Compared to the previous year, the number of deals rose by 50.8% to 89 transactions, representing an estimated value of £6.6bn.

Core areas that attracted the attention of investors were the plant-based sector and, conversely, meat and seafood. Outside of those, there was significant interest in direct-to-consumer (D2C) businesses, as shown by Nestlé's acquisition of Simply Cook, following its purchase of Mindful Chef at the end of 2020. Italian pasta giant Barilla also acquired a majority stake in D2C meal kit start-up Pasta Evangelists.

Mark Lynch, partner at Oghma Partners told Food Manufacture: "There may be some consolidation of demand from the consumer as we come out of COVID, however we think the long term trends for D2C businesses remain positive and expect to see continued M&A in the space."

Plant-based deals included Sonae acquiring Gosh Food and Saputo acquiring cheese alternative supplier Bute Island Foods before snapping up Wensleydale Dairy Products. Oghma Partners said it did not expect the pace of investment in this area to slacken in 2022.

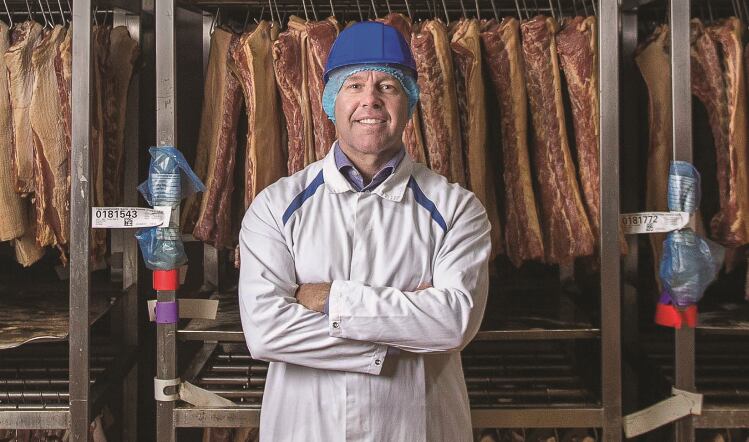

Meat and seafood

In meat and seafood, Sofina acquired Eight Fifty Food Group, the owner of Karro Food Group and Young's Seafood, for £1.2bn - the deal with the second biggest price tag during the year. Pilgrim's Pride also acquired the Kerry Group's Consumer Foods Meat & Meals business for £704m, prior to subsidiary Pilgrim's UK announcing the takeover of lamb processor Randall Parker Foods.

The highest value transaction during the period was Bain Capital's acquisition of European ambient foods business Valeo Foods for £1.5bn.

Almost two fifths of investors were overseas buyers, while a fifth were in the financial or private equity sectors.

The grocery and confectionery segment attracted the greatest amount of activity, followed jointly by chilled foods, and beverages.

Oghma Partners predicted that M&As in the foodservice arena would pick up as the sector recovered from the pandemic over the course of this year.

Cost pressures

However, the firm expected the trading environment in 2022 to be 'more challenging'. "Cost pressures are appearing in most directions, whether that be labour, energy, raw material or distribution," Oghma Partners stated in its 2021 review. "The next 12 months will be a further test of the business models of many companies.

"Weaker businesses that struggle to get pricing through and/or reduce costs will find the prospects of a business exit more testing under these conditions."