The global population is expected to increase by almost 2bn persons in the next 30 years, shifting from the current 8bn to 9.7bn by 2025.

Whilst the rate of the population growth is on an upward trajectory, it is projected to come to an almost halt at the end of the century, due largely to falling fertility rates.

Still, looking likely to hit 10.9bn by 2100 and with an ever-ageing population that is consuming more and more, the strain on the food and drink system is undeniable as we move forwards.

Food production will need to see a 50% increase at least to accommodate – and ideally without dominating much more agricultural land.

“Presently, there is an imbalance between overconsumption and underconsumption,” Julian Ware, UK & Ireland sales manager for ABB Robotics reflected. “In 2010 alone, research found that as many as 1bn people did not have the minimum recommended daily allowance of calories, while others far exceeded those limits.”

As such industry will need to consider not only how we can generate enough calories to feed everyone, but also how it can do it sustainably whilst pivoting to changing consumer demands. Already climbing fast up the agenda, food security, health and climate change will become yet more critical in the years to come.

This will translate into new investment and practices from the food and drink supply chain, with technology playing a crucial role.

Scientific advancement has already given way to a substantial increase (1.84bn tonnes in 1961 to 4.28bn tonnes in 2007) with the introduction of new crop varieties and new practices, such as pesticides and wastewater management. The good news is that we’re already seeing new techniques coming to the fore, including gene editing, new proteins and vertical farming, to name but a few, alongside industrial solutions that prioritise efficiency and energy use.

“There is no one approach that will work to ensure that food producers can meet the requirements of the population but thankfully there are clearly a lot of opportunities to make significant improvements,” Tom Fripp, director of Addition Design, told Food Manufacture.

Increasing capacity will inevitably play a factor in the future of manufacturing, with producers having to introduce new lines and new storage facilities to hold additional stock as consumption increases. But alongside the physical investments and expansion, tech will play an important part in supporting new machinery capabilities to deliver on future demands.

“Like all forms of manufacturing in the 21st century, food production and supply needs to fully embrace technology to make them more efficient and quicker to adapt to changing consumer demands. But the range and sheer scale of the food production that is needed makes the market a particularly challenging one and will require solutions from far more than production alone,” continued Fripp.

“Better, more efficient distribution is needed to ensure the right produce is safely delivered when and where it is needed to avoid waste; better politics and marketing is needed to shift consumer trends in the interests of fairer circulation rather than profit; and technology is needed to keep production machines working with greater reliability and with increased accessibility along the supply chain.”

Digital transformation

As Fripp cited examples of technology capable of managing output based on consumer demand in real time, automated machinery maintenance where replacement parts are ordered autonomously when needed, and full lights-out manufacturing of complex products, he explained that technology’s role is perhaps easiest to foresee within this mix of challenges.

“There is already a precedent being set in other sectors that are embracing industry 4.0 techniques,” he noted.

Ware agreed that technology will continue to play a huge part in the future of manufacturing, in particular the opportunities afforded by big data and robotics.

Big data and analytics

“The capabilities of big data mean that when sources as varied as consumer buying patterns and smart sensor readings provide manufacturers with huge datasets, the data can be collated, analysed in detail and used to create actionable insights,” Ware said, noting that this will have a significant impact in optimising food production and minimising waste.

When it comes to the power of data analysis, Bridge Cheese is one manufacturer that has anticipated the benefits of digital insight, with plans to roll out a new Enterprise Resource Planning (ERP) system later this year. This will replace existing spreadsheets and paper records with a full integrated system that will digitise its operations.

“The ERP will also help us to capture data and analyse it, so we can identify areas of efficiency improvement and gain a full understanding of production costs,” Bridge Cheese’s managing director Michael Harte said.

Waste not, want not

Alongside intelligence to predict demand vs supply, 3D printing technology is also likely to have a role in the future.

As Fripp explained: “3D printing can put just the right amount of material exactly where it is needed on the component being produced; and in this age of sustainability, we need technology that helps us to use only what we need and nothing more. When you couple that with 3D printing’s adaptability, accessibility and usability, the markets that it can affect change within are growing.”

Addition has also been implementing technology to its AddParts service. This supplies ‘digital spares’ for production and packaging lines on-demand and has been developed for manufacturers with lines where spare parts are not available, difficult to source, expensive to hold stock of, or only available on long lead times.

“For these customers, AddParts tackles the not-insignificant costs of downtime by digitising these critical components, making them available through a dedicated, secure storeroom (on a portal on the AddParts website) and then, when needed are produced using our industrial 3D printers,” Fripp said. “This has a dramatic effect of making parts available that previously were not, opening up opportunities to have repaired components made available within days, reducing physical stock holding of spare parts and reducing the costs of component failure-related downtime by up to 90%.

“We can also optimise and improve components based on the knowledge of the engineers and maintenance teams who know their machines best.”

Harte also raised the opinion that digitalisation can help entice new recruits. “It’s no secret that since Brexit and Covid, recruitment in the food and drink industry has been challenging. We need to attract good people, but the perception of manufacturing is sometimes that it’s dirty or low tech – which we know is not true! When you can add in tablets and apps to your digitalised production processes though, it does become more appealing to digital natives and we see this as a positive recruitment tool.”

Robotics

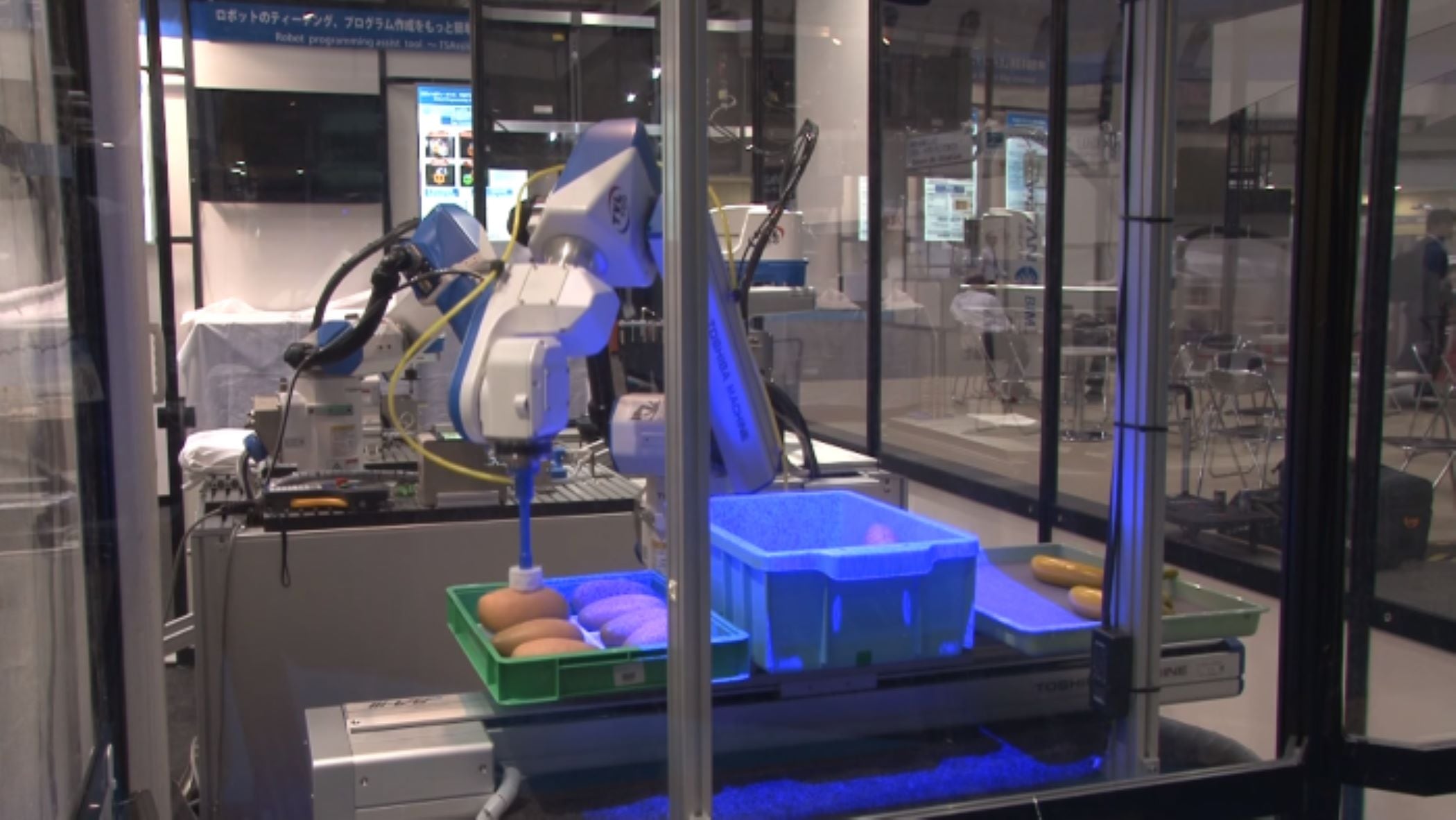

As we reported earlier in the year, robotics has become more prevalent in the food factory. Perceived complexities in robots have slowed the uptake in food and drink production, however, ABB says developments in software and progression in co-bots (robots working alongside humans) has given way to new opportunities for robot deployment.

Robotics offer a great solution to the ageing population too, Ware highlighted. As many developed countries face a long-term demographic ‘crunch’ as their populations age and the available workforce shrink, he believes robotics will be able to plug a key gap.

Alongside the capability to switch between multiple production and packaging process with minimal downtime, they will be increasingly used to take on more monotonous and hazardous tasks.

“Robots will increasingly be used to improve the lives of their human colleagues by taking over many of the most repetitive, strenuous, or hazardous jobs. They can work in environments which can otherwise impact on workers’ health in many ways, through dust, allergens, noise or similar,” Ware pointed out.

Improvements in robotics has been on-going, with Ware highlighting advances in end-of-arm tooling in particular: “One example is ‘vortex handling’ technology, which uses suction, rather than grip, to enable the safe handling of particularly fragile products such as poppadums, for example. Even the most fragile products, such as bread or brittle goods, like biscuits, can now be lifted, moved and packed with greatly reduced levels of product wastage.”

Vision technology and artificial intelligence is also witnessing advancements, making robotics more versatile. Today, pick and pack robots can recognise items on the production line by size, shape and colour regardless of their orientation.

Packaging of the future

For TIPA, the strain on production lines will require the sector shifting to more localised production to reduce environmental impact in the future.

“We have specifically designed our packaging technology to fit in a ‘plug and play’ solution so our materials and technology is compatible with existing plastic processing and packaging lines,” said Daphna Nissenbaum, co-founder and CEO of TIPA. “This means we don’t own any of our factories, instead using existing local ones to create packaging close to our clients. This minimises the risk of supply chain disruption, decreases the carbon footprint of our packaging, as well as utilising existing infrastructure.”

TIPA also works with a range of advocacy coalitions that encourage governments to integrate better waste management practices to support changing types of packaging.

“We believe compostable packaging plays a key role in eliminating single use plastic waste. This is why we have been developing compostable solutions for over 10 years and have succeeded in creating lightweight, durable, strong, transparent packaging that mimics the qualities of plastic, without the detrimental environmental impact,” Nissenbaum added.

For fellow packaging company Ball Corporation, aluminium packaging holds great promise.

“Infinitely recyclable and economically valuable, aluminium packaging is one of the most sustainable packaging solutions available today. Once empty, an aluminium can, bottle or cup can be recycled and back on store shelves in as little as 60 days,” explained Mandy Glew, vice president of commercial EMEA & Asia at Ball Corporation.

To further help manufacturers on their sustainable journey, Ball has also reduced the weight of its aluminium STAR cans by up 8% (depending on the size and shape of the container).

“Through making these innovations relating to weight, it saves our customers on transportation costs and we save significantly on energy and emissions when combined across the millions of cans we sell globally,” Glew told Food Manufacture.

Energy efficiency

Of course, casting our gaze into the future, one cannot forget to mention emissions.

Net zero has fast become a familiar term among food and beverage processers, and as sustainability moves from ‘nice to have’ to an imperative, we’ll likely see new technology and machinery emerging in support.

Two key areas producers are exploring include logistics and energy created in the plant. This will not only apply to their own factories but also to suppliers, as more and more companies take on scope 3.

In 2022, Ball procured more than 285,000 MWh of renewable electricity from a VPPA wind power project in the United States, and over 250,000 MWh in Spain and Sweden.

“Through a VPPA agreement announced in May 2022, we expect to procure 600,000 MWh of clean energy each year from a new Texas-based wind energy project, covering more than 50% of Ball’s North and Central American electricity load,” added Glew.

“We are acutely aware of the pressing need to reduce our climate footprint. This is why we are transitioning to renewable electricity across our operations by 2030. Not only does utilising renewable electricity improve the credentials of our factories, but it also reduces the carbon footprint of our aluminium cans by 10-18%.”

Deniel Bourne, UK and Ireland sales manager for Watlow Thermal Solutions Business Unit, agreed, nodding towards a shift in how factors will manage power generation.

“Global food and beverage corporations are committing to science-based targets and pledging to reduce their greenhouse gases in line with the 2015 Paris Agreement. This includes reducing emissions by up to 30-50% by 2030 and achieving net-zero emissions by 2050,” Bourne said.

“Manufacturers are looking to move away from commodity heating elements and basic control solutions to more advanced thermal solutions that achieve industry improvement goals such as temperature uniformity for product quality and recovery time for higher throughput.

“To enable this, the electrification of manufacturing equipment including boilers, dryers and ovens is being considered as a key component to accomplishing these reductions.”

One such example of alternative heating is heat treatment thermal loop solutions, which Bourne says offer several advantages over traditional methods, including improved temperature control and increased efficiency.

“The thermal loop system comprises the heater, sensor, temperature control and data recording elements to provide precise temperature control and enable faster heating and cooling and optimised soak times.”

As more of the food and drink sector embrace Industry 4.0, we’re also witnessing advancements in this kind of equipment, with thermal controls being integrated into digital transformation frameworks which leverage IoT and data management systems.

According to Bourne, a trend in solutions that comply with GxP (good practice) guidelines and equipment which also incorporates attributable, legible, contemporaneous, original and accurate (ALCOA+) data integrity principles is emerging.

As part of its own digitisation journey, Bridge Cheese has begun carbon monitoring, looking at where it can reduce these specific emissions. “We are in the process of implementing power factor correction, voltage optimisation and looking at alternative sources of energy. We have also changed the programming on our cooling system to reduce electricity,” said Harte.

Of course, electrification will not only emerge more in the plant but also outside it, as companies migrate to electrified fleets. Only last month, McDonald’s supplier Agrial Fresh Produce invested in its first electric heavy goods vehicle. PepsiCo has also introduced electrical vehicles into its supply chain, alongside more novel solutions such as its cooking oil-powered trucks which could save as much as 2,650 tonnes of greenhouse gas emissions per year.

“Looking to the future, we will be increasing our use of alternative fuels when it comes to transporting our products,” concurred Ball Corporation’s Glew.

“Currently, we are trialling the use of hydrotreated vegetable oil, otherwise known as HVO, in partnership with one of our customers. The use of HVO fuels produces up to 90% less CO2 compared to fossil diesel, significantly reducing the environmental impact of transportation.”

Another interesting proposition for lowering emissions has also been offered by its work in packaging weight. Through the aforementioned innovations relating to weight, Glew explained that its customers can actually save on transportation costs.

The future may be uncertain but the case for technology is unwavering

It’s clear there is a tough rough ahead for food producers, but this should be eased as progressions in technology emerge. And whatever shape the future factory takes, it’s evident that it will be technological powered and very different to today’s methods.

But as Fripp flagged, moving forwards we must share data as an industry: “Data needs to be shared in the interests of ultimate efficiency rather than siloed and protected to guard profitability.”

Hopefully, the recently announced Food Data Transparency Partnership (FDTP) will open up new opportunities for safe data sharing across the UK F&B sector, helping to drive solutions around innovation, sustainability and health, among others.