Pressure on food and drink manufacturers to make a profit is greater than ever and, with costs in numerous areas rampant, Multivac illustrates why automating processes has become critical to margin retention and profitability

In its latest State of the Industry market report (Q1 2025), the Food & Drink Federation (FDF) depicted a bleak picture for food and drink manufacturers, revealing that 41% are scaling back investment in long-term productivity drivers, as both cost pressures and a new raft of taxes, regulations and labour costs come to bear.

Confidence among manufacturers in the sector remains low at -43%, according to the report, with a third of businesses (33%), including nearly half (47%) of small and medium-sized enterprises (SMEs) expecting conditions to deteriorate further, as global market forces and government policies hit home.

Costs are at an all-time high and increased by an average of 4.5% over the year to March 2025. Plus, manufacturers expect these to rise by an additional 4.8% in the next year.

In particular, processors cite the price of energy, ingredients and labour as taking their toll. These have forced many manufacturers to re-evaluate all aspects of their business in light of the need to create additional savings, retain margins and make tough choices for longer-term survival, let alone growth.

However, the FDF also identifies automation as one area where food manufacturers are keen to invest, with 54% of businesses wanting to prioritise this to overcome skills shortages and drive productivity.

At Multivac, head of product management Liam Smith acknowledges that the industry is seeing big changes, which he says are affecting businesses right across the board.

“Speaking recently to one of our larger customers, they were looking at increases of £2.5m in labour costs, just because of the Budget,” he says. “So, all of a sudden, businesses – large and small – are having to change their ways of working to be competitive in what is already a very competitive marketplace. We’ve always pushed automation at Multivac and, for many [food manufacturers] it has been a ‘nice to have’. Now, it’s becoming a necessity, otherwise some manufacturers could potentially go out of business.”

Henry Brook, Multivac sales director, says the willingness to invest in automation has always been there, but agrees that the strength of that will has “doubled” since [the] April [Budget]. “It’s not just national insurance, it’s the minimum wage and business rates. So, a business’ return on investment (ROI) has suddenly become much shorter on any automation projects, as the cost of labour has gone up substantially. For an SME, it’s a sizable chunk straight off the bottom line.

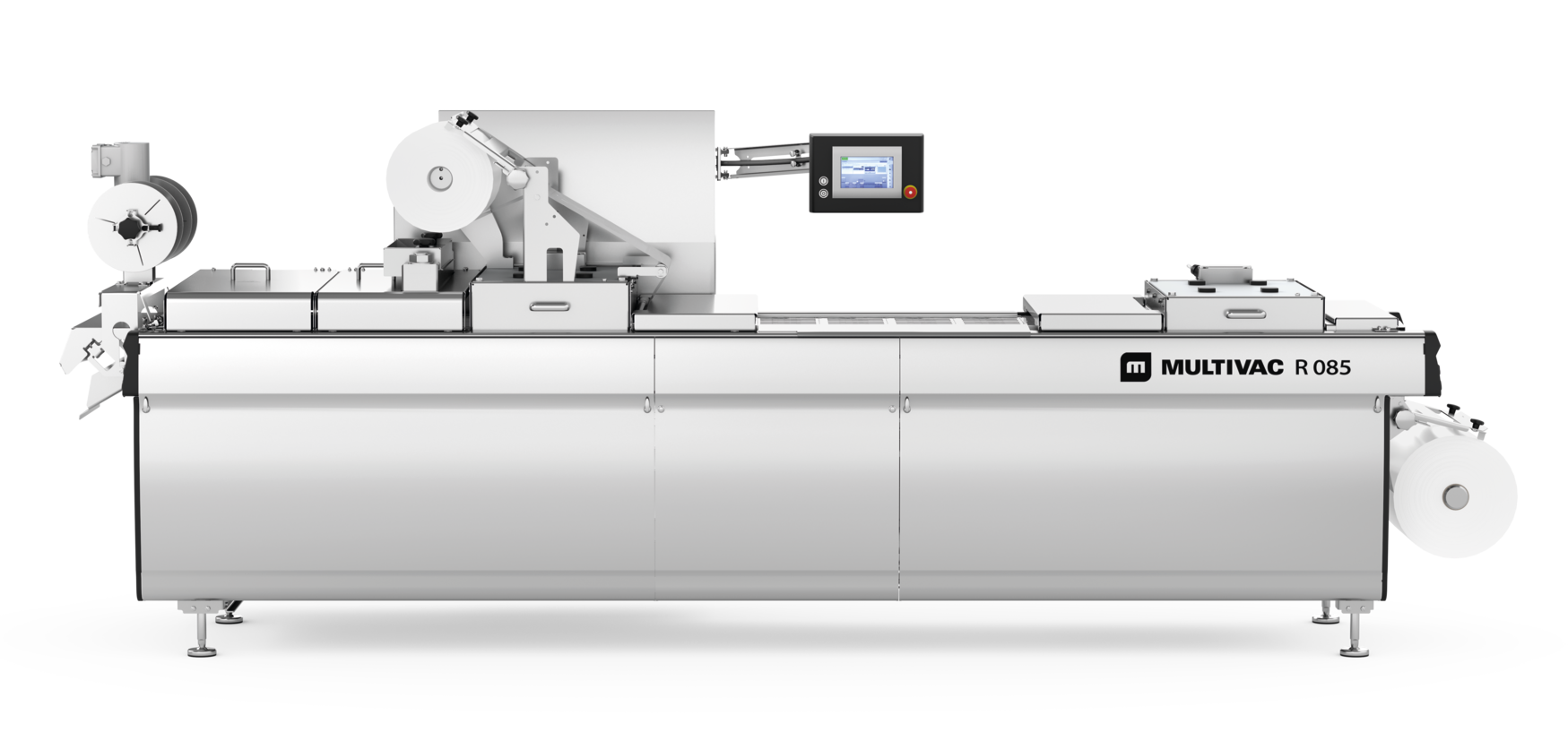

“We’re seeing more and more interest now in our compact thermoformers, which are relatively new to the market and designed for catering butchers… they can do the work of three or four people, using just one person, and resulting in better presentation. Previously, some of the thermoformers in our range were just too big for SMEs, but our R085 entry-level thermoformer starts at just 2m long.”

Raw material price pressure

Back at the beginning of the production line, with the rising costs of raw materials as an example, Smith points to the shortage of beef and poultry in the UK – an issue he says will not be fixed any time soon.

For beef, the UK is facing a declining cattle herd and the forecast is for a 6% reduction in slaughter numbers for prime cattle across 2025. The number of poultry in England decreased by 1.5% to 129m in 2024, largely due to a 3.5% fall in the number of broilers, which account for 68% of all poultry processed.

“We’re probably looking at another three years before the slaughter rates can be brought up to where they need to be,” says Smith. “So, the costs of that raw material will continue to rise.”

As such, processors will need to extract as much yield as possible from this increasingly expensive raw material – and automation will be one way in which they can achieve that goal. Multivac’s TVI GMS 400 entry-level portioning machine boasts the strapline of ‘one more steak per primal’ – “and that makes a big difference when you’re spending a lot of money for that raw material”, notes Smith. “If I wanted to put a number on it, you’re probably talking savings of six figures-plus, even for the smallest butcher, by changing to this piece of equipment.”

Plastics and more

The benefits of recent technology are also being applied to more cost-effective packaging formats, with manufacturers moving from semi-rigid to flexible vacuum packaging, for example. While this might give a different end-effect on-shelf – note the controversy in 2023 over Sainsbury’s change to its mince packs – consumers are starting to understand that it’s the product inside the pack that is important, not the pack itself.

However, with thermoformed vacuum pouches, plastic is reduced – thereby decreasing a company’s liability under the UK’s Plastic Packaging Tax taxation – but shelf-life is also improved, says Brook. “While the manufacturer’s packaging cost is roughly half anyway compared to modified atmosphere packaging (MAP), transport and storage costs are massively reduced, and the longer shelf-life means consumers are not wasting as much product. But also, the important story is sustainability. If consumers are serious about saving the planet, then the industry has to do much more to reduce plastics and increase shelf-life – and that means there will be a learning curve for consumers to accept.

“I don’t think it’s a matter of ‘if’ packaging changes, it’s a matter of when. More and more products will use vacuum packaging – that’s inevitable.”

Right Pack Consultancy

Multivac’s Right Pack Consultancy works with customers to advise on packaging and sustainability, taking into account current legislation and retail standards – as well as what is coming down the pipeline. “If a food manufacturer needs to redesign packaging to comply with these requirements, it cannot just be done overnight,” says Brook. “There’s a lot to think about when you are changing a pack format, so our packaging division, which supplies packaging for both our machines and other industry equipment, offers this consultancy service to our customers.

Energy

If you ask any food manufacturer, what’s one of their biggest bills, energy is always up there, notes Brook. “And although we keep getting told that energy prices will go down, they never seem to do so.”

For over 10 years, Multivac has been powering its thermoforming packaging machines with servo-electric lift systems, as opposed to compressed air. “As an engineering rule of thumb, compressed air is 10 times the cost of electricity,” observes Smith. “Yet a lot of the market is still using compressed air, so there is a huge saving to be made on costs there, as any machinery component that is powered by compressed air, can also be powered by electricity.”

The company also offers an ell-electric tray sealer and all-electric R085 for SMEs. And, it has just introduced a fully electric Metalquimia meat injector, suitable for compact machinery ranges, with a 70% power saving versus its previous offer.

A smarter future

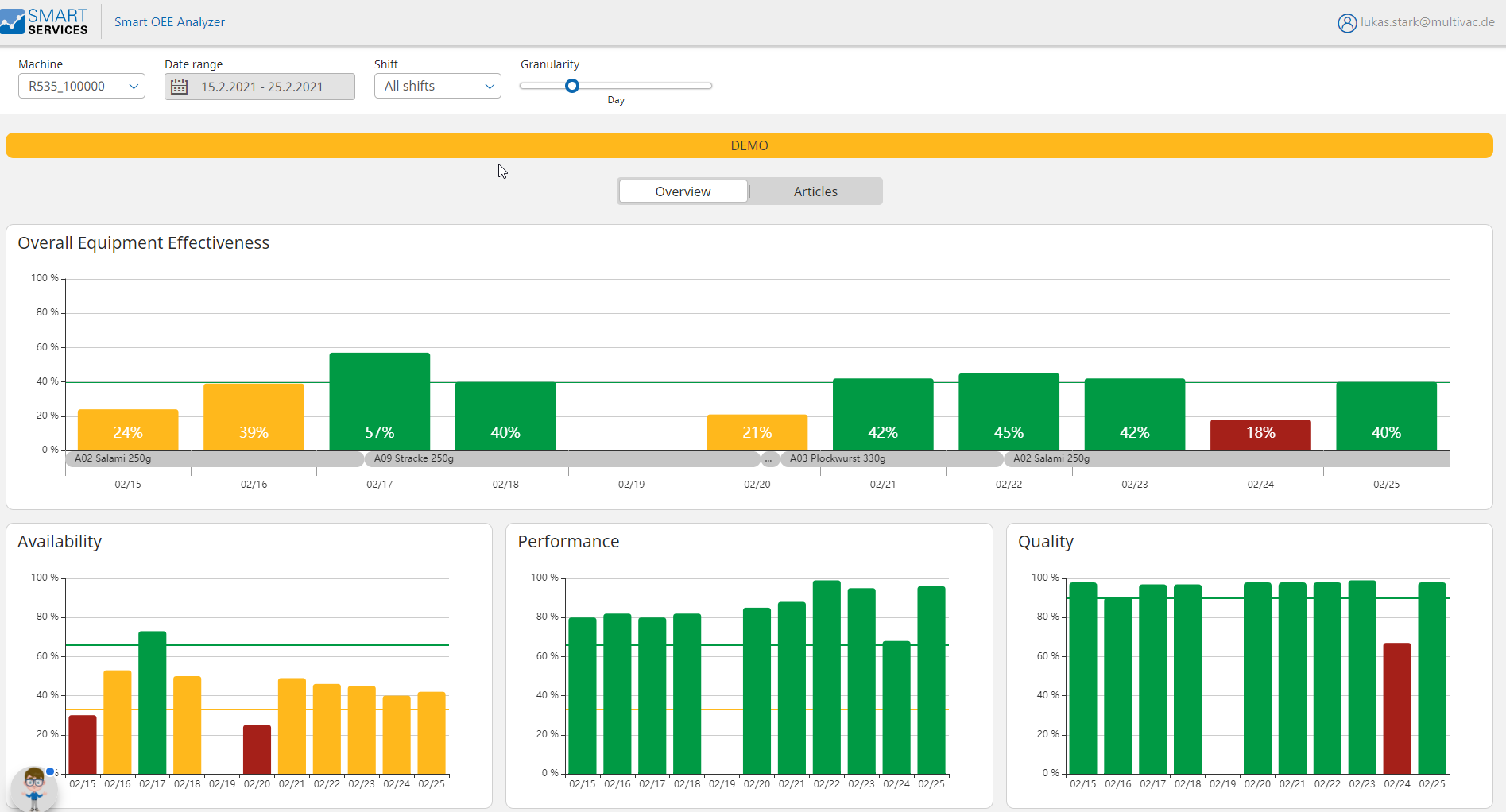

Of course, digitalisation and AI are bound to play their part in the future of automation – and Multivac’s customers are already seeing the benefits of its Smart Services, says Smith. “We have a digital platform built into our machines – particularly thermoformers – and we are rolling that out into our more compact ranges, too. This enables manufacturers to monitor their electrical, pneumatic and water consumption and, by using AI, we are able to establish what is optimal for a particular machine.

“So, we can spot any anomalies to that optimum and alert the operator or business owner to that fact.”

As an example, he cites a recent scenario with a Multivac customer where there was a pneumatic leak on a valve. “You’d never hear that inside a factory, but because we could pick that up [via our digital systems], we could notify the company, who then identified where the leak was occurring and got it repaired. The saving on that, alone, was probably six figures across a year in air consumption.

“The price of energy will continue to rise, but there are things we can do by using data and monitoring software that will ensure we keep to that optimum performance on equipment.”

At the recent IFFA exhibition in May, Multivac also revealed its AI-supported vision systems, which can automate pack inspection and the checking of labels and print, even at high production speeds, helping to increase line efficiency and production capacity even with limited personnel resources.

As the company’s CSO, Dr Tobias Richter, summed up at the time: “Smart processing and packaging technology is a real factor in competitiveness: It helps not only to optimise the sustainable operation of the machine, but also makes it possible to achieve agile production, which can be adjusted to the growing demands of a changing market.“

Oktoberfest opportunity

Multivac is inviting food manufacturers to join the company at its Oktoberfest event in Swindon, from 2-3 October, where it will be exploring the latest trends and innovations for the processing and packaging industry. Styled as “an excellent opportunity to network with industry experts, gain insight into cutting-edge technologies and discover solutions that can enhance business operations”, the event will be rounded out by an evening dinner and charity auction with special guest Phil Tufnell, the former England cricketer and TV personality.

For more information on how Multivac’s automation solutions can save your business money, get in touch on sales@multivac.co.uk or call 01793 42589