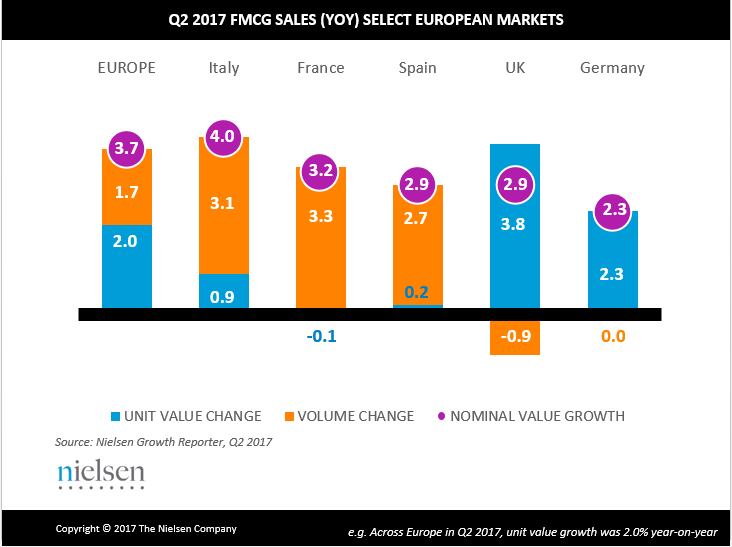

Sales of fast-moving consumer goods (FMCG) in the UK were boosted by a 3.8% rise in the prices consumers paid for goods in the second quarter of this year. However, the volume of items bought by UK consumers dropped by 0.9%.

The figures were part of Nielsen’s report on the growth of Europe’s grocery market, which found consumer spending on FMCG in Europe grew by 3.7% in the second quarter of this year – the highest level in three years.

Increase in the prices shoppers paid

The European grocery market

- The European grocery market grew 3.7% in the second quarter of this year

- UK consumers spent 3.8% more on groceries compared with last year, while buying 0.9% less

- Turkey saw a 14.2% rise in grocery sales year-on-year

- Switzerland saw 0.7% drop in grocery sales year-on-year

Nielsen’s data – collected from across 21 European countries – reflected a 2% increase in the prices shoppers paid for goods and a 1.7% rise in the volume of items they bought.

Oliver Deschamps, Nielsen’s senior vice president of retailer services Europe, said the growth of the European FMCG sector could be attributed to four key factors.

“Improving economic conditions – particularly in the likes of France and Spain – falling unemployment in a number of countries, consumer confidence rising to its highest level in years, as well as inflation remaining under control,” he said.

“The timing of Easter also played a bit-part role but the dashboards are all green at the moment.”

Highest year-on-year growth

Turkey had the highest year-on-year growth for grocery sales, growing 14.2%, followed by Slovakia with a 9.3% rise in sales.

Denmark saw the lowest sales growth at 1.2%, while Switzerland saw sales drop by 0.7%.

Deschamps added: “With gross domestic product growth across Europe projected to remain at around 1.75% in 2017, assuming no major political or economic shocks over the next six months, the outlook for the grocery market for the rest of year is a continuation of southern Europe’s sales recovery and northern Europe’s volume growth.”

Meanwhile, the UK’s food-to-go market will be worth £23.5bn by 2022, according to a grocery think-tank IGD.