Government funding proposals for SMEs fall short

The Federation of Small Businesses (FSB) said a government proposal to remove clauses in supplier contracts preventing them from using their unpaid invoices to secure funding was only a small part of the picture.

“This should help to improve cash flow by removing legal barriers to invoice finance,” John Allan, FSB national chairman, said.

“However, this is still only one small part of the picture. For example, access to finance remains a big challenge for many small firms and more needs to be done to improve the situation.”

Major step forward

But the Asset Based Finance Association (ABFA) hailed the proposed Small Business, Enterprise and Employment Bill as a “major step forward” in opening up finance for SMEs – traditionally the largest proportion of the food and drink manufacturing sector.

“It has been a long time in coming, but we are delighted to see the issue of bans on invoice assignment clauses addressed,” Jeff Longhurst, ceo of the ABFA, said.

“These are unacceptable restrictions, particularly in the context of ever-lengthening payment terms being imposed on smaller suppliers … what’s vital now is to see robust regulations to implement this commitment brought forward as quickly as possible.

“If SMEs’ interests are to be protected, these rules cannot be watered down or delayed.”

The regulation would benefit businesses that tend to be lower down in the supply chain and readdress the balance of power between small suppliers and larger customers, Longhurst claimed.

The current contractual restrictions place “onerous and unnecessary” restrictions on the freedom of UK businesses to use the debts owed to them by their customers to access finance, he added.

‘Biggest alternative’

“Asset based finance has already become the biggest alternative to traditional lending, and as more businesses gain access, there is substantial capacity for further funding to be provided,” he said.

Restrictions in contracts banning the re-assignment of debts are often contained in the contracts larger businesses have with smaller suppliers, the ABFA claimed.

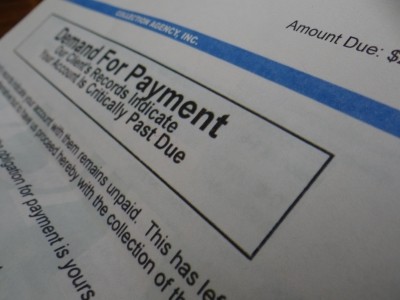

This will often mean smaller businesses are unable to secure funding against the value of their unpaid invoices, it added.

Earlier this year, one food manufacturer said that banks were restricting SMEs growth by not offering finance, even when they had secured retail contracts.

Meanwhile, a number of food manufacturers warned against alternative funding measures, such as crowd funding.