Fuel prices to hit food manufacturers’ profits

While manufacturers might pass the cost unto their customers, it was more likely they would absorb the cost and take the hit on their margins to maintain/grow market share, an EEF spokesman told FoodManufacture.co.uk.

“So far, official statistics show that manufacturers seem to be [absorbing the costs], with output prices for food products increasing at the smallest rate than any other manufactured good in the 12 months to November 2016.

‘Hit on profit margins’

“Combined with the sterling depreciation, any increase in output prices is unlikely to fully offset the increase in input prices, meaning that a hit on profit margins is largely unavoidable.”

Fuel prices have risen to the highest since 2014, with petrol at 118.11 pence per litre (ppl) and diesel at 120.74ppl, according to car insurance firm the RAC.

The rise in the wholesale price of petrol and diesel followed production cuts announced by the Organisation of the Petroleum Exporting Countries (OPEC) – which controls about 42% of global oil production.

Brent Crude oil is doubled its price since last year, rising from $27.88 (£22.44) a barrel to $55 (£44.27).

The EEF added: “Manufacturers in [the food and drink] sector will find it hard to offset the hit on domestic margins through higher export sales.”

Cut fuel taxes

In response to the price hikes, the Freight Transport Association (FTA) called for the government to cut fuel taxes to help logistics companies.

FTA deputy chief executive James Hookham said: “If the government wants to keep Britain trading effectively in the new global market, then it should cut fuel duty by 3ppl.

“Two thirds of the cost of fuel on the forecourt is tax, so a cut would have a huge impact on logistics firms and private motorists alike.”

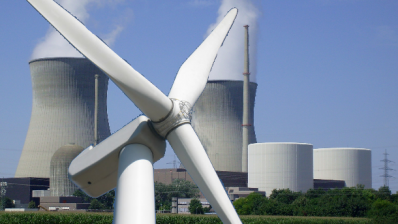

Meanwhile, food and drink manufacturers should explore alternatives to fossil fuels to save money, urged Wyke Farms’s md Richard Clothier in November last year.

Fuel prices – at a glance

Unleaded petrol: 118.11ppl

Diesel: 120.74ppl

Super Unleaded: 128.97ppl

Liquefied petroleum gas: 55.17ppl

Source: RAC – accurate as of January 6 2016