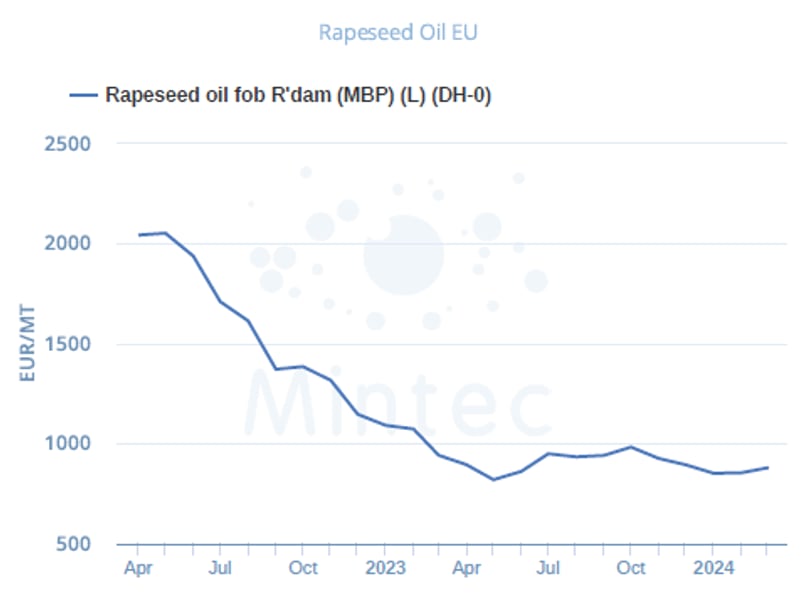

Rapeseed Oil

The price of Euronext rapeseed futures averaged €418.31/MT (£358/MT) in February, down by 2.6% m-o-m, and a 23.9% y-o-y decrease. Market players note varying market coverage among rapeseed oil buyers, with some secured until Q3 2024, while others continue to buy as needed.

Buyers without long-term contracts are competing for limited volumes from major players. This has prompted sellers to hold prices firm, leading to increased bids from buyers.

In February, Mintec observed sluggish domestic rapeseed sales among European farmers, attributed to unattractive prices compared to previous seasons. Farmers are now exploring markets offering better returns. Low prices in physical and futures markets have also dampened rapeseed imports into the EU.

Reduced selling could suggest tighter supplies, possibly leading crushers to pay higher prices. However, concerns about international demand, especially competition from major producers like Canada and Australia, raise doubts over March.

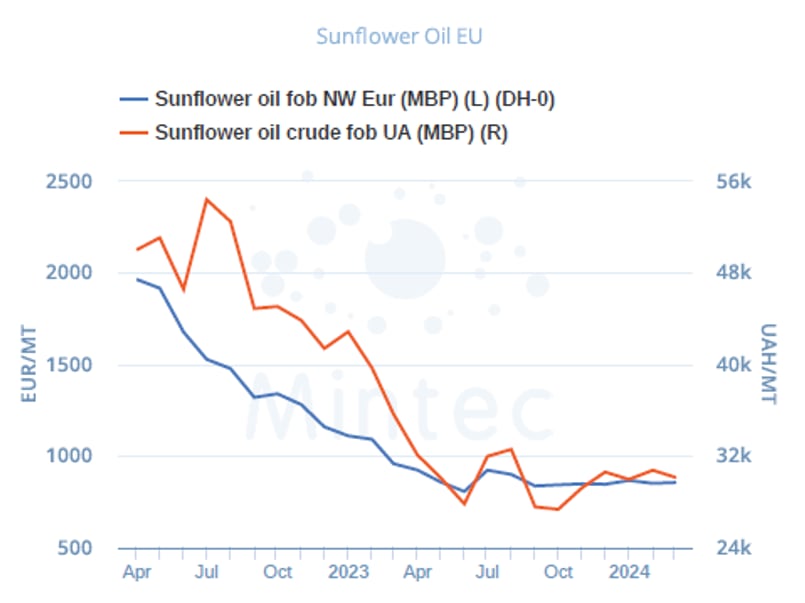

Sunflower Oil

There was a decrease in the Mintec Benchmark Prices (MBP) for EU sunflower oil in February, reflecting lacklustre market activity. The MBP sunflower oil MBP averaged €850.64/MT (£728.07/MT), down by 1.8% m-o-m, and by 22.0% y-o-y.

Mintec observed subdued sunflower oil demand in February, particularly in the EU where the market has been inactive. This trend is expected to continue into March due to extended physical coverage until June/July 2024.

Conversely, demand for sunflower oil from the Black Sea region is rising, and Turkish buyers may purchase large volumes of sunflower oil in March due to dwindling supplies, potentially boosting global prices according to market players.

The price of Ukrainian sunflower rose in February, attributable to renewed demand, particularly from China. The MBP of Ukrainian sunflower oil stood at UAH 30,753.8/MT, up by 2.7% m-o-m in February, a 22.5% y-o-y decline.

In March, the sunflower seed and oil market will closely monitor ongoing farmer protests in the EU, potentially impacting prices. These protests challenge trade regulations and increased costs due to the Ukraine conflict, causing uncertainty over Ukrainian grain and oilseed products.

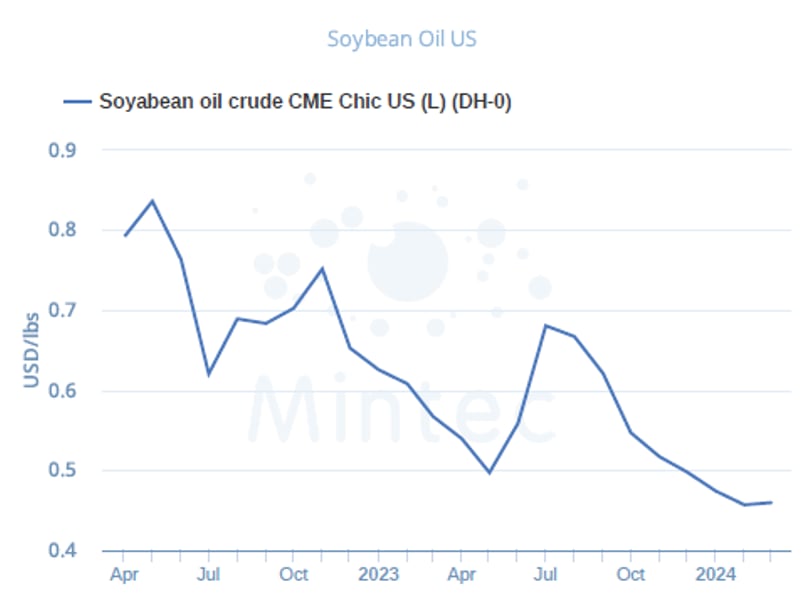

Soyabean Oil (Soy oil)

The February 2024 price of CBOT soyabean oil futures averaged $1,006.18/MT (£789.85/MT), down by 850.643.6% m-o-m, and a 24.9% y-o-y decrease. The soyabean oil futures price declined for the seventh consecutive month, attributable to lower demand. Expectations of ample supply from March 2024, from the South American harvest, also contributed to the price decline.

In its February report, the USDA forecast soy oil production in the US to rise by 3.0% y-o-y, up 6.8% compared to the five-year average. Domestic consumption for the 2023/24 MY is expected to rise marginally by 0.5% y-o-y for food usage.

Brazilian soy oil production is estimated to increase to 10.4 million metric tonnes in the 2023/24 season, up 1.2% from the previous season.

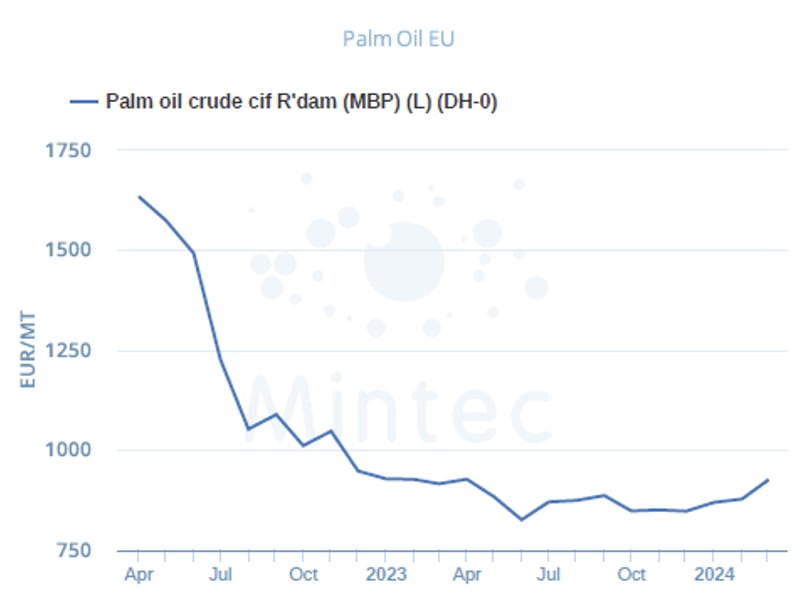

Palm Oil

The MBP of EU palm oil averaged €877.23/MT (£750.83/MT) in February 2024, up by 1.0% m-o-m, a 5.3% y-o-y decline.

The EU palm oil MBP rose in February, reaching its highest level since September 2023, attributable to concerns about production in Indonesia and Malaysia (top producers) and increased demand over the month as players sought to cover open positions.

Market sources have stated that palm oil export availability could remain strained this year due to rising palm oil requirements for biodiesel in Indonesia and Malaysia.