacted by cost-of-living pressure, with weakening volume sales driving a value sales decline over the 12-month period.

White wine is the biggest category for volume and value but has a lower average volume price compared to the rest of the category.

White value sales are down on the last year for all categories, except fortified wine and rose wine, which is holding on at +0.3% and +0.7% respectively. However, in recent months all are on a downward trajectory.

Sparkling wine value sales has been hit particularly hard, with a -4.2% drop followed by red wine at -0.8% and white wine at -0.2%.

Volumes are also well down on last year, with sparkling the only category showing signs of recovery in more recent weeks.

Fortified wine on the other hand has seen the biggest fall at -0.9% Y-o-Y, followed by red wine at -4.1%.

Price growth (average volume price) is generally higher Y-o-Y, although it is slowing. The exception is sparkling wine, which is down on the last 12 months by -1.2%.

Promotional investment has increased Y-o-Y (except for rose and fortified wine) but it has not stimulated category volume growth.

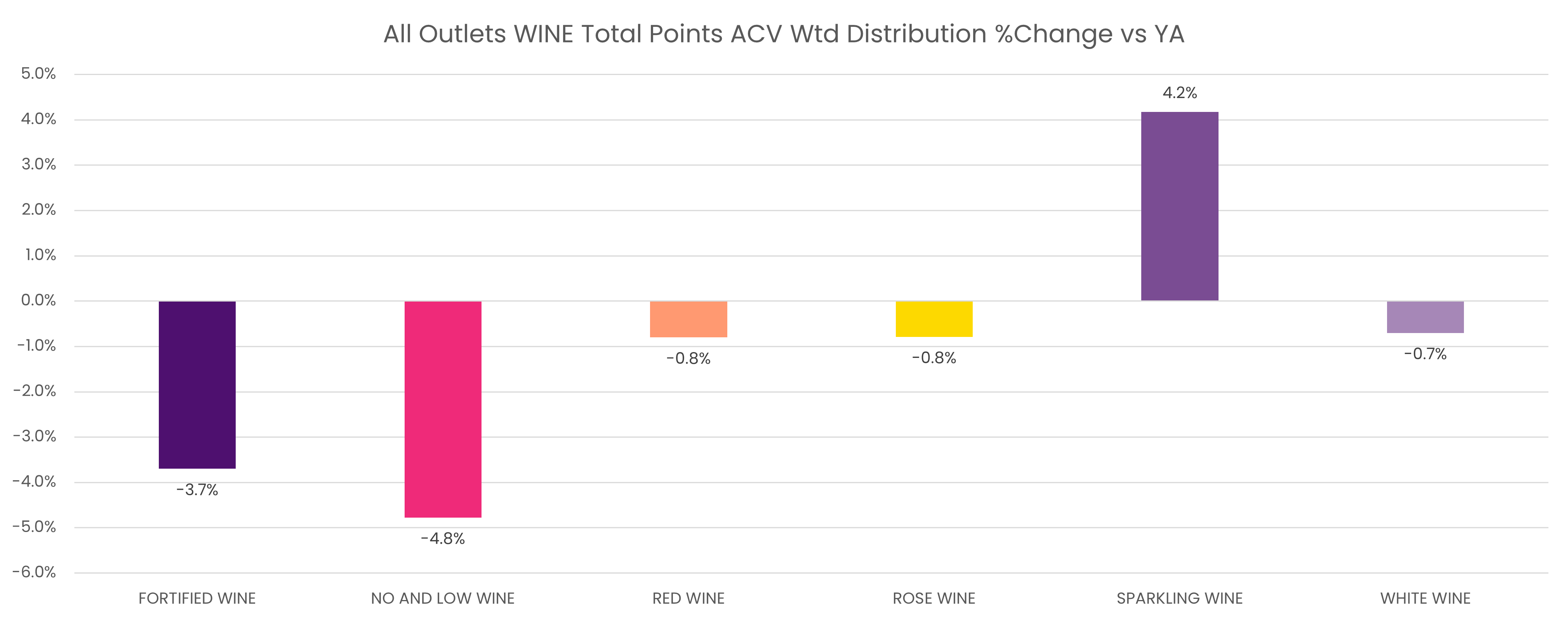

Sparkling wine is the only category to have seen growth in range vs the last year. This has slowed the decline in volume sales in the last three months.

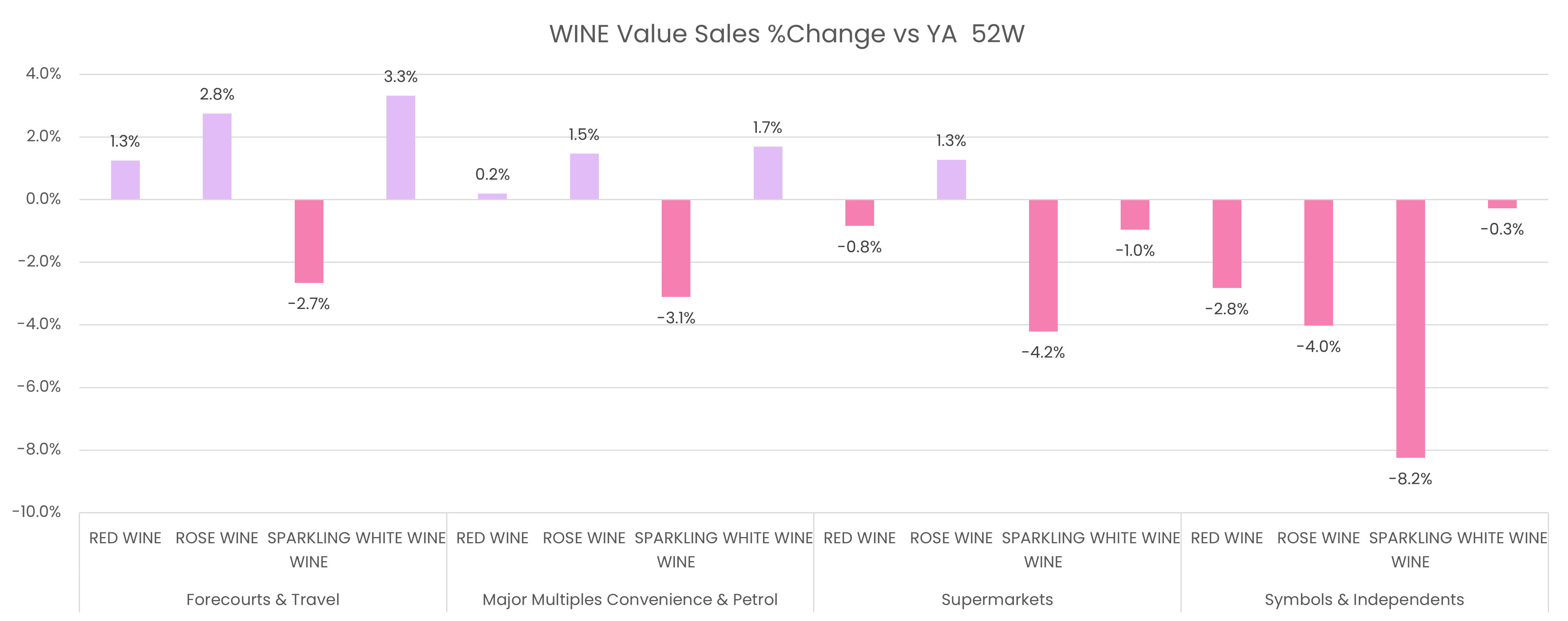

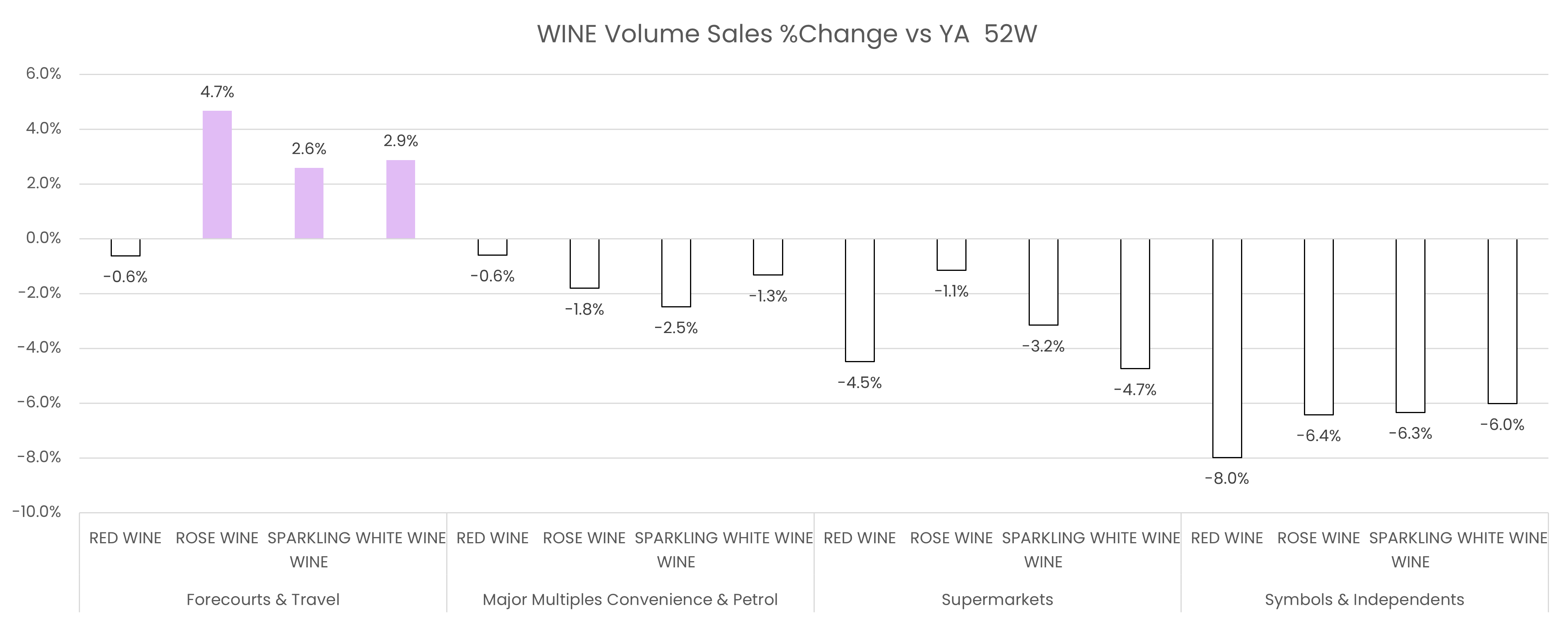

The major multiple grocer channel is the big share winner in wine, driven by both white and red wine. Meanwhile, forecourts and travel is the best performing channel in terms of value sales in all categories except sparkling wine (-2.7% on year).

Moreover, forecourts and travel is the only channel to see volume growth with symbols and independents hardest hit.

Trends in action

19 Crimes

19 Crimes, Treasury Wine Estates’ global wine brand has expanded into the Spanish wine category with the launch of its Tempranillo, Red wine.

It’s a move in which 19 Crimes believes will bring younger consumers into the brand, who are looking to explore wine options outside of Australia. The launch of the 19 Crimes Argentinian Malbec was the first time 19 Crimes delved into a red non-Australian country of origin and it has taken the category by storm.

“Tempranillo is a varietal that is growing in value at 4.1% ahead of both the Total Still Wine market and Red Wine,”(7) commented Chantal McDowell, senior brand manager at 19 Crimes.

“It’s becoming hugely popular with shoppers and we wanted to provide 19 Crimes fans, who are looking to explore wine options outside of Australia with more choice and variety within the existing 19 Crimes range.”

The 19 Crimes Tempranillo is a medium bodied, fruity wine with red and black cherry aromas, with spicy and smoked notes and a touch of oak. The 19 Crimes Tempranillo will include an augmented reality label, with the brand to roll out its first dual language AR experience, telling the story and bringing to life the character of Manuel Lopez in English and Spanish.

Manuel Lopez is a 35-year-old, 5’3 Soldier with dark hair and dark eyes, who was born in Madrid in Spain. He stood before an English court and was accused of taking four coats, six pairs of trousers and three waistcoats – goods they claimed were not his. He was convicted by deportation to Australia on the 26 October 1835.

The 19 Crimes Tempranillo is available in 750ml versions at 12% ABV from Sainsbury’s at a RRP of £7.50 in the UK, and can also be purchased from Excelsia in Spain.

Kingsland Drinks

Headquarter in Irlam in Greater Manchester, Kingsland Drinks is a full-service drinks company creating, importing, packing and distributing wine and spirits brands and no and low alcohol products for global and UK premium brands.

NPD slows but becomes smarter

Offering an overview of the general trends, Jo Taylorson, head of marketing and product management, Kingsland Drinks, said: “RTDs remain the fastest-growing category in BWS (beer, wine, spirits) by Value, now worth nearly £550 million – volume has plateaued

“There has also been an increase in higher ABV RTD products as brand owners look to premiumise.”

She noted that canned RTDs and cocktails are working their way into the mainstream, with a loyal following among younger generations.

“Their approachable packaging, lower alcohol content options, and diverse flavours have appealed to a wide range of consumers, especially younger adults and those new to alcohol.”

While the spotlight remains on RTDs, she said NPD has slowed. Yet as the category matures innovation is becoming “smarter” and launches “more effective”

“The result is a shift in shopping habits, as consumers make more considered choices within the category rather than chase the new best thing on shelves,” she explained.

“The RTD sector – both big and small brands – have been quick to react while upholding a primary principle; quality.

“Global and big UK names are feeling the pressure of challenger brands as a collective. The competition does not come from a single brand, but the power, force and growing market share of the smaller players together. Alone, they’re able to scale and innovate quickly and to a very high quality, albeit not always at a price point that can drive mass appeal. Together, they form an exciting, cool, attractive and winning part of the category.”

Fruity and botanical wines

In terms of flavour, Taylorson said the Kingsland team expects to see fruit flavours such as pomegranate, watermelon, blueberry and mango come to the fore over the next year or so, along with drinks containing herbal and botanical flavours such as rosemary and wormwood, and the resurgence of drinks with tomato juice, such as Bloody Mary.

Value vs quality

Price sensitivity, value and quality reign supreme for UK consumers who – more than ever – are watching their spend.

“Value and the right product mix are essential to keep customers moving up the price ladder while catering for their shoppers who will invariably looking household names alongside more interesting products capable of driving interest,” Taylorson said.

“Campaneo – hailing from Spain and backing lesser-known regions such as Campo de Borja – has built real momentum and a cult following of shoppers and wine critics who appreciate its quality credentials and accessible price point. Campaneo’s brand proposition, centred around its outstanding reviews, affordability, and exceptional quality liquid, helps cement its place on drinks fixtures as an accessible, quality branded option.

“We’re expecting the wines to be a firm favourite over summer, especially its real crowd pleaser Sauvignon Blanc and Verdejo varieties that are light bodied, versatile and great for a BBQ or lighter summer dishes. The Sauvignon Blanc is available in a convenient 2.25L Bag in Box (BiB) format. Consumers have embraced this format, notably because of its recyclability, affordability, and how it preserves liquid quality.

“New consumers to the bag-in-box category realise the benefits in terms of convenience, freshness and quality, it’s a great format to have in the house for party evenings and beyond – bag in box wines stay fresh for up to six weeks so can cover a whole weekend, or multiple gatherings.”

Bag-in-box is also considerably lighter to transport and offers the ability to be made from recyclable materials.

In anticipation of demand and growth in this area, Kingsland upgraded its overall filling capacity to 180 million litres on production lines, spanning various sizes from 187ml up to 3L, formats such as bottles, cans and boxed wines, and liquids ranging from no and low, spirits, and red, white, rosé and sparkling wines.

Regions

Whilst Kingsland Drinks’ Australian wine brand, Andrew Peace, is up 29% in volume over the past 52 weeks,(8) bucking the trend among most Australian brands, which are seeing volume declines, it has also been working with partner producers in the US to bring two trending wines to the UK market.

“Both hailing from Washington State, under creative new brands stocked in Aldi, the Jaw Drop Syrah and Washington State Merlot come from an under-explored Stateside wine region that is gaining recognition year on year,” noted Taylorson.

“Another emerging wine region is Bulgaria and we have sourced an elegant Pinot Noir rosé, which is now stocked in Aldi stores nationwide. From the Thracian Valley and launched under the retailer’s ‘Unearthed’ brand, showcasing lesser-known wine regions and varietals, this pale pink rosé taps into summer drinking trends, pairing well with summer salads and fish dishes.”

Minimum Unit Pricing – Scotland

In 2012, the Scottish Parliament passed the Alcohol (Minimum Pricing) (Scotland) Act 2012 (the 2012 Act) which allowed Scottish Ministers to introduce a system of minimum unit pricing for alcohol.

Minimum Unit Pricing (MUP) was subsequently introduced in 2018, with the minimum price of alcohol set at 50p per unit (ppu). In other words, the more alcohol a drink contains, the higher the minimum price for that product will be. The aim is to reduce alcohol-related harm by making alcohol less affordable.

In September 2024 the MUP was stepped up to 65ppu. For example, this means the minimum price for the following:

- Whisky (700ml bottle at 40% strength) - £18.20

- Vodka/gin (700ml bottle at 37.5% strength) - £17.07

- Wine (750ml bottle at 13% strength) - £6.34

- Beer (4 average-sized cans at 5%) - £5.72

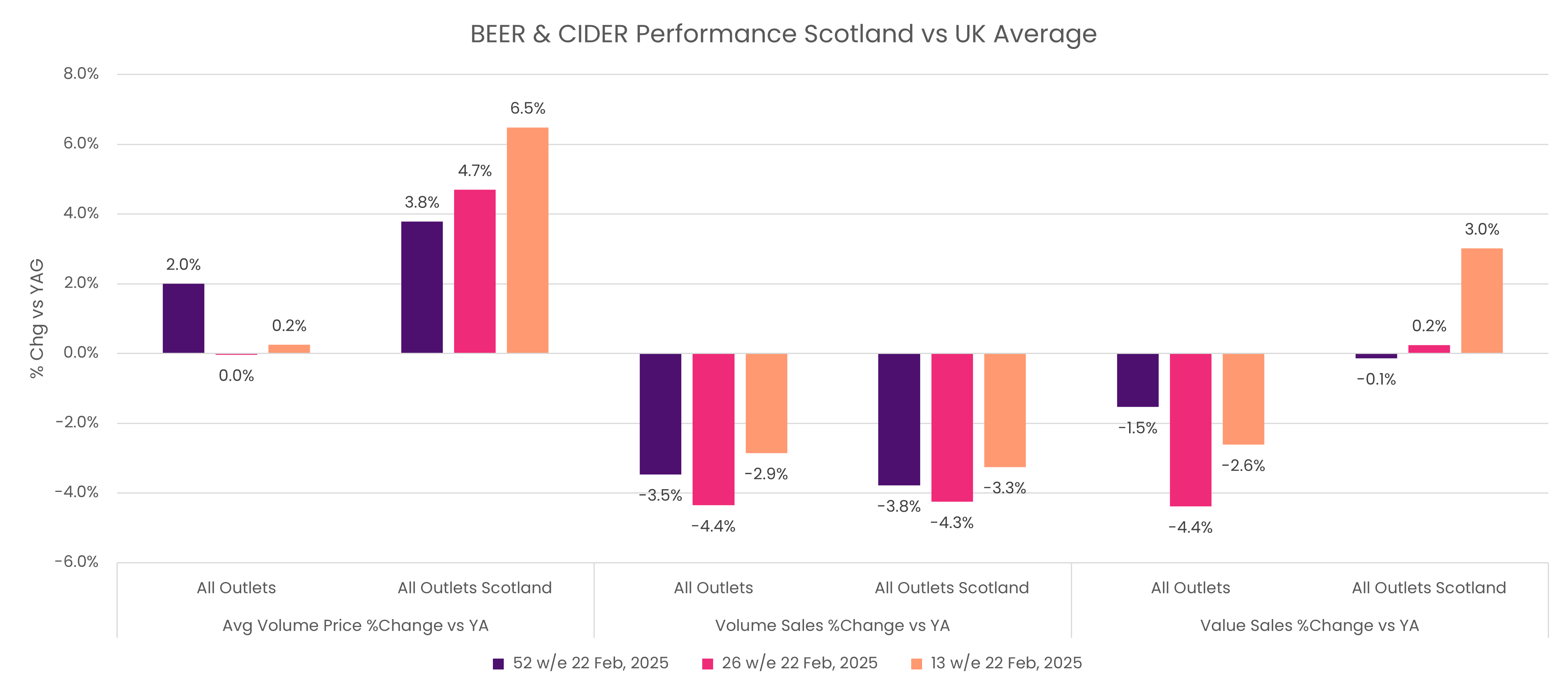

Circana’s findings showed that the introduction of MUP in Scotland has boosted the performance of alcohol, notably in wine, beer and cider. These categories have seen sales grow vs last year – well ahead of the UK as a whole.

Spirit volumes in Scotland are dropping off sharply compared to the UK average. However, value sales – despite in decline – have been boosted by average volume price increases and are on an upward trajectory ahead of the UK as a whole.

Overall, MUP has pushed Scottish shoppers to smaller pack sizes but at a higher average volume price. Interestingly, more expensive spirit products have retained volume share, while cheaper products have lost share because of the price hike.

Wine volumes in Scotland are ahead of the UK average, which is surprising given its increase in average volume price.

“This is hard to rationalise but may suggest volume has switched from spirits to wine,” said Lawrence.

References

- Licensing International, 2024 Global Licensing Industry Study

- Euromonitor Nov 2022 – Total Treat category a Summation of categories - Cakes, Chocolate Confectionery, Coffee and Ice Cream

- Kantar Worldpanel data, October 2023

- Baileys Global Treating Equity Dip, Kantar May 2024

- Kantar | Worldpanel Division | FMCG Take-home Panel | Data to 26-Nov -23

- Kantar | Worldpanel Division | FMCG Take-home Panel | Data to 26-Nov -23

- Kantar | Worldpanel Division | FMCG Take-home Panel | Data to 26-Nov -23

- Circana data, Latest 52 wk MAT up until 13/4/2025. Total Off-trade excluding Aldi & Lidl