CapVest acquired Karro, a leading UK pork processor, in 2017. CapVest and Management subsequently acquired iconic seafood business Young’s Seafood in 2019 to create Eight Fifty Food Group.

Eight Fifty later consolidated five other protein businesses from across Europe to create what is today a leading European multi-protein specialist.

Sofina Foods is one of Canada’s largest food producers and has a 25-year history of acquisitions, growth and success. It is one of the country’s leading manufacturers of primary and further processed protein products for both retail and foodservice customers.

Brands include Cuddy, Lilydale and Janes

Its brands are staples in Canadian households and include Cuddy; Lilydale; Janes; Mastro; San Daniele; Fletcher’s, Vienna and Zamzam. Sofina Foods currently operates 21 different sites and employs approximately 5,000 people.

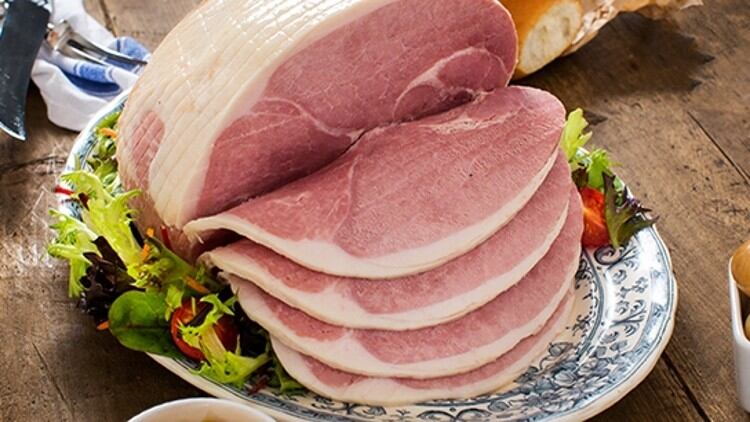

Eight Fifty is a leading supplier of both branded and own-label seafood and pork. The pork division is one of the largest processors and suppliers of products across the UK and Ireland. The seafood division is the largest provider of chilled and frozen products across the UK, including the Young’s brand, and is a major player in frozen seafood across Germany and France.

The Group employs around 8,300 people, across 23 manufacturing sites. The business will remain under the leadership of chief executive officer Di Walker and will complement Sofina Food’s existing leading North American platform. As Europe’s multi-protein specialist, Eight Fifty will continue to provide sustainable, high-quality food products while focusing on growth.

'Leading European multi-protein business'

Capvest partner Jason Rodrigues said: “We’ve created a leading European multi-protein business through a combination of strategic investment in our core asset base and complementary acquisitions of fantastic national champions.

"Eight Fifty delivers best-in-class products to our customers and consumers and we are all very proud of what Di Walker and her team have achieved over the last four years. We’re confident that Eight Fifty will continue to flourish under Sofina Food’s ownership.”

Walker said: “We began this journey as a UK-only pork supplier doing less than £500m in sales and after several years of transformational organic and acquisitive progress are now the European multi-protein specialist with over £2bn in sales.

"This transaction and the interest in Eight Fifty is a great reflection on the quality of the business and testament to the work that CapVest and our entire management team have completed.”

'Ambitious expansion'

Michael Latifi, founder and executive chairman of Sofina Foods, said: “As a leading Canadian multi-protein specialist, this acquisition allows Sofina Foods to continue on our path of ambitious expansion.

"Sofina Foods is one of Canada’s largest food producers and we have created a solid global foundation for continued growth. With a history of excellence in food production and processing spanning over 25 years, the strong brands of Eight Fifty Food Group align perfectly with our prominent brands and our shared future vision.”

The new company will have more than 13,000 employees globally and will command $6bn in annual revenue.

'Set stage for considerable growth'

Bob Wilt, president and chief executive officer of Sofina Foods, said “Our team in Canada and our new partners at Eight Fifty Food Group have set the stage for considerable growth. I look forward to working with Di and to welcoming Eight Fifty to the Sofina family, and to drawing upon the significant expertise that exists across both businesses."

CapVest and Management received financial advice on the deal from Jefferies, JP Morgan and Rothschild & Co, legal advice from Willkie Farr & Gallagher and Walker Morris, and financial and tax due diligence services from KPMG.

Sofina Foods received financial advice from Rabobank as the lead financial advisor and Scotiabank as the co-financial advisor. Additional advice was provided by PWC, Stikeman Elliott and Taylor Wessing.

The transaction is subject to approval from regulatory authorities.