Supported by Adam Street Advisers, the buyout included the business and all its subsidiaries.

Commenting on the MBO, Burton said: “Our senior management team’s wealth of experience in the drinks industry has led to an impressive product portfolio, which we are constantly evolving and developing.

“This funding package will allow us to further boost our plans and enable us to bring more new and innovative products to our customers.”

Finance support

Adam Street Advisers has supported the Corinthian Brands for the past 12 years across three separate transactions.

Managing partner Andrew Barnsley said: “The recent MBO enables the business to go forward with a new generation of managers supported with a funding package from a highly innovative, alternative funding provider.”

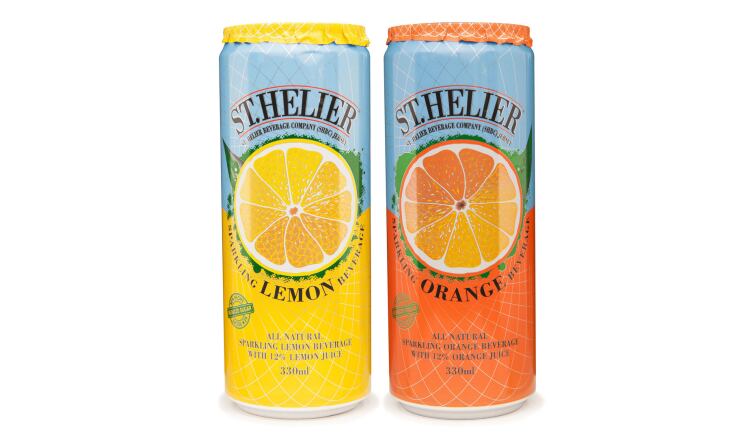

Founded in 2011 by Hibberd and Burton, St Helier Beverage Company produces a range of alcoholic and soft drinks, including its drinks brand Dragon Soop, HCC Cider, Lamcello 'Posh Perry', St Helier sparkling fruit beverages and Old Style Ginger Beer.

High street supplier

Corinthian Brand drinks are sold through many high street supermarkets as well as a range of wholesale and independent stores.

Dave Sherrington, regional head of sales at ThinCats, added: “John and Paul are a force to be reckoned with, having a phenomenal 60 years of knowledge and experience of the drinks industry between them. Their plans for the future of the business are impressive, and we have no doubt that this funding will launch the business into another successful phase.”

Meanwhile, Canada's Sofina Foods Inc has agreed to acquire Eight Fifty Food Group, which comprises several protein businesses including Karro Food Group and Young's Seafood from funds managed by CapVest Partners.