From automation to optimisation

We continually hear reports that the UK food and drink industry is finally embracing automation, as if this were a single decision by a single entity. Naturally enough, the picture has been and remains very mixed, with many smaller businesses demonstrating a sometimes surprising willingness to invest, and some larger manufacturers displaying an equally surprising reluctance to do so.

When margins are tight and capital scarce, taking a piecemeal approach to automation is tempting (and sometimes unavoidable). But even where a business cannot justify recreating an entire line, there are better and worse approaches to automation.

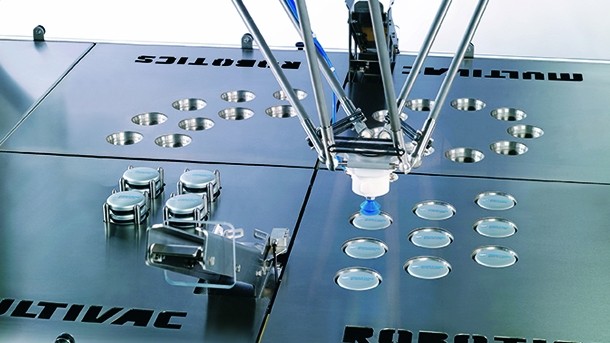

Equipment manufacturer Multivac may be best-known for its thermoforming systems, but for the past eight years or so it has been integrating these with its own robotics, as well as other essentials such as coding and marking. This means, for example, that it can provide pick-and-place robots for the tray-loading, pack-channelising and case-loading stages as well as robotic palletising.

Integrated design allows the entire packing stage to be operated from a single human-machine interface (HMI). As product manager for systems James Bedford explains, control and automation can be consolidated around a single HMI at the ‘high care’ and ‘low care’ ends of the production line, but not really in any practical way across both.

Naturally, Multivac argues that the benefits of requiring only one HMI are further strengthened when the various modules are sourced from a single supplier. “With a competitor robot, for example, slight delays in synchronisation may build up over time,” says Bedford.

Historically, the food industry has shied away from automation in part because of the precarious nature of retailer contracts. This has tended to make the question of return on investment a thorny and not always very scientific one. “We'd always try to calculate payback over the time of the contract the manufacturer is buying the particular machine for,” Bedford explains.

Modular approach (Return to top)

But like other suppliers of automation, Multivac emphasises the point that robots and other systems can be reprogrammed to handle new products or even allocated to another part of the line. “If it’s poppadums today, it may be naan bread tomorrow," he says. "All our handling systems are modular.”

If reductions in workforce requirements have always been the main driver behind automation, the imminent introduction of the National Living Wage for over-25s is set to ratchet up this effect still further, according to Bedford. “You may end up with a very small number of operators, but there are other efficiencies and the repeatable quality of robotics, for example, to consider. That may mean fewer rejects down the line.”

But those with experience in controls and automation do not single out this low-hanging fruit of lower wage bills and consistent quality as being the most exciting benefits. At Siemens Industry, business manager for food and beverage Keith Thornhill goes so far as to suggest that automation not informed by Big Data is difficult to justify at all.

With Big Data comes ‘the bigger picture’ as a basis for decision-making, rather than fragmentary information, he argues. “Automation will still have an important part to play, but it is really about how you apply it. So you have your scheduling system for deliveries to retail, for example, and it is about how you integrate that with your production."

Siemens and its integrators supply across the industry from distilleries to fresh-produce plants. According to Thornhill, even lower-margin categories benefit from being able to respond quickly to weather-driven or other unscheduled shifts in demand.

“It's true for small as well as bigger companies,” he says. “These capabilities are scalable. Many of those smaller food businesses would benefit from automation, but also from having the data to make the right decisions.”

Too often, Thornhill believes, this is as much about short-term thinking as it is about lack of funds. “But manufacturers are starting to demonstrate more of a will to enter into a process of continuous development. They appreciate that other countries with a longer-term approach are investing in technology. Given that consumers can be quite fickle, [UK manufacturers] understand that they too have to invest.”

At SAP management software integrator Signum Solutions, md Lindsay Pointon underlines the fact that there is no necessary link between automation and investment in an enterprise resource planning (ERP) system. “Smaller businesses wouldn’t necessarily consider ERP, and when they do, they need a compelling reason to invest,” he says. “Much of the time, it's driven by customer demands and British Retail Consortium (BRC) accreditation requirements.”

Signum business development manager Julie Knowles explains that, even while small businesses may have software systems for sales, accounts and other office functions, manufacturing will too often still be paper-based, with a worrying ‘black hole’ where production and quality data should be. In some extreme cases, that 'black hole' can conceal fraud, she claims.

In one foodservice supplier of poultry products, Signum is involved in creating a direct link between new factory-floor weighing equipment and a management-level ERP system. “We may also be integrating with the mixing and packing operations, so we can capture data here, too,” says Knowles. “Batch data including the supplier and kill date goes straight into the ERP system.”

She adds: “The benefits are batch traceability, stock visibility and simply ensuring that product goes to the correct customer. Ultimately, it's about customer retention.”

Of course, while an automated line is likely to be more productive than a manual or semi-automatic operation, the manufacturer that has invested in new equipment will want to ensure that it is as efficient as possible.

OEE measures (Return to top)

Overall Equipment Effectiveness (OEE) is used by machinery manufacturers and, increasingly, their customers as a handy and comprehensive measure of how close a machine is to being optimised. As Barry Graham, Omron product marketing manager for Sysmac Automation explains, OEE is a function of availability, performance and quality.

Omron emphasises the ability of its latest Sysmac NJ controller to maximise machine availability in particular. This works on a number of levels. On one level, it is about reducing changeover times. The servo drives on processing or packaging equipment will increasingly adjust accurately and speedily in response not only to operator input, but also to data from input devices such as vision systems or barcode readers.

“When the product on the line changes, those devices will identify the new product, the controller will pull up a file of parameters and set up the line appropriately,” says Graham.

“Within the Sysmac library, we have been developing application files or function blocks and one of these is to do with reducing machine downtime.”

Machine availability is not only about changeover times. Unscheduled maintenance can be a big headache for manufacturers, and while troubleshooting diagnostics are common to many machines, predictive capabilities are rarer.

Graham states: “Our performance-monitoring application will look at the light being received back into a sensor, for example, and be able to determine whether it has been contaminated by food from the line.” As a result, this problem (or a more serious one) can be remedied during scheduled downtime.

For its part, Siemens emphasises the concept of Totally Integrated Automation (TIA), which again ties into this idea of logging trends. “If a certain component goes over a set temperature, for example, the line will stop, and with TIA the aim would be to track temperatures and be aware of the trend,” says Thornhill. “If there is any part of the line which does not communicate, that means there's good data which is going nowhere. TIA is about having multiple components that will talk to each other.”

Industry 4.0 (Return to top)

Integration can be taken a stage further, along the lines of the much-debated Industry 4.0. “If you want to move from integrated automation to integrated manufacturing with its links to retail you can do this via ethernet connections into the ERP layer,” he says. "We are fortunate that our manufacturing execution system hooks up into cloud data.” He adds that cloud-connectivity is where next-generation integrated approaches are heading.

For all the assertions that smaller as well as larger businesses can benefit from enterprise-level systems, the reality is that many would not see this as an obvious investment. As Multivac points out, there are lower-level systems, some operating from a checkweigher, that keep tabs on weight trends in the meat industry, for example. Its own Multivac Line Control module offers quality control and batch traceability back to the supplier. Where integrated ERP is required, Multivac works with German partner CSB-System.

Here and elsewhere, manufacturers have more choice than ever about the level of operational sophistication they want to invest in. Whatever their growth forecasts, they may consider that combining improved internal visibility with better, faster external data makes sense in turn making sense of automation.